Macro Market Update, 28 November

Last Week Summary

- Genesis failing at finding a $1B raise to fill up the holes left by the FTX contagion.

- Binance starts a $1B recovery fund for promising projects that got caught in FTX.

- Curve released its native stablecoin crvUSD whitepaper and Github code.

- A whale wallet borrowed CRV (92 million CRVs at peak) on Aave to short and got liquidated, the position was not fully covered, and 2.64M CRV (≈ $1.6M at current value) remains as bad debt

- ConsenSys had trouble Collecting MetaMask Users’ Wallet and IP Addresses

- COVID makes an aggressive return in China, leading to new lockdowns & protests.

Legacy Markets VIX

- With VIX breaking below 21, a lot of hedging has come off in equity markets. The correlation between equities and crypto will also be weaker at these levels. The lag effect, especially on the upside in crypto, will be larger. But with that said, with equities trading at higher levels and tech & crypto lagging quite a bit for some time now. A stall in industrials and energy could give them both a good chance at catching up.

- It’s an important thought to keep a close eye on the VIX here it has rallied all year from these levels & has caused sell-offs every time. If it does so again, crypto does not have the relative strength to stabilize in such an environment and would most likely go for another leg lower.

Open Interest & Funding Rates

Since the FTX implosion, OI on BTC has been flat. We expect BTC to keep moving slowly while things clear up, giving room for altcoins to gain strength.

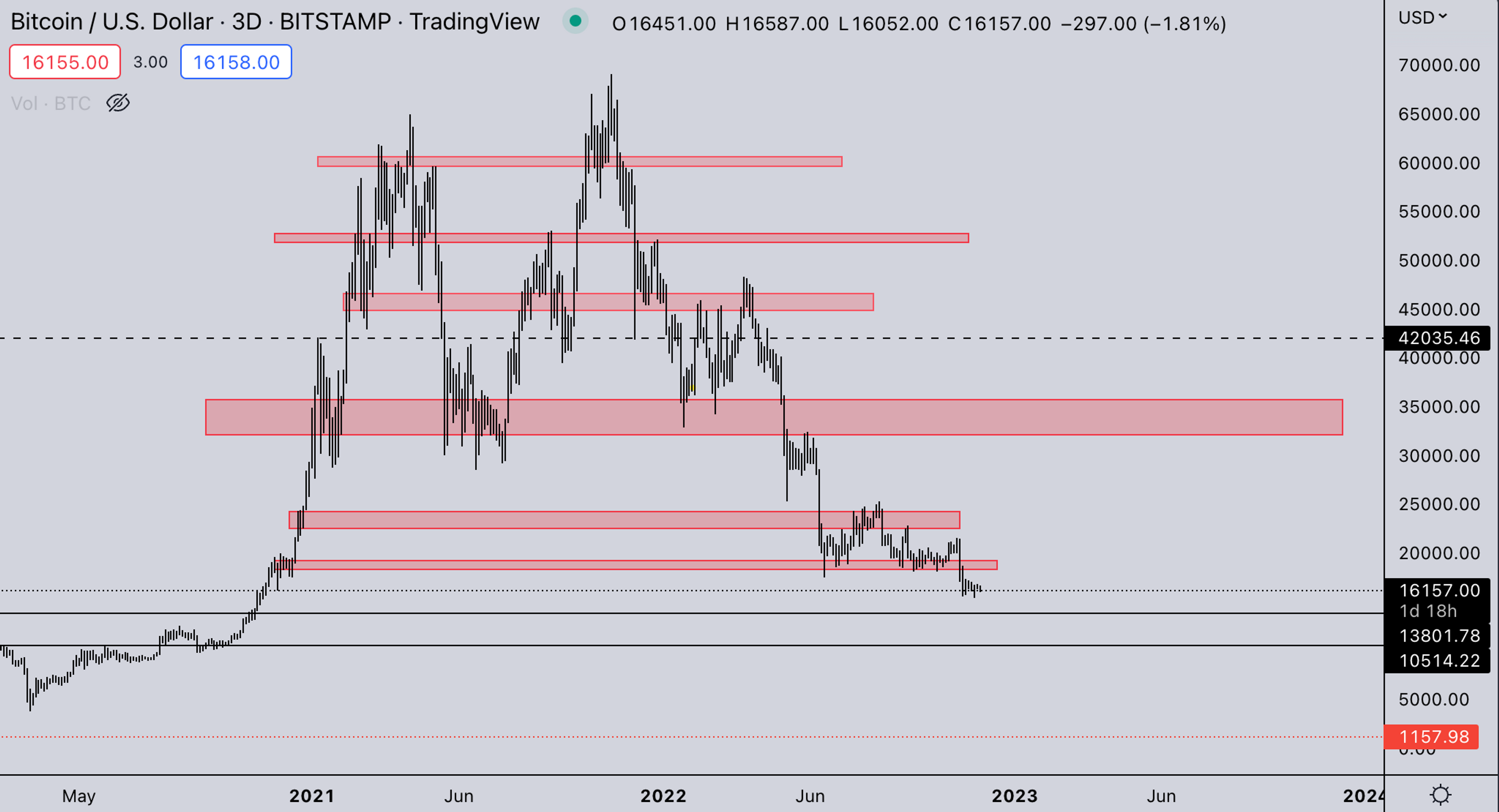

BTC Weekly View

BTC hasn’t really done anything since the FTX implosion. This leads us to believe that the worst might actually be behind us. There aren’t a lot of exchanges that could publicly blow up and have the same market impact as FTX did. Companies caught in the contagion will likely go the legal way, and those coins will be locked for years. So we don’t see an immediate driver for more open market sell pressure. Giving crypto a good chance to mean revert.

ETH Weekly View

- ETH is still holding higher lows vs June. If ETH rotates from this support, the size of the price structure would actually allow a sustained rally. This could possibly lead to ETH trading 2.5-3k in early 2023 (Q1-Q2).

- If ETH would fall back to sub 1K, we don’t think the June low would hold and most likely see ETH fall deeper into the 600-700 area.

ETH/BTC

ETH/BTC is shaping up stronger again. The current size of this consolidation is becoming quite ridiculous. If ETH can push above the red zone (.081), it will gain significant momentum. And bring significant momentum to the market, + the push likely leads ETH/BTC to new ATHs, which will bring retail eyes back to.

TOTAL2 - USD Market Update

As good as BTC ratio’s look on most ALT/BTC charts, the USD charts still look weak. TOTAL2 is consolidating right at the June lows. As we talked about with ETH, a push upwards from here likely brings it back above the 2021 floor (red zone).

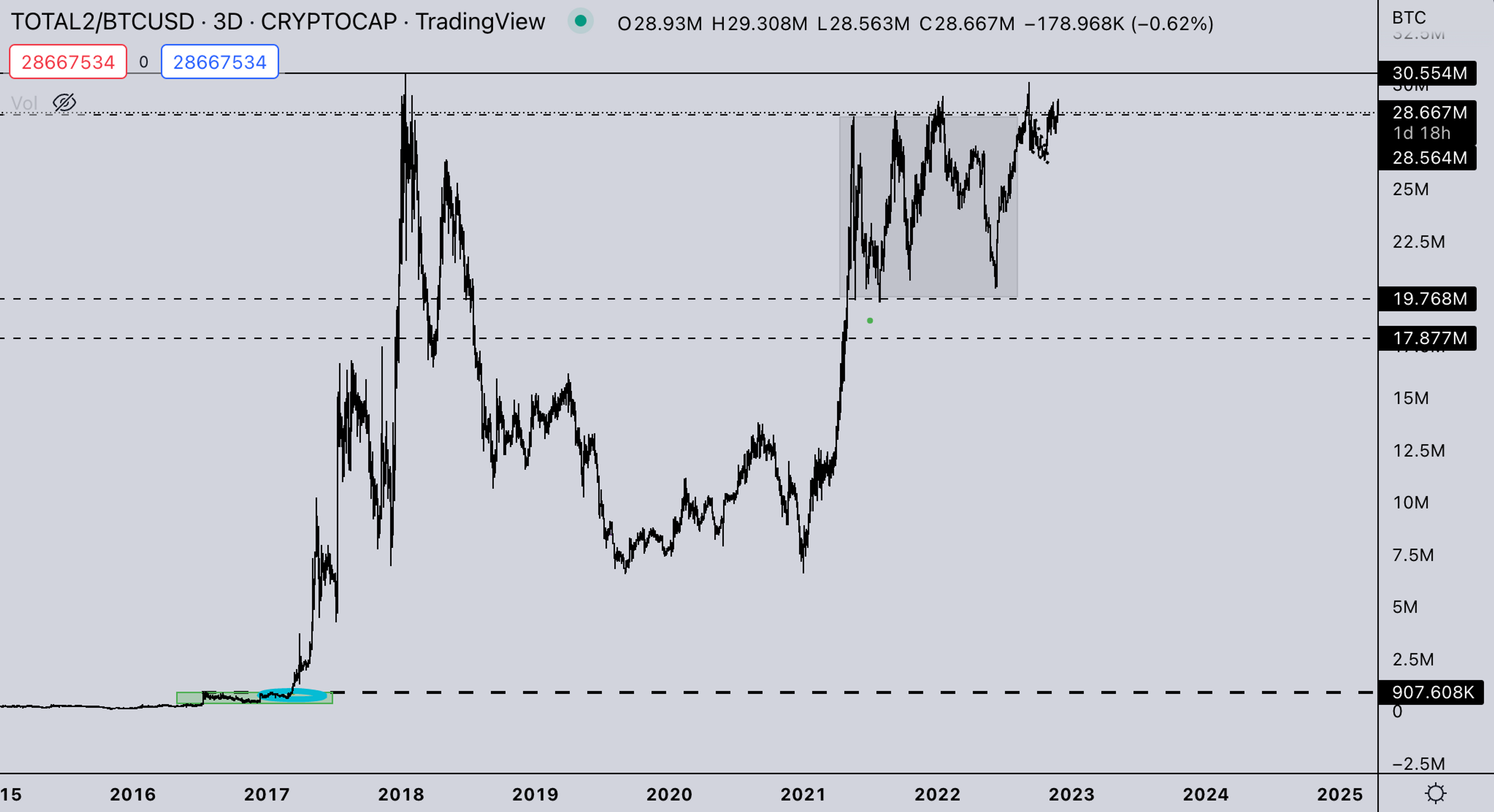

TOTAL 2/BTC

TOTAL2/BTC is looking really good if we get a repeat of the 2017 breakout (see blue circle) we can garner quite some upside. What is actually interesting is that the 2017 breakout was led by coins like LTC/XRP/DASH. And currently, those coins are actually again the relative strength in the market. Because TOTAL2 is actually dominated by the larger coins, it makes sense that the breakout would be led by higher-cap altcoins.

Summary

- ALT/BTC ratio’s quite bullish.

- FTX fallout is likely to not impact the open market any further. More likely to go through legal procedures, which could take years.

- Lower VIX levels mean less correlation between equities and crypto.

- FOMC minutes showed Fed officials see smaller rate hikes coming ‘soon,’ the market is expecting Fed to slow down its hiking pace, and a 50 bps in Dec is priced in.

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?