Macro Market Update, 17 October 2022

Last Week Recap

- CPI again came in hotter than expected. By now, CPI seems like a crowded trade, resulting in one of the biggest daily reversals on SP500 & Nasdaq.

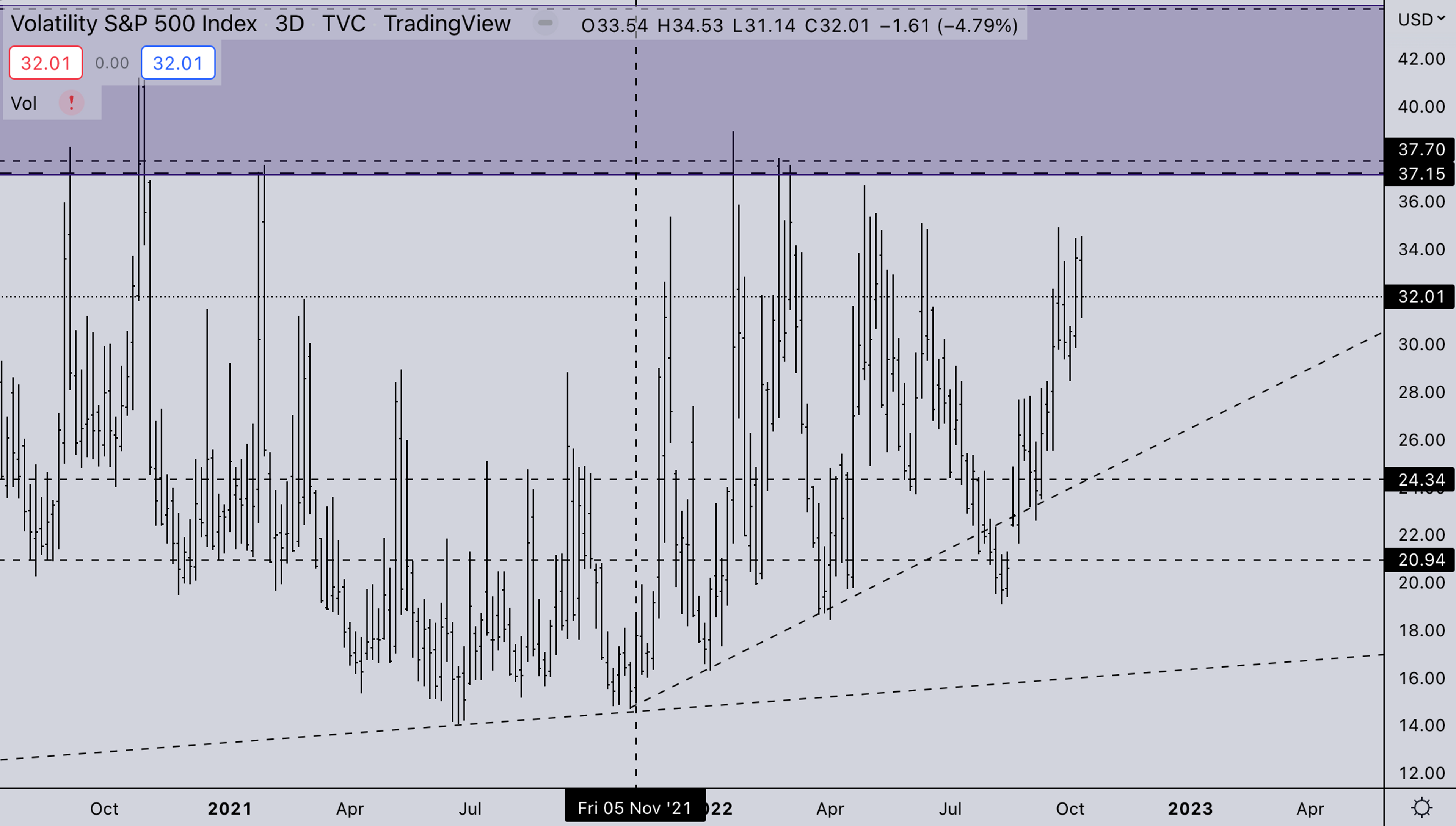

- The geopolitical situation is intensifying, leading to a sustained higher VIX environment.

- Mango markets on Solana get exploited for 117M.

- BOE ended emergency intervention on the 14th of October.

- JP Morgan beats earnings expectations leading the reversal on Thursday.

Legacy Markets

- VIX sustained in the lower 30’s. With the geopolitical situation intensifying, Russia, Ukraine, China, and the US over the chip industry, there are quite a few unknowns at this point that could lead to higher VIX.

- Economies around the world are starting to crack more and more under the aggressive policy of the FED. Other Central banks already started intervening (BOE, BOJ) with little success. Volatility has been low on crypto during this period, but it’s set to come off anytime now.

Open Interest & Funding Rates

OI on BTC is still sustaining higher levels since the initial push from the 3 & 4th of October. With price trading in such a small range with the OI build, a move, either way, will be quite explosive, driven by liquidations.

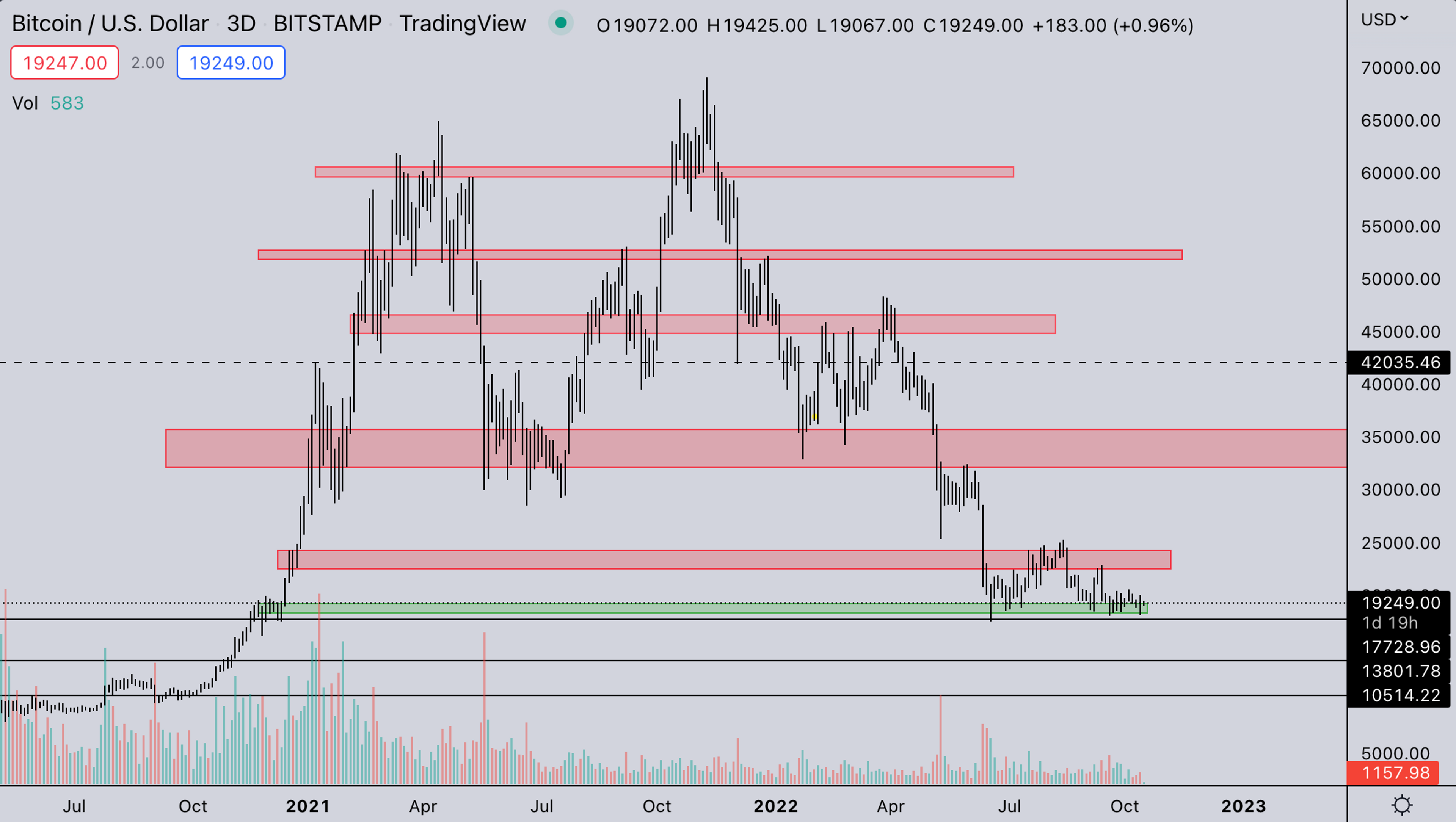

BTC Weekly View

- BTC is still sitting on support. The market has closed four weeks straight under the 2017 ATH. The range is also quite exhausted, which leads us to think we’ll see a pick-up in volatility soon.

- The current price structure is over 4 months old. Historically consolidations this size have led to multi-month trends. So whatever the direction will be, it will likely last for some time.

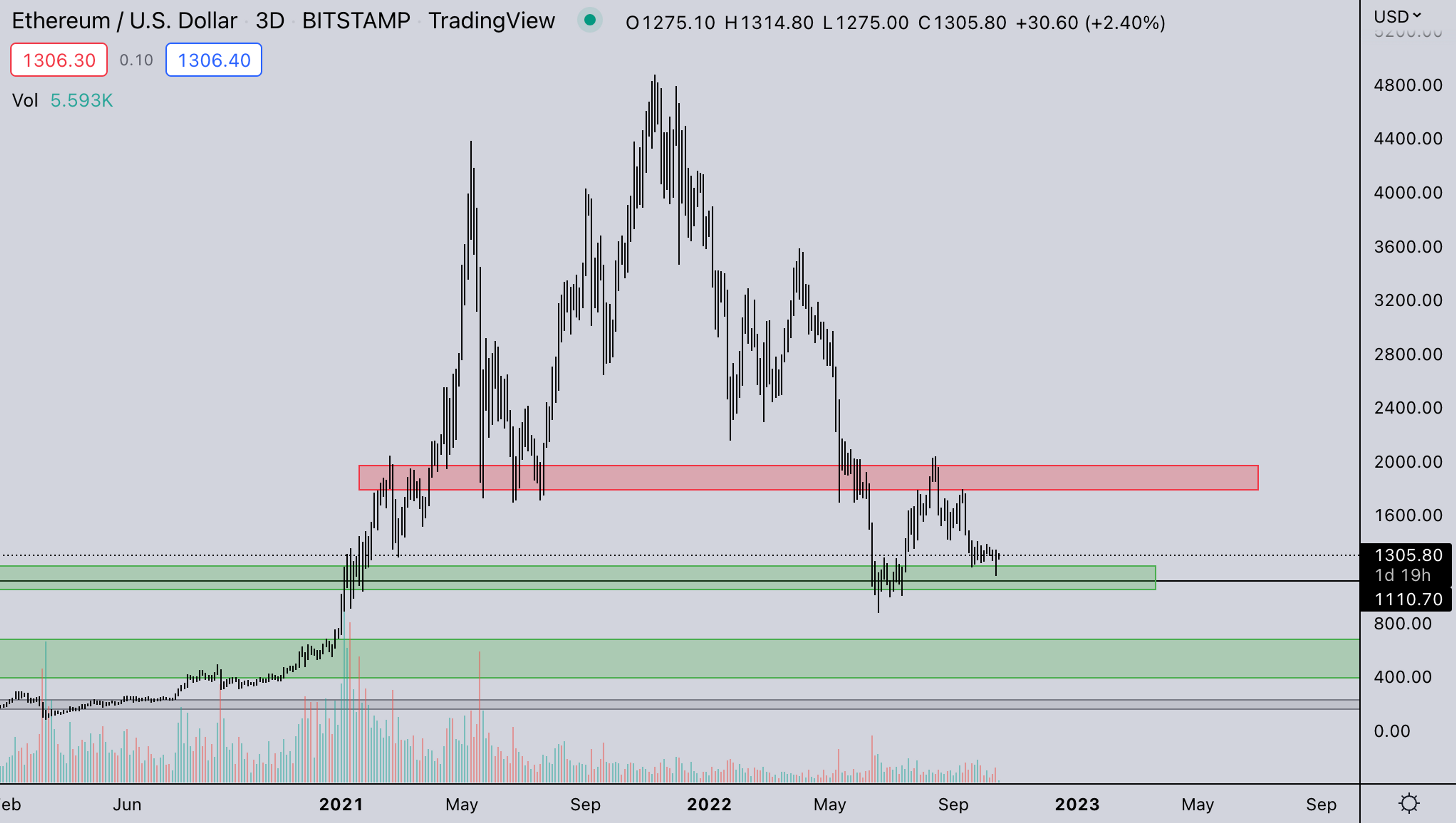

ETH Weekly View

- ETH is still stronger, outperforming the stock market and also BTC. Where many stocks retested June lows or even broke below them, and BTC also retested close to June lows, ETH only retested the range highs of summer. Most likely, the daily sell reduction of the merge + fundamentals around staking lock-up leads to a stronger ETH.

- However, ETH is also at a key inflection point like BTC. A rotation upwards would set it up for quite a large expansion.

- A breakdown would let it most likely retest the June lows.

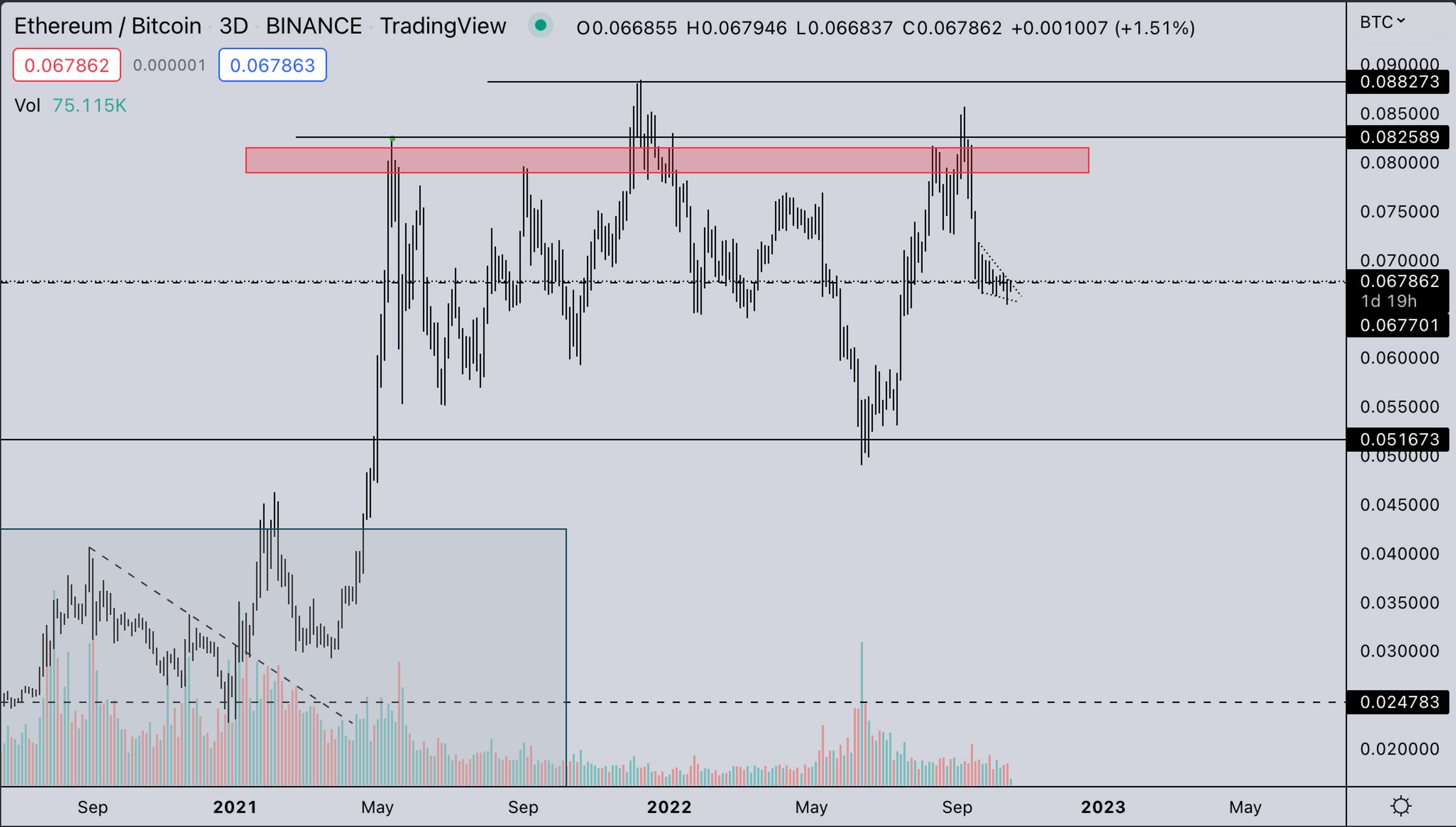

ETH/BTC

- ETH/BTC has formed a tight range on this consolidation's midrange point (0.067). With the relative strength of ETH, there’s quite a high probability that this rotates upwards back to the highs & hopefully finally clears the entire price structure.

- This would not only be favorable for ETH/BTC but would signal other ALT/BTC pairings to move higher.

TOTAL2 - USD Market Strenght

TOTAL2 is currently under the 2021 support, and below are trendlines. With what ETH/BTC shows, there’s likely a continued weakness because of a strong dollar in dollar valuations. But from what the market shows, there is underlying strength in ALT/BTC, given that ETH/BTC can make a move higher.

TOTAL2 - BTC Market Strenght

TOTAL2/BTC, as mentioned in the previous slide, with ETH/BTC consolidating in the midrange, we’re seeing a similar price formation on TOTAL2/BTC. If ETH/BTC rotates up, other majors will likely pick up on BTC pairings, and TOTAL2/BTC will finally break the 2017 ATH. This would lead to a sort of hidden bull market as nobody really trades BTC pairings anymore (They were, however, very popular in the pre-17' era of crypto).

SH*TPERP/ALTPERP

Lowcaps are finding some strength again relative to the highcap coins. Highcaps are moving more in tandem with BTC. Some lowercap coins are finding relative strength, especially Cosmos ecosystem coins and other outliers, so there’s definitely some positioning going on in the lowercap altcoin land.*SH*TPERP/ALTPERP is a measure of speculative risk. When SH*TPERP outperforms ALTPERP it shows a measure of speculation in the market, which shows how much risk people are willing to take at a certain time.

Summary

- Earnings week with Goldman Sachs reporting on Tuesday and Netflix on Wednesday. Given that banks lead the rally on Thursday post CPI, Goldman earnings will likely be market-moving.

- With volatility being where it is in crypto at the moment and the duration of the consolidation (4 months!), the break of it can lead to multi-month trend.

- ALT/BTC ratios indicate relative strength, which gives early hints of most likely a weak BTC/USD.

- Biden ordered all US engineers in chip companies to resign or renounce American citizenship leading to further geopolitical tension.

- Central banks are intervening increasingly, pressuring the FED in their choices, but they still seem hell-bent on getting inflation down before supporting their allies.

- JPY weakness continues. With the BoJ holding the majority of 10yr JGBs & unwilling to tighten, JPY support requires the BoJ to lighten US Treasury holdings putting pressure on UST yields.

- The market expects a 75 basis point interest rate increase, with a probability of 97%, at the Nov 2 FOMC meeting (https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html).

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?