All You Need To Know About the ETH Merge and Its Impact on the Market

The highly anticipated Ethereum merge is just around the corner, and the crypto community is buzzing with opposing opinions and discussing its consequences. Scheduled for mid-Sep, the process of validating crypto transactions will shift from what's known as Proof of Work (PoW) to Proof of Stake (PoS).PoS isn't a new concept in blockchain technology, and many other projects are running on it, but when the Merge happens, Ethereum will become the largest blockchain network to run on POS. Due to the complex ecosystem of Ethereum and the consensus mechanism shift, nobody knows for certain how this event will impact the crypto industry.

The Merge

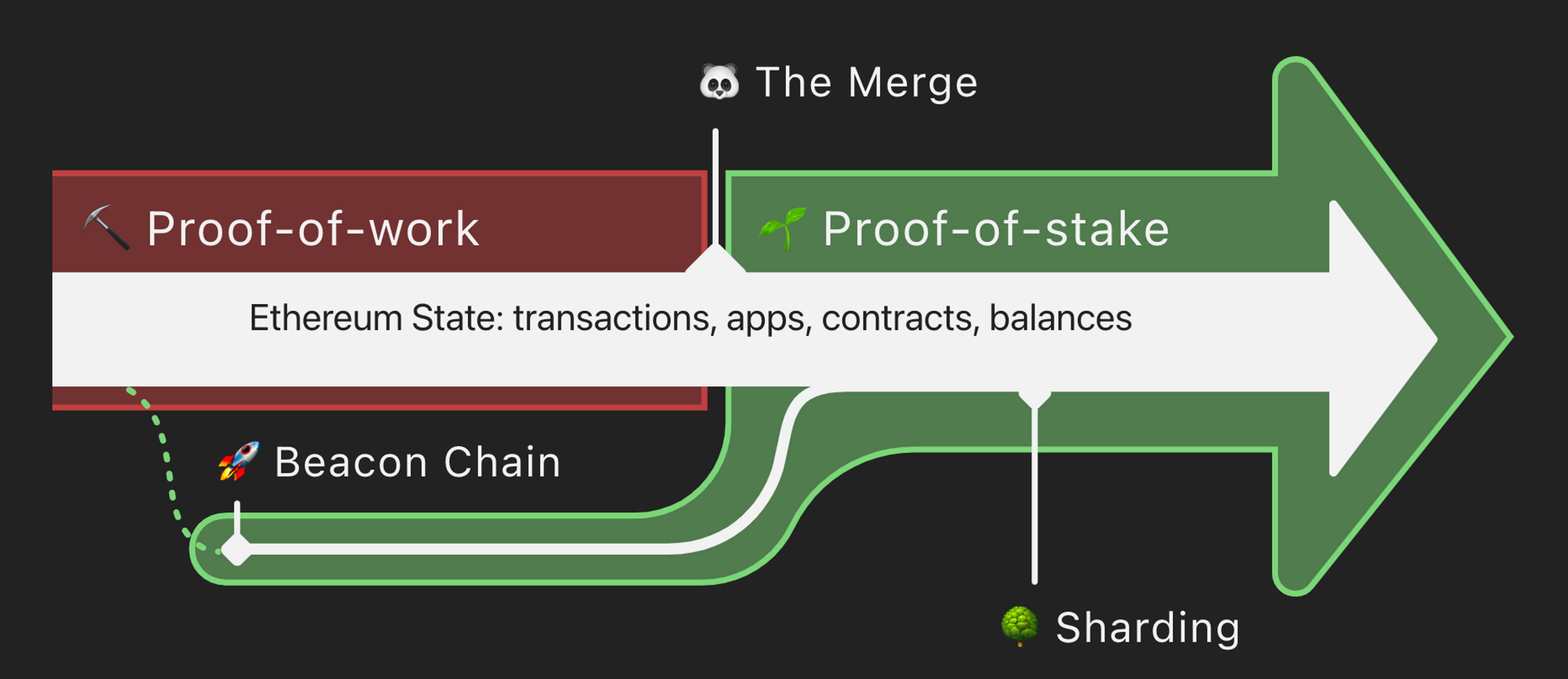

The Merge is the name of the process that the Ethereum blockchain transfers from using a PoW to a PoS consensus mechanism. It is called the Merge because it merges two separate blockchains currently running in parallel: the Ethereum mainnet, an energy-intensive mining process, and a special-purpose blockchain called the "Beacon Chain." Simply put, the Merge is a change of the consensus mechanism used to verify transactions and secure the network. The transition to a different consensus mechanism will bring many benefits, such as easier scaling and helping reach 100,000 transactions per second. "The Merge" is expected to cut 99% of Ethereum's carbon emissions. [caption id="attachment_1169" align="aligncenter" width="1864"]

(source: https://ethereum.org/)[/caption] Ethereum's PoS system is already being tested on the Beacon Chain, launched on December 1, 2020. So far, 9,500,000 ETH ($37bln equiv) has been staked there. PoS is an energy-efficient validation process used to verify transactions and secure the network, so the new consensus layer will exponentially reduce Ethereum's energy consumption.

What Are The Risks?

When the second largest cryptocurrency starts talking about switching to a more sustainable and secure consensus mechanism, it's bound to make waves and divide the crypto world. Ethereum is the most-used blockchain and powers ETH which has a $200 billion market cap. It also hosts numerous decentralized applications and DeFi protocols and establishes the authenticity of millions of non-fungible tokens (NFTs). The fact is that the Merge will affect not only the Ethereum blockchain but all the products and services in its ecosystem. Since Ethereum is switching from miners performing PoW, many people from the Ethereum mining community aren't thrilled about losing their power and income. They're working to build a hard fork of the current network to continue mining operations. This approach will essentially create 2 versions of the blockchain:

- 1 PoS with the symbol ETH

- 1 PoW with the new token symbol ETHW

Unfortunately, this will not only divide the Ethereum community (something we're already witnessing) but also create an additional issue: two versions of NFTs and digital assets will exist, which can attract replay attacks. For example, if a transaction happens on one chain, there's a way hackers and scammers can exploit the trade on the other. If by now you still didn't think about what might happen with your assets, now is the time. During the Merge, all ETH, regardless of where it is or whether or not it's staked, will automatically be converted to ETH2. So, you do not need to do anything if you invested in ETH or ERC20 tokens built on the Ethereum network. But if you plan on interacting with the ETHW blockchain, you need to break the link between the assets in your wallets and each blockchain to avoid any possibility of a replay attack. Added to possible technological risks, there are also ideological concerns. The Merge critics say PoS will make Ethereum more centralized and less secure.

Market Impact of ETH Merge

First of all, ETH's PoS transition is a structural change to the network, which will:

- Increase staking's real yield from the current ~0% to ~5% post-Merge

- Likely reduce the supply of ETH, so make it a deflationary cryptocurrency instead of the current inflationary one

- Increase the network’s overall efficiency and safety.

All these factors are tailwinds to ETH price in the medium to long term. However, in the short term approaching ETH to merge, we expect the ETH price to be still under some pressure and remain high volatility due to the macro environment and struggle between merge risk and benefits from ETH hard fork. On the macro end, although the U.S. CPI peaked in July due to lower commodity prices and market prices in some dovish Fed (e.g., a 100 bps hike in remaining of the year and possibly a cut in the second half of 2023), recently released Fed minutes and officials' discussion revealed that Fed will focus more on the still hot labor market. This could be slightly more hawkish than expected at Jackson Hole Summit as trying to refocus the market that fights against inflation, pushing the U.S. dollar index (DXY) to above 108 and a new round of sell-off in the crypto market. We expect the headwind from Fed policy against inflation will remain through the Merge. Secondly, although the ETH's Pow hard fork will issue additional ETHW tokens to current ETH holders and most merge-related trading strategies suggest people buy more ETH before the Merge, the potential technical risk during the Merge is still preventing some institutional buyers from kicking in, as they will feel more comfortable to step in once merge finishes and risks are gone. So putting all these factors together, we expect ETH price to continue under pressure and retain high volatility in the short term before Merge and merge narratives are likely to be superseded by Fed policies and the macro environment.

Kairon Labs PoV

Being the buy spot/short futures trade is very saturated, other opportunities may arise on merge day. We will be looking closely at DEXETH-backed coins as some price misalignment in the DEX/CEX pricing on these coins. Since ETH moves to a deflationary framework, we expect some initial pullback until stability is established for the deflationary factors to kick in. This means that deflationary currencies tend to increase in value as a decrease in supply meets demand or surpasses it. That is where to look for a solid equilibrium price discovery post-merge for the uptrend to kick in. Have additional questions about the Merge and its impact on your investment or token project? Reach out to us!(authors: Brett Beattie and Patrick Li)

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?