Crypto Macro Market Update - January 9, 2023

Last Week Summary

- Crypto and US equity had the first rally in 2023 since last Friday, after US job numbers showed slower-than-expected wage growth, therefore signaling easing inflation.

- Lido surpasses MakerDAO as the highest TVL DeFi protocol, with the Liquid Staking Derivative narrative going on along the Shanghai upgrade, to introduce ETH unstaking.

- SBF pleaded not guilty to criminal charges. The trial date is set for October 2, 2023.

- SEC files objections to Binance US's plans to acquire Voyager.

- Huobi to lay off 20% of its employees, while also changing the salary from fiat to stablecoins.

- Gemini’s Winklevoss issued an open letter asking Barry Silbert to address withdrawal issues by Jan 8th, but DCG kept silent.

- Blackrock adds the possibility for Bitcoin exposure via CTFC futures settled contracts.

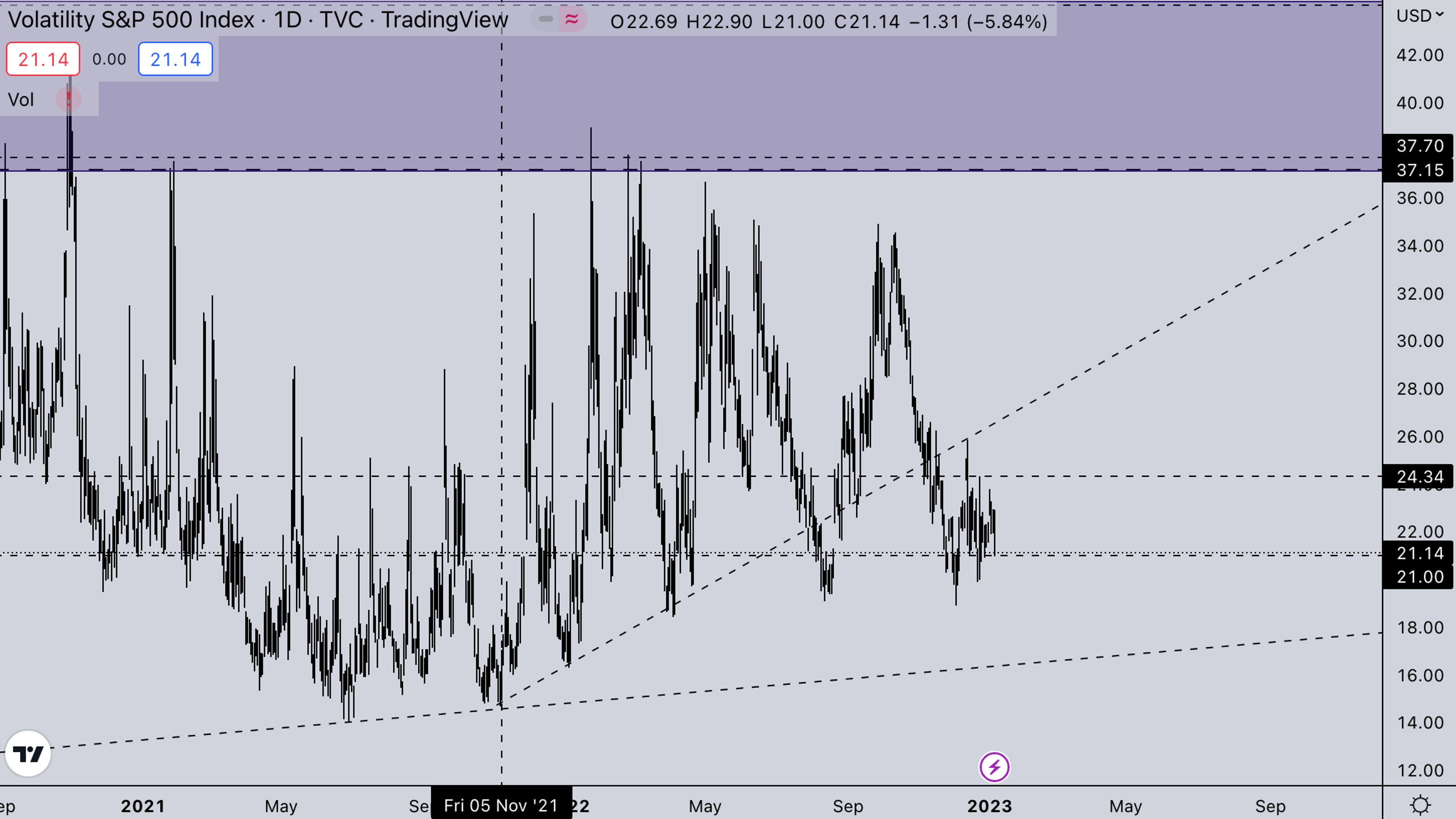

Legacy Markets – VIX

VIX closed on the edge above 21. With correlations between markets already dropping, crypto has less and less influence from the stock market, as long as we stay in this lower VIX regime.

Legacy Markets – DXY

The DXY index experienced a strong start to the week but saw a reversal of its gains following the release of the non-farm payroll data. This allowed for a reprieve for risk assets on Friday and has set the stage for the potential for a short squeeze in the market this week.

BTC Weekly View

Last week, it was announced that the distribution of funds and payout information for MTGox has been delayed until March, with payouts extending until September. This, coupled with the stability of equity markets at their lows, provided sufficient positive momentum for a minor rally in the cryptocurrency market. At present, the value of BTC remains below its June lows. If it were to reclaim this level, it would likely result in significant upward momentum for both BTC and ETH.ETH Weekly View

ETH has quite the compression. With volatility hitting historical lows on both ETH and BTC, compressions like this have led to massive moves before the immediate threats of the FTX fraud being frozen in legal strings. There doesn’t seem to be a clear catalyst that’s crypto-specific that could send this lower, other than macro QT and big tech being on a cliff (like AAPL, AMZN, etc…)In March, ETH has the Shanghai upgrade. We think staking will be a popular narrative in the future for institutional investors & maybe even companies. But will those pull the trigger in the current macro environment? We still do not know.

ETH/BTC

ETH/BTC broke upwards from the compression we’ve mapped out last week. ETH has been consolidating in this range for almost 2 years now. The real acceleration in both ETH/BTC and ETH/USD will happen once we clear the range. This means ETH/BTC above .08-.081.

TOTAL2 – USD Market Strength

TOTAL2 experienced a strong recovery last week, with certain major coins such as LTC, SOL, and LDO experiencing notable rallies. These rallies were fueled in part by short squeezes. It appears that sentiment may have shifted from "buy on dips" to "short on rallies," as evidenced by the heavy funding for long positions during these rallies. At present, the altcoin market may seem somewhat overbought. As such, it is likely that we will see range-bound activity this week, with the potential for market movement due to Powell's speaking engagement and the release of CPI data.

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC also reflects the recovery on BTC pairing with the majority of alts rallying way more than BTC. For now other than the DCG deadline, with Gemini which we will get to know more about this week, there doesn’t seem to be any crypto-specific risk. We’re still waiting for TOTAL2/BTC to have a defining breakout from this range.

Summary

- Powell speaking on Tuesday.

- CPI will be speaking on Thursday.

- A low VIX environment with a weak DXY gives crypto enough space to rally.

- Deribit ETH vol term structure softer & 25 Delta P-C moving less bearish since EOY.

- We are expecting some Q1 ETH IV moves & have prop positioned accordingly via long straddles.

- A likely tech short squeeze in equities this week, after last week's close.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?