Macro Market Update, 21 November

Last Week Recap

- BTC and ETH kept range-bound as FTX contagion slowly came to the surface

- DCG & Genesis seem to be in trouble. They’re currently seeking an emergency loan of 1B

- Grayscale also refused to post proof of reserves regarding GBTC backing, claiming “security” concerns if it would share addresses

- The negative premium for GBTC and ETHE both exceeded -40%, which is record lows

- Likely year-end bearish order flow is likely incoming from funds that got caught up in the FTX implosion due to LP’s withdrawing/ fund closing down.

- Gemini halted the withdrawal of its Earn program

- FTX “hacker” selling ETH to BTC via renBTC over the weekend

- Binance started a recovery fund targeting crypto projects facing a liquidity crisis

- EI Salvador starts buying BTC again, per President Nayib Bukele’s tweet

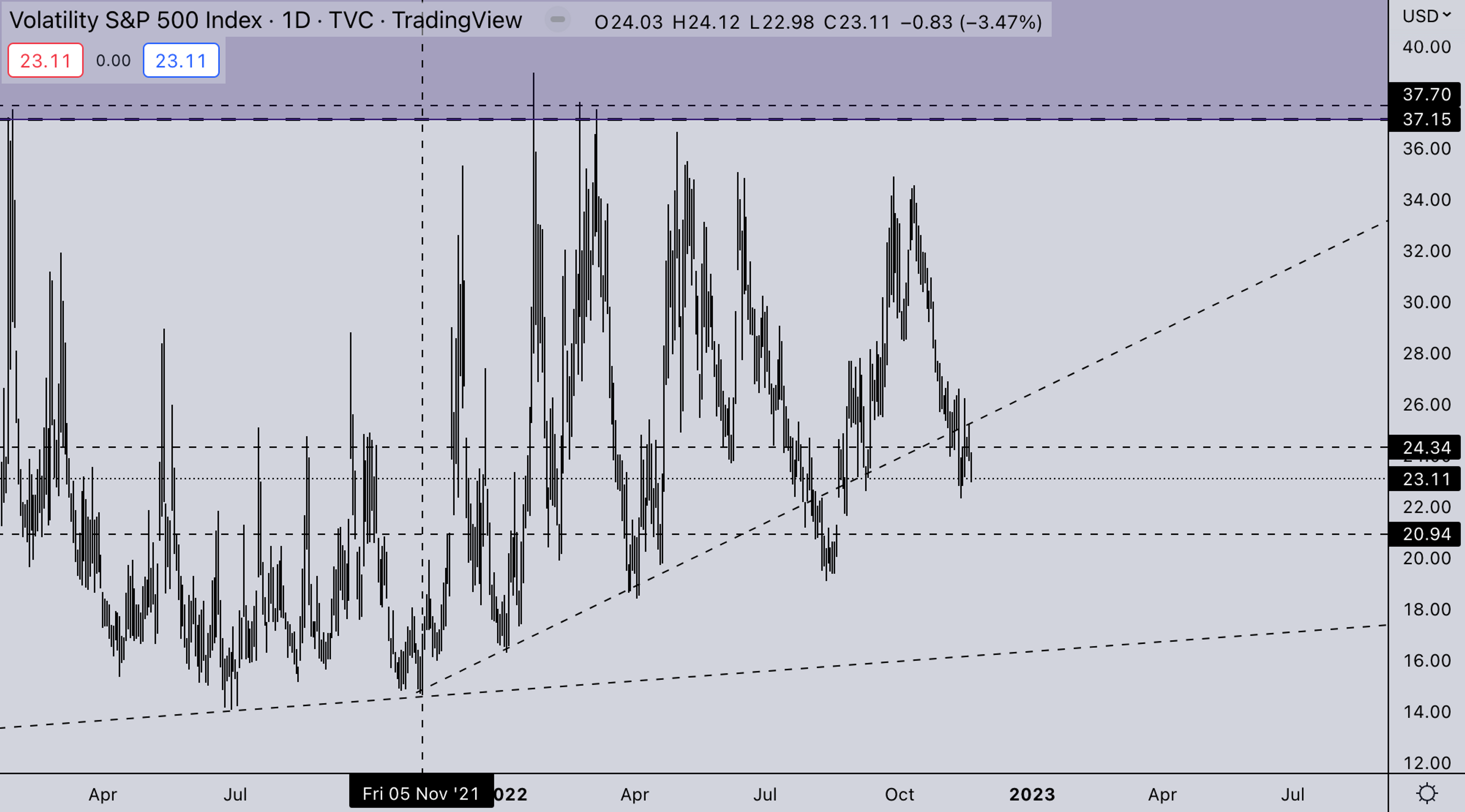

Legacy Markets - VIX

- With VIX entering the lower 20s & equities starting to get a little extended for a bear market rally. And macro-wise, a lot hasn’t changed. CPI came down a bit but is still high & no resolution in the geopolitical situation. The chances of VIX establishing a new floor are quite high. For crypto, one of the only reasons they haven’t fallen lower yet is because of the equity strength in the current rally and DXY weakness. If this strength starts waning, expect crypto to go with it.

- As VIX and DXY are the main drivers for the down waves in equities and crypto, we also include a chart about the DXY from now on.

- The main driver for the current equities rally is the dollar weakening. With the dollar at a fairly good level for some upside and equities being a bit extended, the expectation for the coming week would be DXY slightly up, -> Equities chop/slightly down, and crypto also chop (if there are no new blow-ups).

Open Interest and Funding Rates

OI hasn’t changed much the 3B drop in OI is mainly FTX OI going to zero. There isn’t a whole lot of leverage on CEXes, but as we’ve seen numerous times now, there is a lot of leverage behind the scenes between crypto companies.

BTC Weekly View

- As mentioned last week, crypto is closer to a bottom than ever before in price, but bottoms also take time to reverse.

- With BTC trading under a 5-month range which was broken on high volume. Purely from a technical perspective, we’d expect a 10-13k range for a bottoming zone.

- The upside is if DXY gets weaker again and equities rally further, and crypto doesn’t implode further could be squeezed into the low 20s.

ETH Weekly View

ETH is slowly grinding through the low summer support. For traders, this is a “chop zone.” We think it’s likely that ETH will take out the June low and weaken on ETH/BTC side. (Alts always lose strength on fast down moves from BTC). Afterward, gaining strength again on ETH/BTC (See next slide).

ETH/BTC

With uncertainty about contagion going around like wildfire, ETH/BTC is also losing ground. Day by day, it’s looking more likely that we’ll see another leg down on BTC with the FTX “hacker” still having a massive stack of ETH that he has been selling over the weekend we’d expect ETH/BTC going for one more leg down into .06-.063 area.

TOTAL2 - USD Market Strength

USD valuations are weak, with BTC being weak. TOTAL2 will absolutely go lower if BTC fails current levels. The expectation would be that TOTAL2 bottoms somewhere 350B area. Giving ±30% downside on the entire alt market.

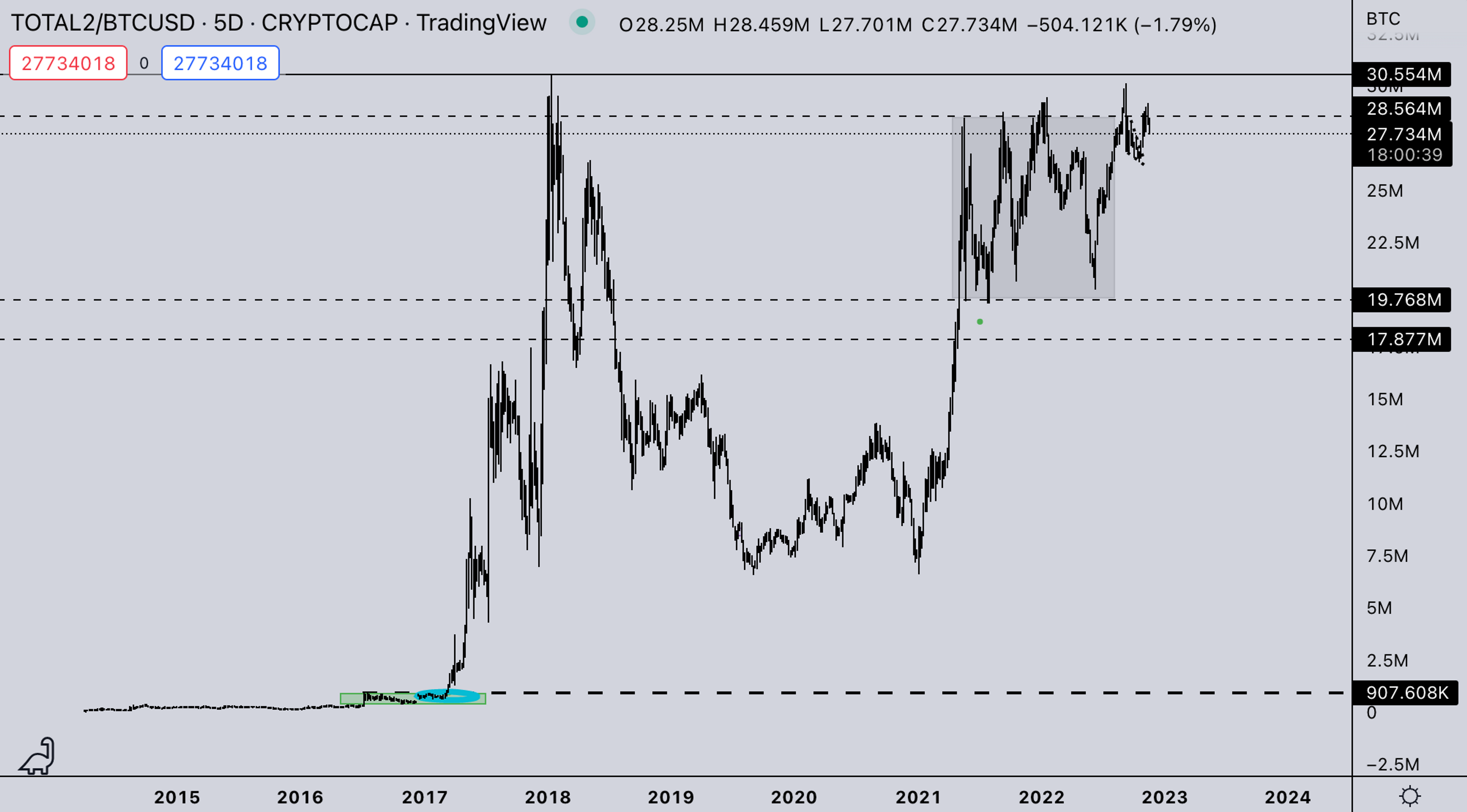

TOTAL2/BTC

TOTAL2/BTC was losing strength last week as alt’s are completely losing speculative premiums. With the expectations of seeing bearish year-end flow from funds redemption selling/ closing shop. We’re very cautious in relation to the popular fund coins as they will likely get sold off the most, dragging TOTAL2/BTC lower. On the other hand, if the market gives another leg down on BTC, the possible ALT/BTC upside from 10k levels is quite high.

Summary

- The crypto sector is under pressure due to FTX/Alameda and related events despite some good macro narratives, including less hot CPI and likely split US congress.

- Expected bearish year-end flows on crypto funds redemption selling/winding down.

- BTC & ETH 25 delta R/R (Risk-Reversal) (Put Implied Vol - Call Implied Vol) maintaining elevated levels since the 7-Nov-22 spike. We are bearish on the 1m ETH 30Dec22 25 delta R/R (P-C) and have prop positioned accordingly.

- Equity strength is currently giving crypto some support even in the current situation.

- Still, a lot of questions mark around big entities related to FTX.

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?