Crypto Macro Market Update – December 19, 2022

Last Week Summary

- Inflations slow down as CPI comes in lower than expected.

- FED's slow down rate hikes up to 50BPS.

- Crypto is meandering as uncertainty around Genesis and DCG's financial health keeps increasing.

- Trump launched the "Trump Digital Trading Card" series NFT.

- Mazars (auditor) suspended all services to crypto clients including Binance, citing concerns over how the public understands proof of reserve reports.

- Raydium was hacked for over $2M due to a private key compromise.

- OKX went down for several hours on Sunday, citing cloud hosting issues.

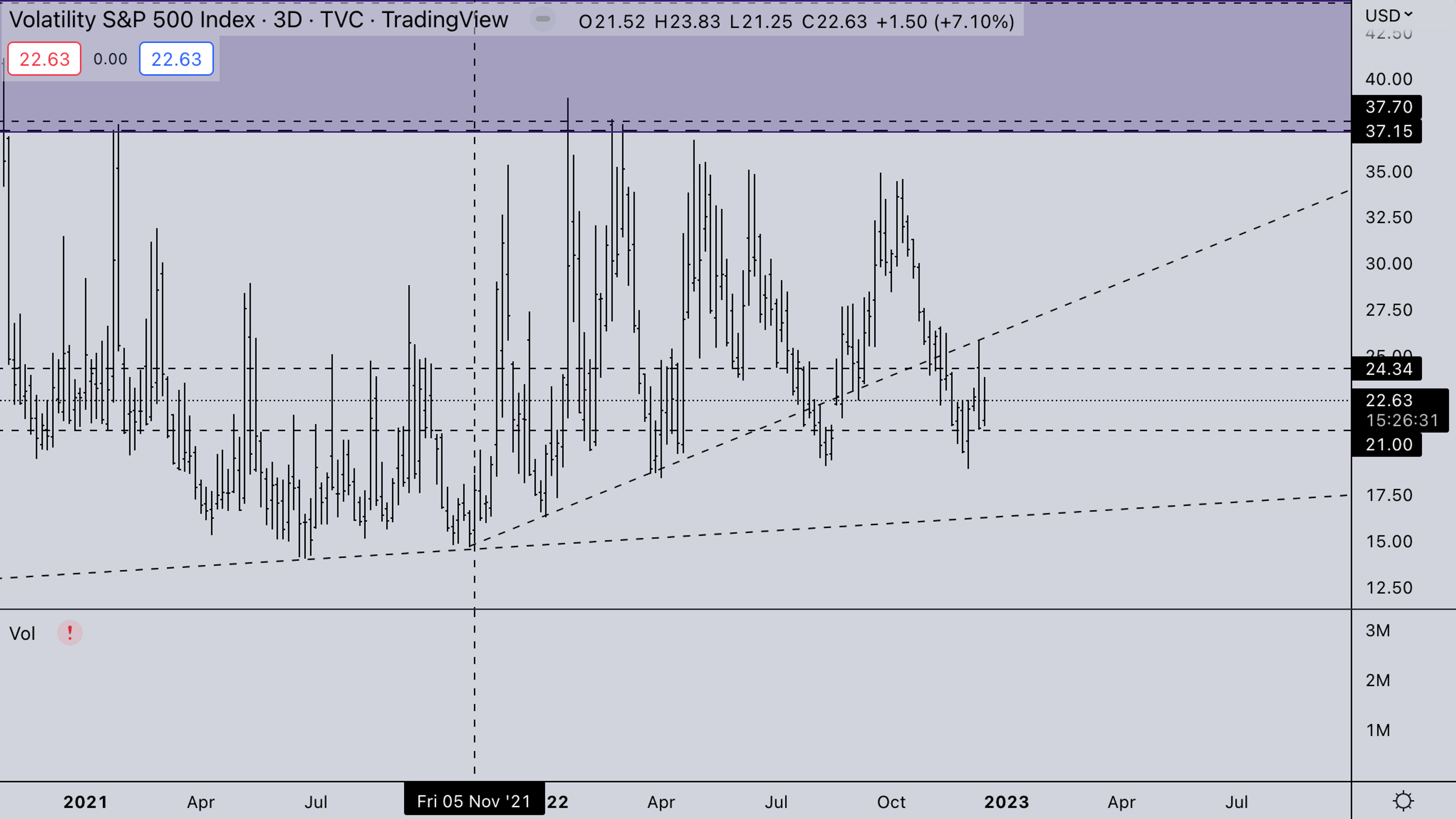

Legacy Markets VIX

Last week, the market saw a brief spike in the VIX just before CPI and FOMC data. Technically, the VIX still made a lower high. If the VIX can break under 21 again this week, it would likely spell the end of the correction for equities. This would also relieve the pressure of crypto - which got dragged down with the sharp selloff in equities after FOMC.

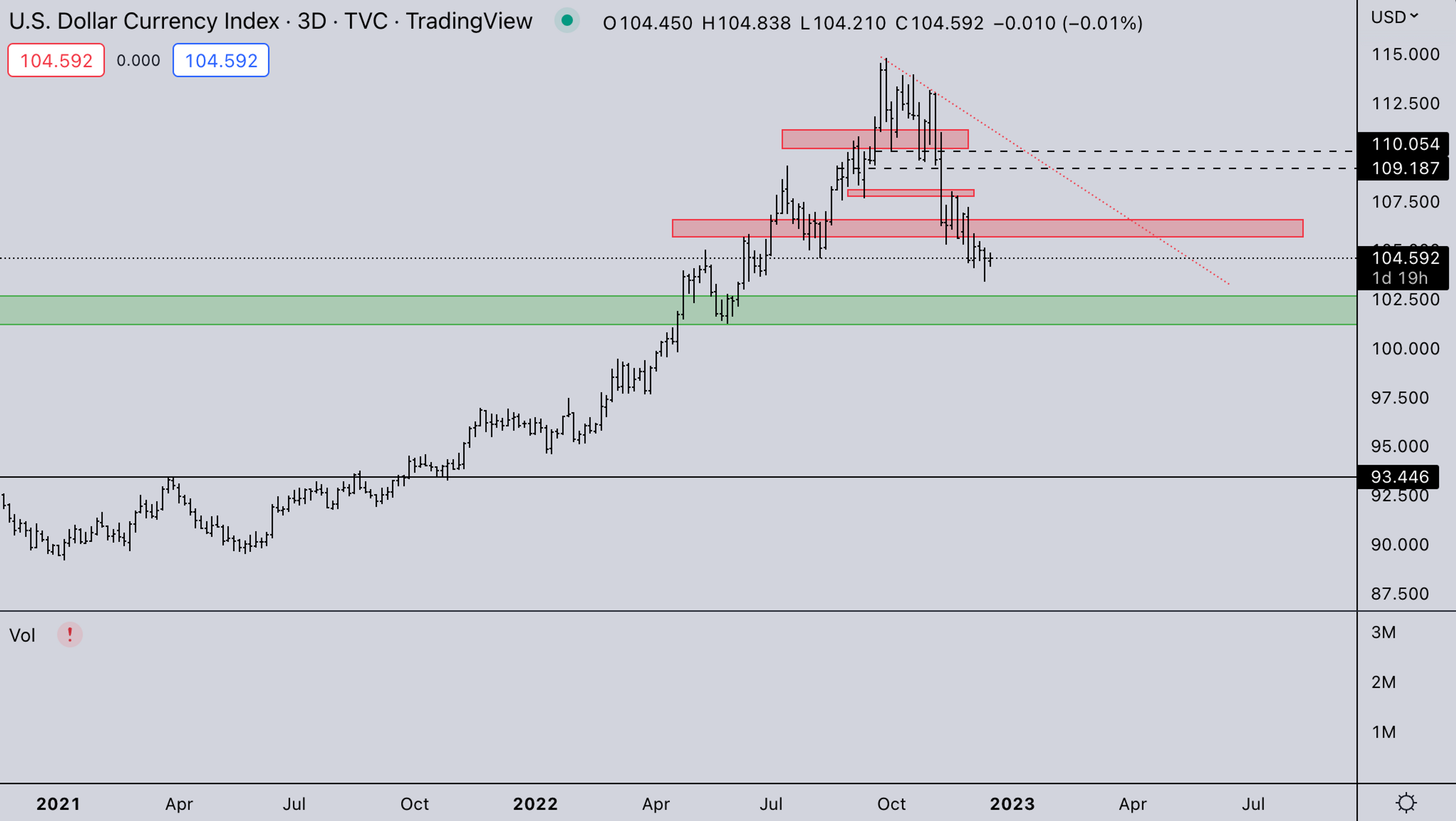

Legacy Markets DXY

DXY is still weak. With the initial down wave slowing down it will most likely range for the coming weeks. This should give the ideal climate for risk assets to reclaim some strength.

Open interest and Funding Rates

Last week, the market was driven heavily leveraged into FOMC. After the FOMC event, we saw a liquidation cascade of almost 1B in total size which only magnified the sharp selloff.

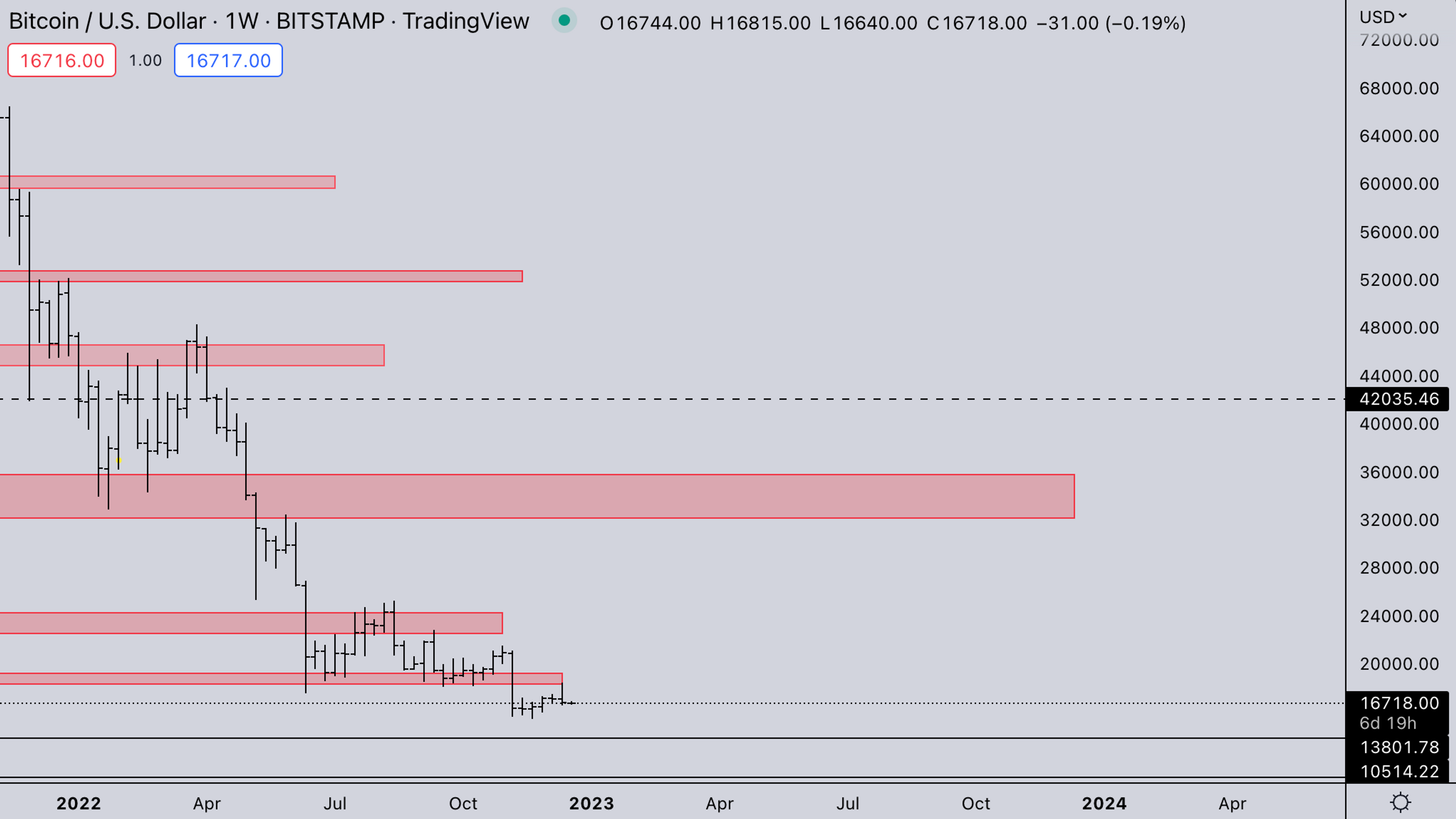

BTC Weekly View

This week will be fairly pivotal for crypto in the short term. With the selloff last week, the BTC weekly structure looks like another failed retest. But if crypto can hold base this week and not break down again - it would signal quite a lot of confidence to market participants.

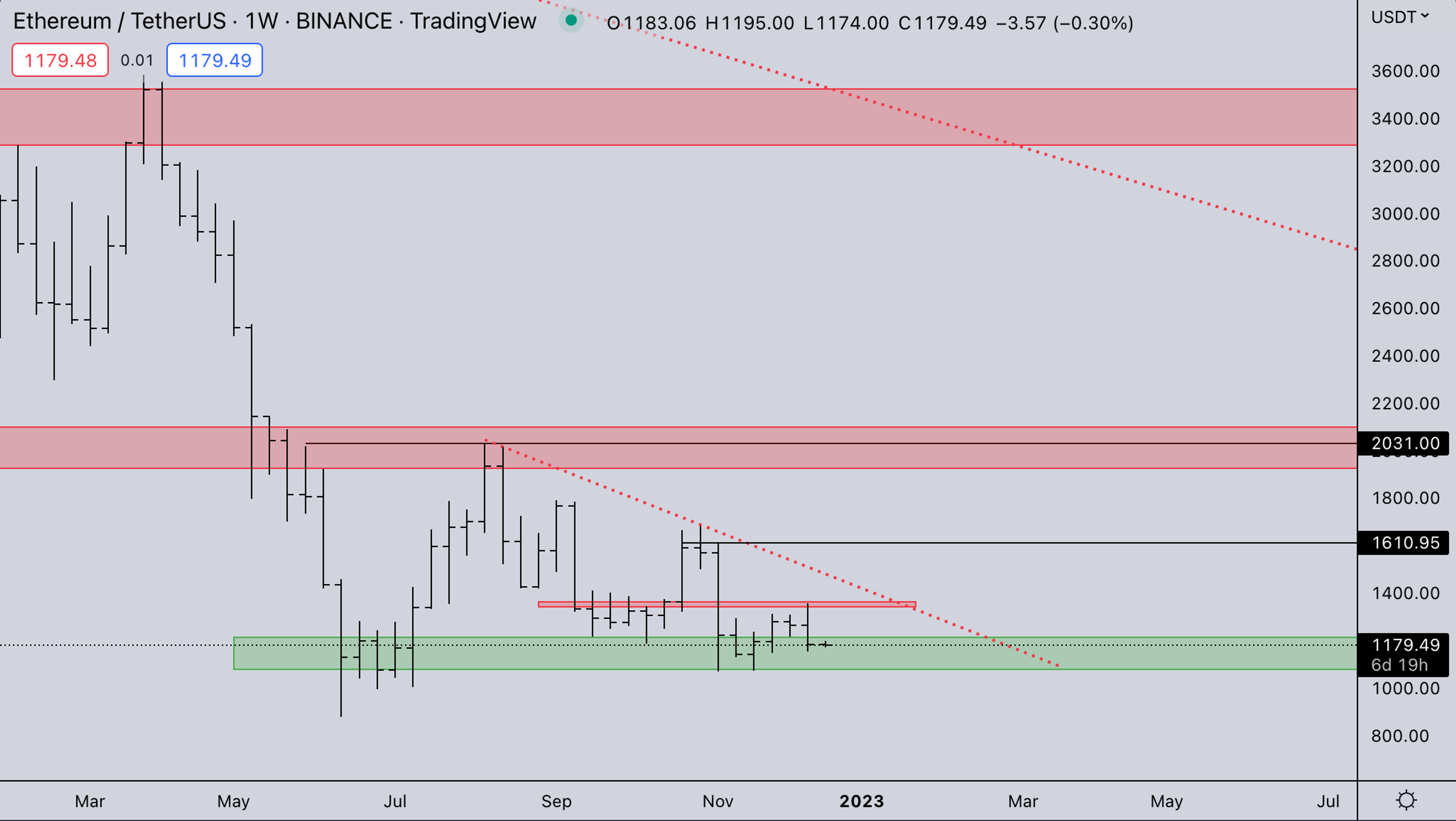

ETH Weekly View

ETH again is sitting relatively higher than BTC. With it still trading above the June lows, the downtrend that has started on lower time frames since July (since the ±2k merge rally), is now nearing completion. Other than the worst case ( DCG liquidating GBTC & ETHE via the open market), we believe the probability of a breakdown is still quite low. Even if the FTX liquidation couldn’t push ETH below (or even June levels low) we still don’t see any fundamentals that could. All the market is searching for now is reassurance from Barry Silbert or DCG statement itself. It’s quite likely they would strike a deal, with for example a Goldman Sachs, which is looking to acquire distressed cryptocurrency companies.

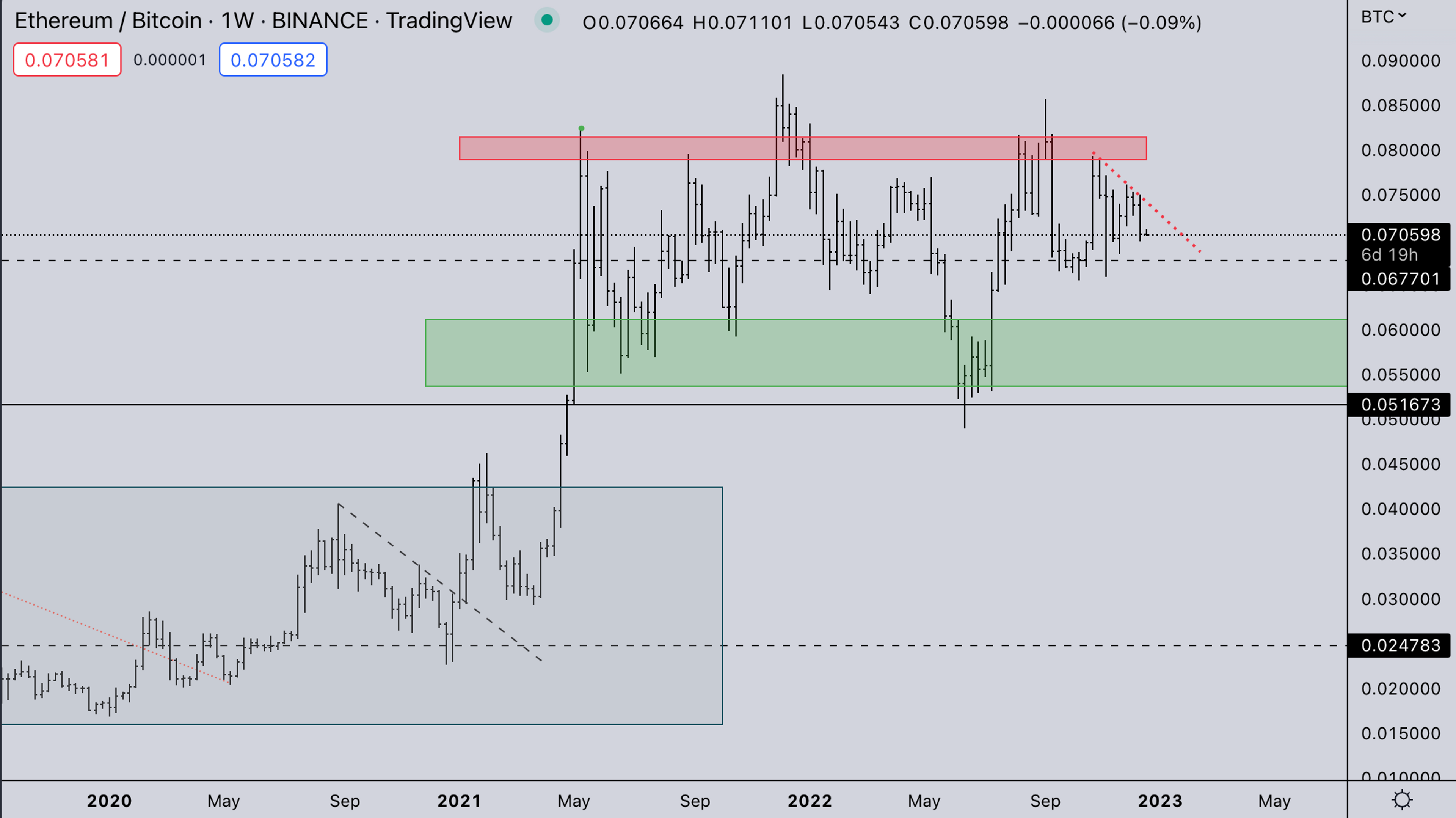

ETH/ BTC

ETH/BTC is still unchanged and in the larger range, based on what we’ve been tracking. Clear strength would still be a break over the 0.08-0.082 zone, and that would signal strength to other major altcoins.

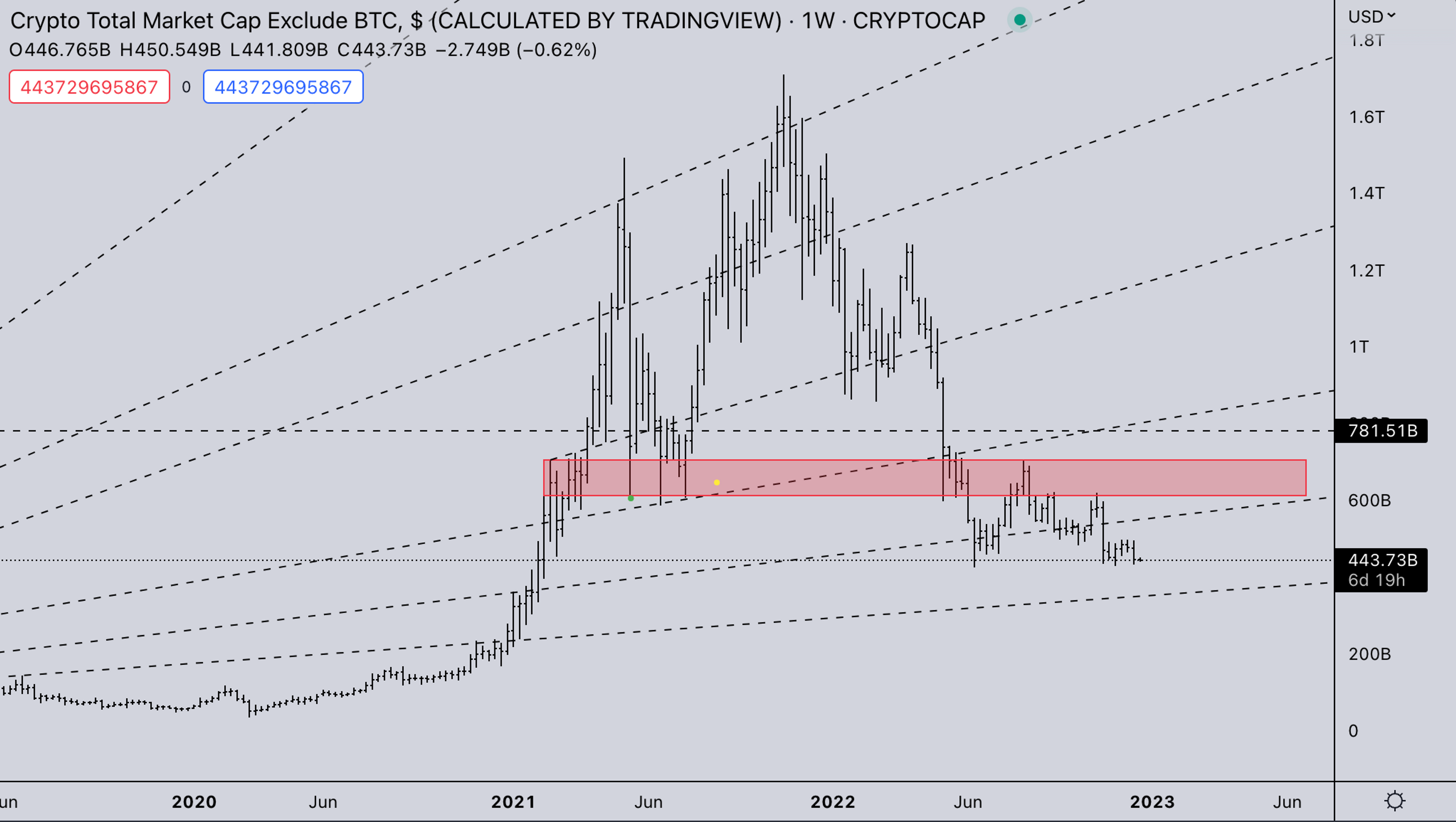

TOTAL2 - USD Market Strength

TOTAL2 has been weak after the rejection last week. There was a clear shift from strength in altcoins to BTC after the rejection. Alts kept bleeding, while BTC & ETH held somewhat stable - showing that the liquidity is scarce in the market and concentrating only on a couple of assets.Just like what we mentioned with BTC and ETH, this week will be the short-term decisive moment, whether crypto gets another leg lower or if it can finally show relative strength and hold the base.

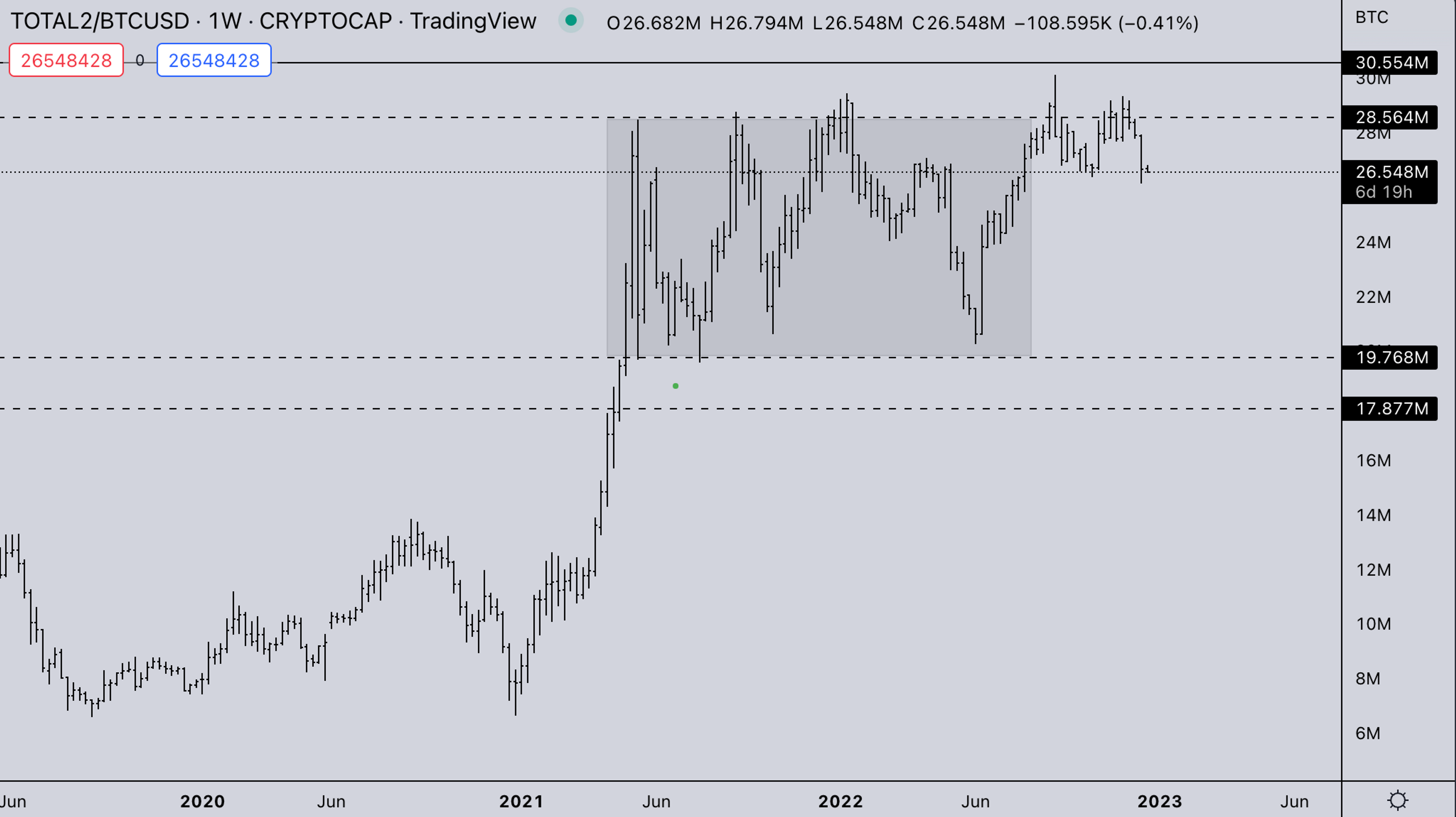

TOTAL 2/BTC - BTC Market Strength

TOTAL2/BTC last week we mentioned that TOTAL2 started showing signs of weakness relative to BTC. This week that got confirmed with a further breakdown & rejection from the 2017 ATH’s. As mentioned in previous section liquidity at the moment just isn’t there for 100’s of coins and that’s why it’s concentrating only around a couple of assets. Mainly BTC & ETH and whatever has some narrative or momentum..

DISCLAIMER

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?