Macro Market Update, 7th November

Last Week Recap

- Dogecoin pump leads to better sentiment in crypto, leading to multiple altcoins popping off

- META will integrate NFT buying/selling in Instagram via multiple L1s.

- Google Cloud adds support for Solana.

- Binance and FTX get intertwined over the weekend resulting in Binance starting to liquidate their entire FTT position and causing mass withdrawals from FTX.

- FED hikes another 75BPS while the labor market stays strong.

- Deribit hacked for $28M from the exchange’s hot wallet.

- Vitalik releases new Ethereum roadmap, including fully SNARKed Ethereum and The Scourge

Legacy Markets

- VIX saw a further drop last week. With VIX decreasing, cross-asset correlation also decreases. This means that the crypto <> equity correlation started dropping. This was also the main reason crypto didn’t react as badly to the large big tech drops.

- VIX has continuously bottomed around the 20-23 level all year. With it trading back there right now should cause lower volatility after all the larger moves last weeks.

Open Interest and Funding Rates

The last leg above 21k was mainly driven by perps. Usually, not a good thing but crypto seems to be on a short squeeze in the immediate short term.

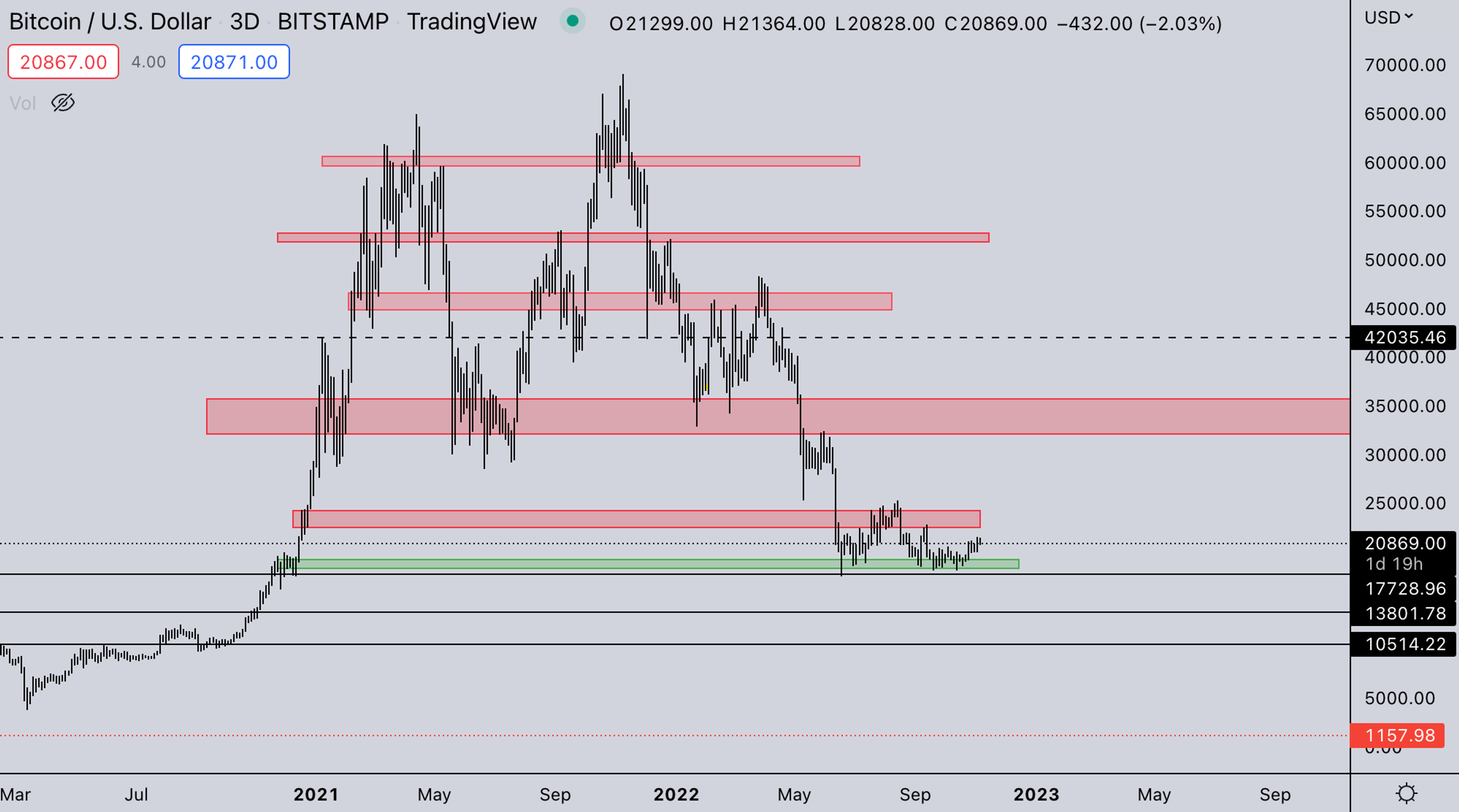

BTC Weekly View

For the amount, some altcoins have moved BTC hasn’t really done anything. It’s still in the large range between 20-24k. For a more sustainable trend in BTC, we’d like to see a break either way.

ETH Weekly View

- ETH is relatively stronger. Again consolidating just under the 2021 lows. Most likely, ETH will retest the 2021 lows leading to a probable upside of around 2k.

- This week a lower CPI print could act as further fuel for more upside.

ETH/BTC Weekly View

ETH/BTC is back at the highs of the structure we’ve been tracking for the last months. As mentioned multiple times, a breakout from this structure would likely lead to a sustained ETH/BTC rally.

Total2 - USD Market Strength

TOTAL2 is also back at the 2021 lows. With this being a major area of resistance, there will likely be some weakness in dollar valuations. With ETH/BTC being back at structure highs, a breakdown in BTC lower would most likely lead to a breakout in ETH/BTC. A breakdown in BTC would also lead to TOTAL2 getting another rejection here.

SH*TPERP/ALTPERP

The strength in the recent push was definitely amongst the highcaps in crypto. The market saw coins like MATIC, and Optimism rally well over 50% from the lows, with liquidity gravitating towards these volatile coins. Meanwhile, lowcaps haven’t gotten any decent action so far. *SH*TPERP/ALTPERP is a measure of speculative risk. When SH*TPERP outperforms ALTPERP it shows a measure of speculation in the market, which shows how much risk people are willing to take at a certain time.

Summary

- Midterm elections are on Tuesday.

- CPI on Thursday

- Hopefully, a positive resolution around the FTX/Alameda FUD that, at the time of writing, is going full speed.

- With ETH/BTC being right under resistance and crypto having relative strength in this lower VIX regime, all eyes should be on it.

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?