Crypto Macro Market Update – February 6, 2023

Last Week Summary

- FED hiked well expected 25 bps and Powell showed a dovish tone during a press conference.

- Meta beat revenue expectations while Apple, Amazon, and Google all reported earnings that disappointed investors.

- U.S. non-farm payrolls recorded an increase of 517,000 in January, significantly higher than expected.

- Coinbase NFT announced it’s “pausing” future NFT drops, but addressed it’s not shutting down

- Metamask added a new privacy setting to change their RPC providers and toggle features that send requests to third-party services that help with phishing detection and identifying the incoming transaction

- Membrane Finance launches EUROe on Ethereum, claiming to be “Europe’s first and only EU-regulated full-reserve stablecoin and payment network.

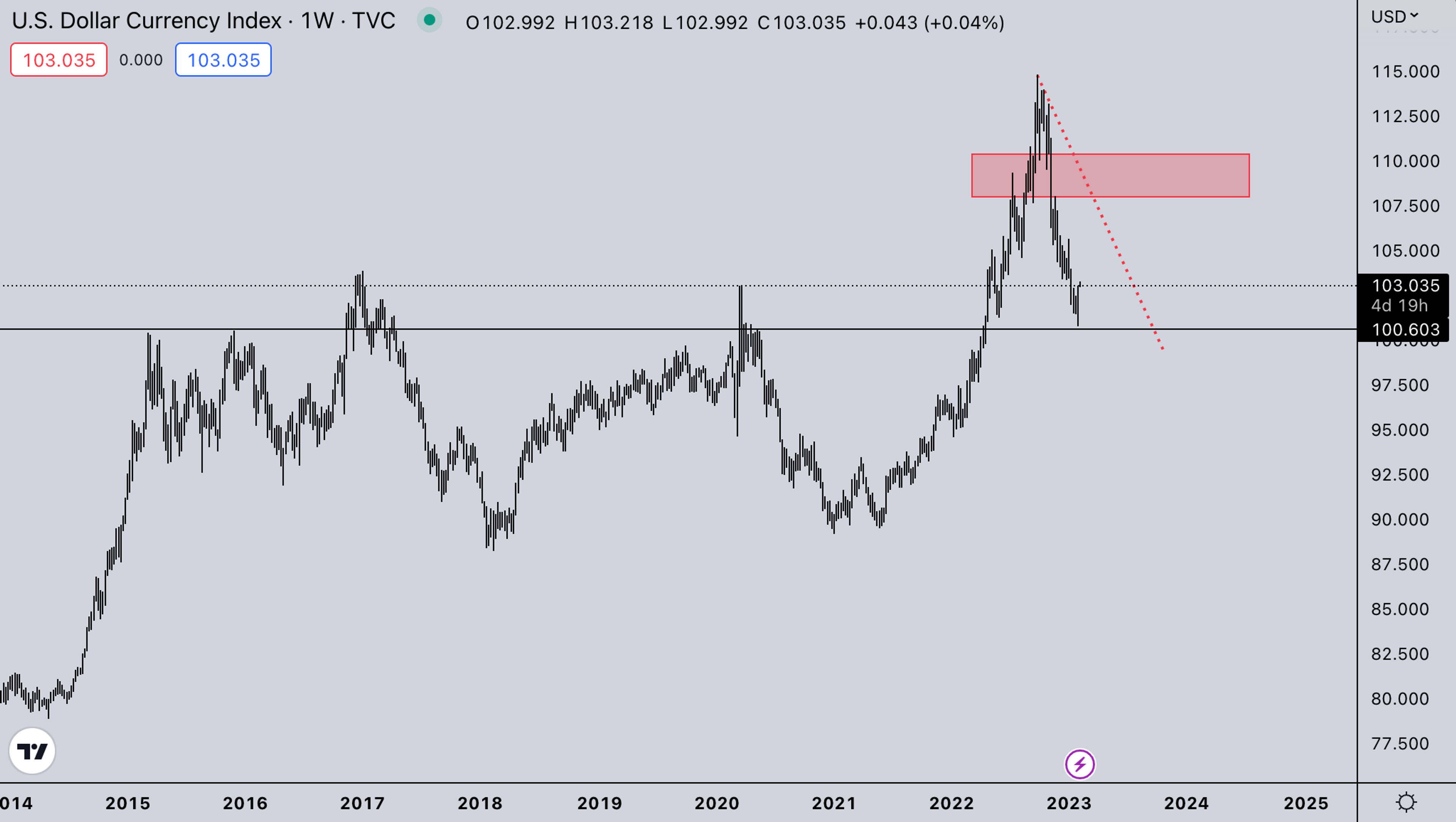

Legacy Markets - DXY

Ever since the BOJ intervention back in Q4 DXY has been trending down. This has given risk assets the possibility for a rally. Crypto lagged in the beginning because of the simultaneous FTX blowup. At the beginning of the year, crypto did a relative mean reversion vs equities while DXY was still down trending. After a couple of new economic data points and DXY being at top of an 8-year range support the likelihood of a rally/bounce is quite high. This should put some downward pressure on equities & crypto which are quite extended after the tech short squeeze.

Legacy Markets – VIX

VIX is still trading sub 21 with it nearly touching the long-term trend which started in December 2017. The bounces from this trend have been significant ever since. With where the DXY is trading, and the possible sticky inflation situation, there’s a narrative for the downside. With the next CPI on the 14th, we expect markets to most likely form a larger range till then. And CPI will determine the next large directional move.

BTC Weekly View

BTC has been range-bound since mid-January. As mentioned in the previous slide, crypto has only seen a relative mean reversion vs equities after lagging because of FTX. With tech seeing a mega short squeeze last week we would’ve expected crypto to also hit higher levels with it. But all the action was mainly centered in mid and lower caps. Meanwhile, the high caps are stuck at range highs. With the location of DXY and other risk metrics, the chances of a decently sized correction or the start of the next macro-driven leg down could be in the works. As mentioned before, this will be mainly driven by what the next CPI print tells us.

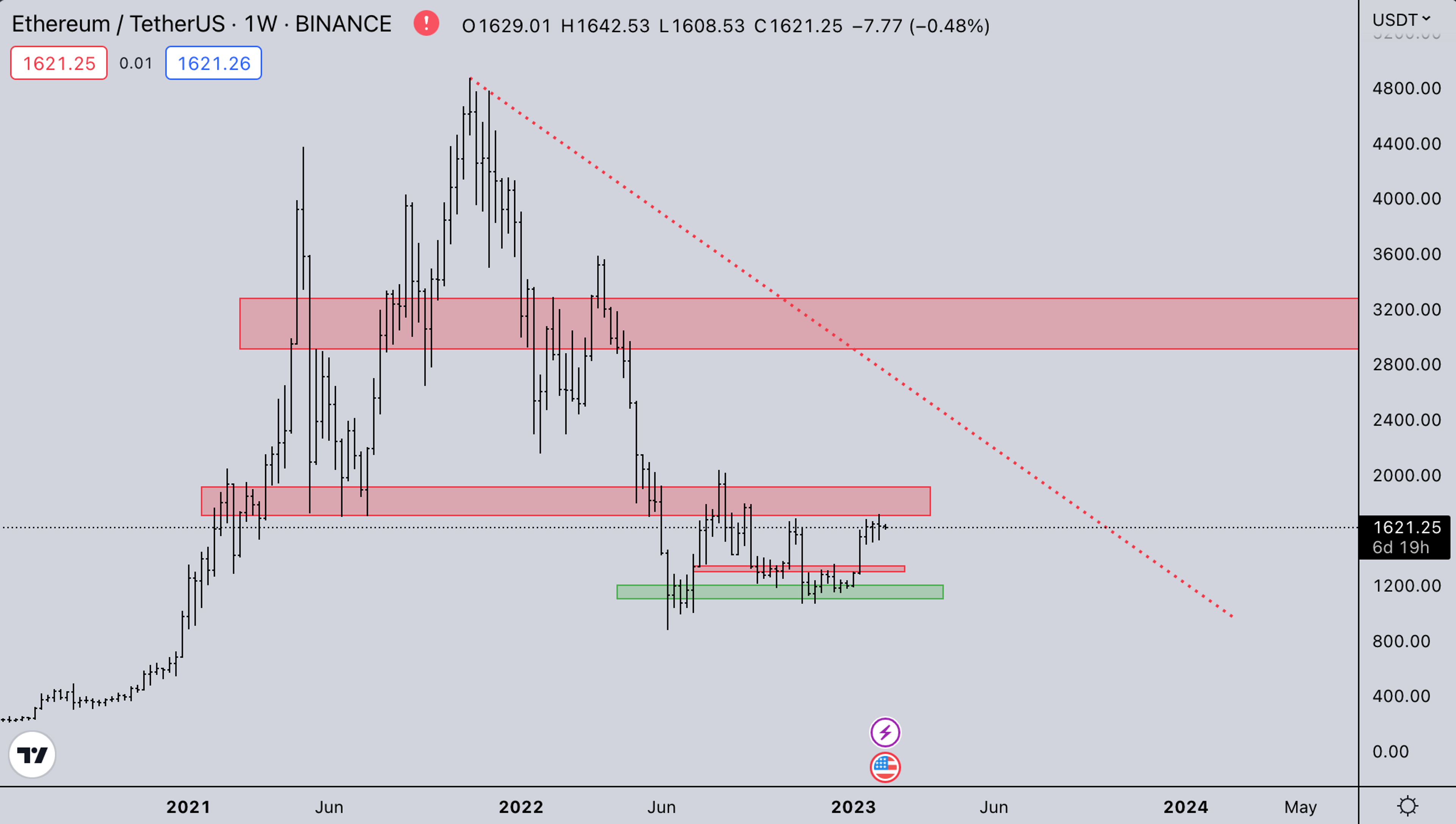

ETH Weekly View

ETH shows the same picture as BTC. Stuck at range highs with a weak relative strength vs BTC. The shanghai fork is coming up and while we think this won’t cause a large selloff from shanghai sellers. We do expect the perception around the unlock itself to have a high probability of causing panic and there a selloff. Especially if we’d see a combination of higher inflation and DXY strength.

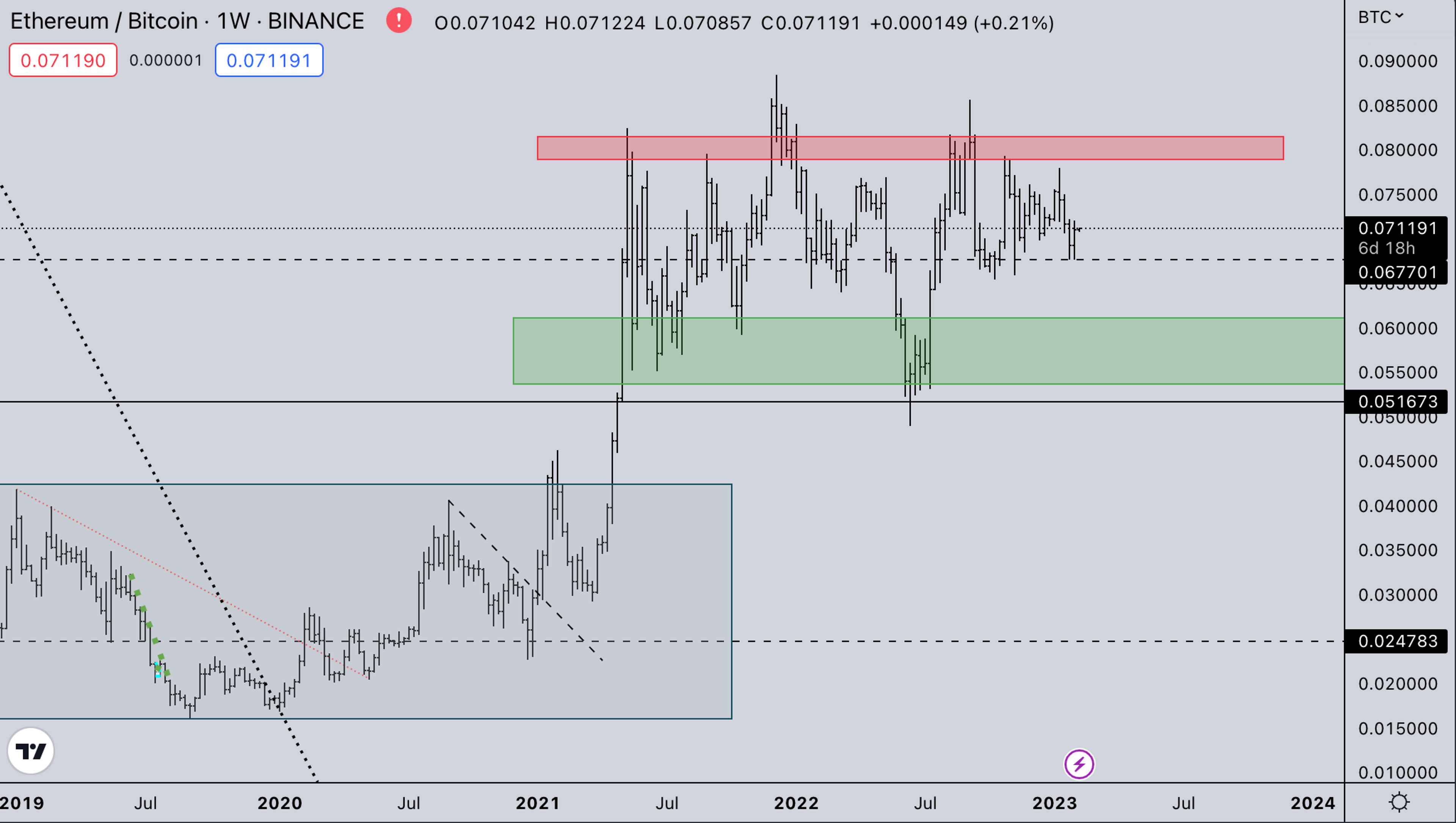

ETH/BTC

ETH/BTC is still stuck in the larger range with a technical bounce from mid-range. We have seen that ETH at this point in time has no relative strength when BTC is trading with a strong upside. While it does find little strength on sideways or slow-down moves. With shanghai on the horizon and possible pressure coming up for crypto in the coming weeks, we’d expect ETH/BTC to keep underperforming in the short term. Note that this course flips if ETH/BTC can break out of the range above .08-.082

TOTAL2 – USD Market Strength

TOTAL2 is also seeing the slow grind up. With relative outperformance mostly in mid-caps, these have almost no effect on TOTAL2 so it doesn’t really reflect what’s happening under the hood on some assets. Just as with ETH and BTC TOTAL2 is also running into large resistance areas, summer high, and 2021 support. So from a technical pov, it would at least make sense for markets to take a breather here till the next CPI data point gets released.

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC is showing the same picture as ETH/BTC. There’s structural underperformance of a lot of high-cap alts relative to BTC. The clue here really is to only focus on the outperformers in USD and BTC terms.

Summary

- Lots of assets have higher time frame inflection points. The next narrative to look for is inflation picking up again in the US. With the FED talking dovish while ECB and BOE are hawkish currencies are setting up for big moves.

- FED is also out of the blackout period and will be speaking this week. On Tuesday Powell is speaking. With the NFP numbers released, we’re monitoring if he has a change of tone after last week's dovish presser.

- There’s also a slight political risk after the Chinese balloon incident in the US.

- Crypto options update:

- ETH 60-day 25 delta R/R still gyrating around the neutral level, slightly bearish currently.

- ETH 60-day ATM vol meandering higher after coming off the Jan23 mid-month spike.

- Deribit ETH Call OI (Open Interest) far outstripping Put OI

- Deribit overall OI concentrated in the 31 Mar 23 quarterly expiry as expected.

- Seeking to-close long Put leg from our ETH 31Mar23 Straddle Position on price softness. Overall profitable LTD

- Ramping up our CeFi/DeFi IV arb biz.

- Lots of assets are at higher time frame inflection points with clear narratives that could cause downward pressure, after a big run so far in Q1 it’s a time to be cautious and let the market reset for its next large directional move.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?