Macro Market Update August 1st, 2022

Last Week Recap

- Large moves up across the board after FOMC and better than expected big tech earnings.

- U.S. GDP declines for the second quarter in a row, a technical recession but dwarfed by the low unemployment rate

- Ethereum deployed the 10th “Shadow Fork” and set the final testnet (Goerli/Prater) merge for early August

- Tether CTO: we plan to support ETH 2.0

- Charles Schwab set to launch crypto-themed ETF on NYSE

- Aave DAO votes to approve the creation of GHO stablecoin, and it plans for GHO to function as an overcollateralized stablecoin similar to MakerDAO’s dai (DAI)

- Polygon’s Q2 data shows a significant growth in the ecosystem

- Babel Finance lost more than $280 million in bitcoin and ether due to its proprietary trading failure, according to the block

- Coinbase shares fell 20% after Bloomberg disclosed that the SEC was investigating it

- Facebook Parent Meta Loses $2.8B on Metaverse Division in Q2

Legacy Markets

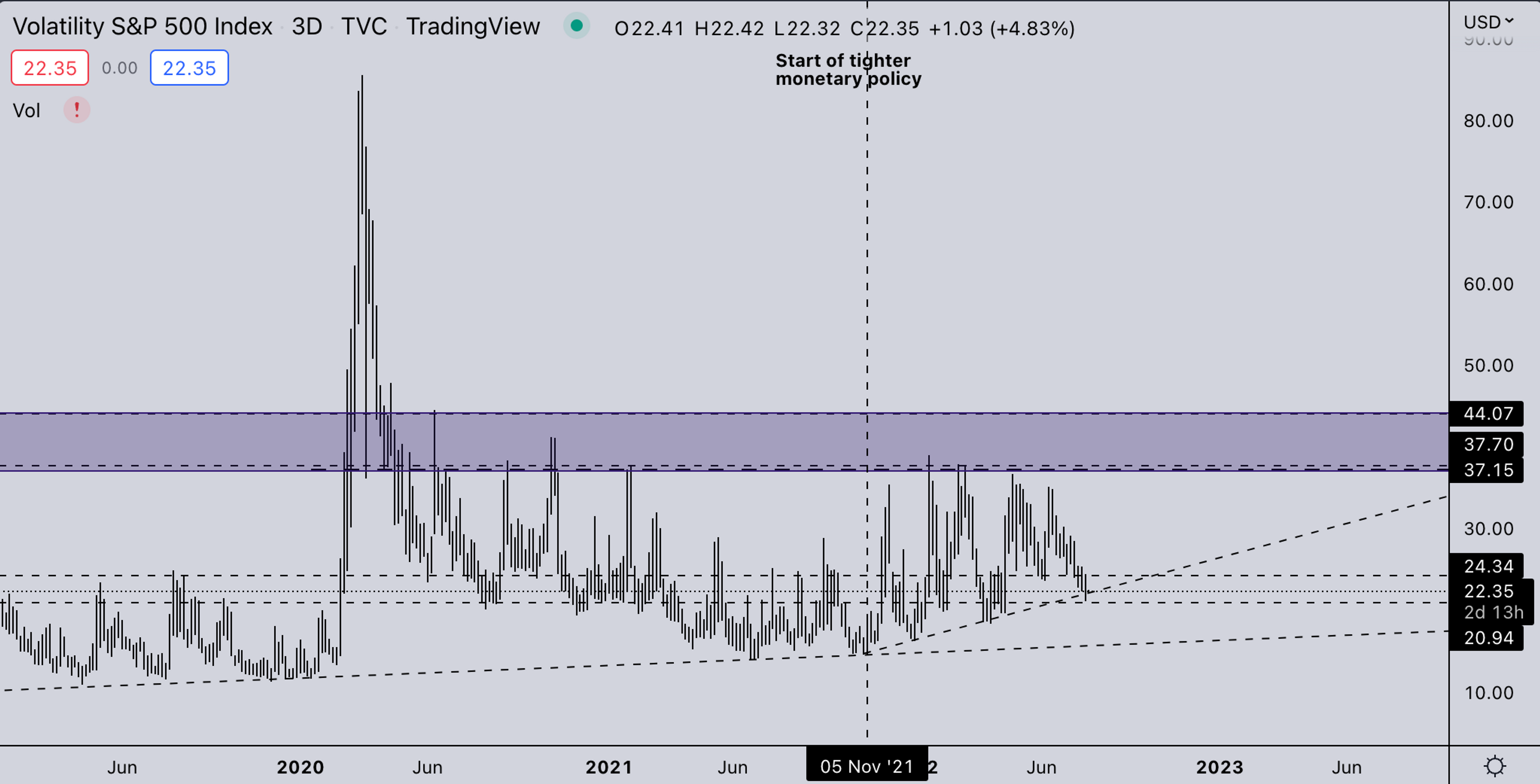

- VIX is hovering around the trend it started 5th of November. With the market already seeing a large relief rally, it’s getting quite a bit more dangerous now as VIX will most likely see some interaction at current levels. This means equities and crypto could range or even drop back a bit. (It doesn’t necessarily have to be bad, just a bit of consolidation).

- Sentiment definitely indicates most people missed the move and are/have rushed into the market. These late longers will most likely get flushed.

Open Interest and Funding Rates

Leverage has been fairly modest on the move to 24k. After FOMC, a lot of hedges came off in futures which helped build the momentum for the rally to 24k.

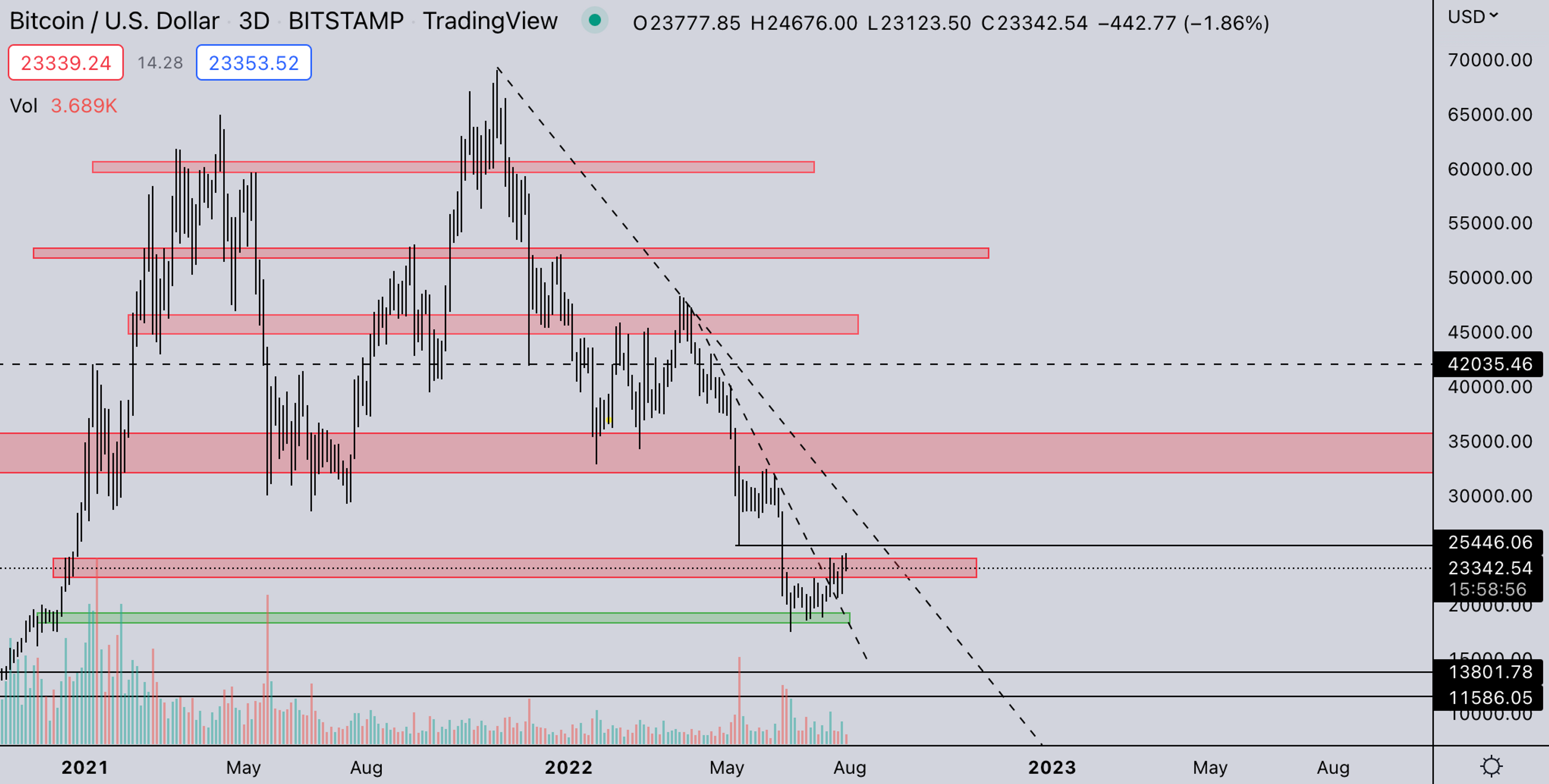

BTC Weekly View

- BTC is still one of the only major coins that haven’t retested the low wick from the LUNA crash (25446$). This is in line with what we’ve been writing about the hidden ALTBTC run happening under the hood.

- For now, BTC is still in range, things can get more interesting on BTC once it reclaims 25.5k else, ALTBTC is still more interesting. While BTC takes its time to figure out all the possible overhead in liquidations from lenders of the 3AC meltdown.

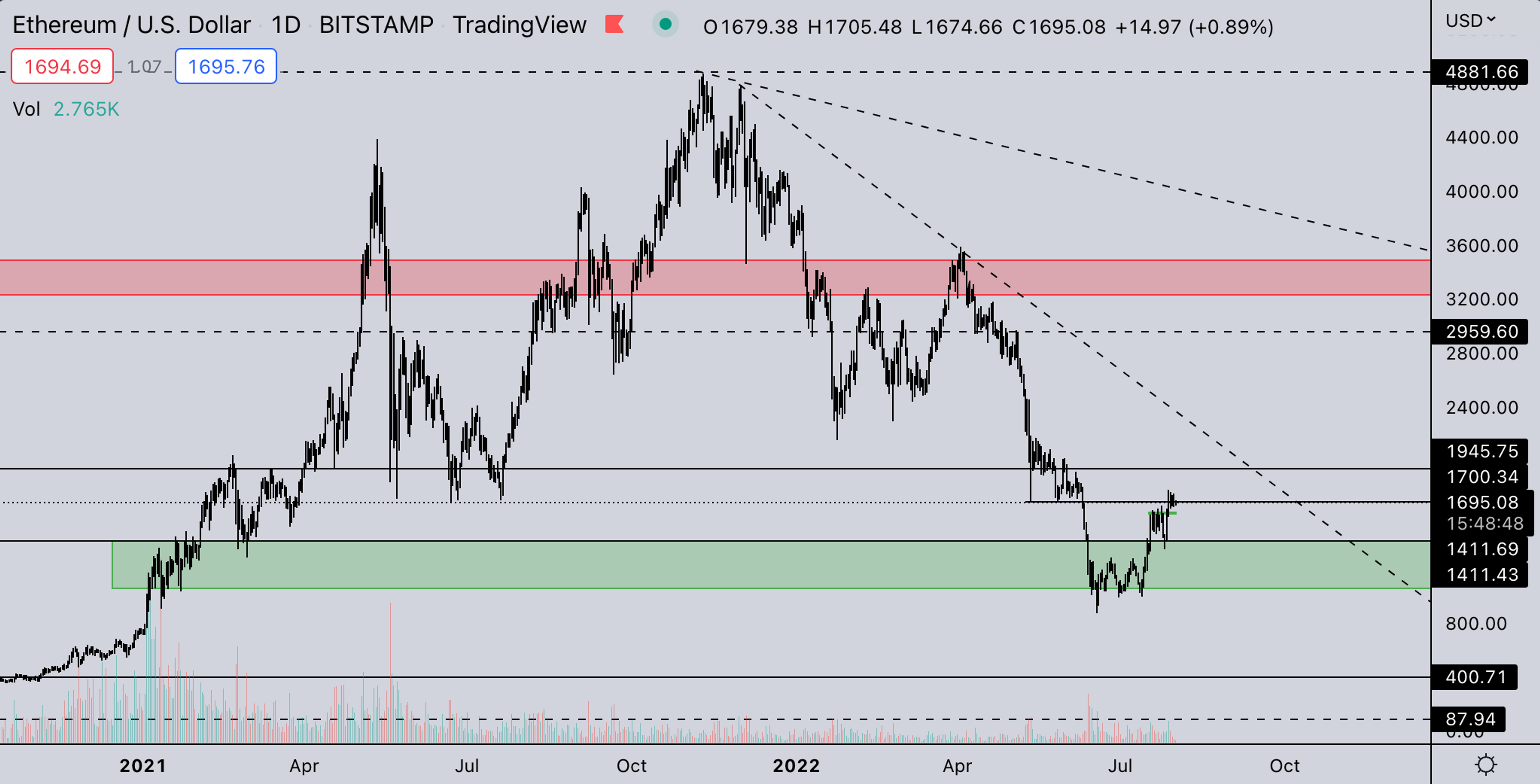

ETH Weekly View

- Where BTC couldn’t even get to the LUNA crash low, ETH is consolidating right on it. Not to mention for ETH, this is a fairly large area as it’s not only the LUNA crash low but also the summer 2021 crash low/bottom. From a price point of view, it's a fairly large wick area over 4 times around 1.7k. The chances of getting some rejection/stalling are high as these high-volume areas generally take time to reclaim.

ETHBTC

- ETHBTC has seen some slow down last week but still not a single sign of weakness. With the merge inching closer and closer and the Goerli testnet upgrade going live early this month, we expect the merge trade to continue. Coins indirectly benefit from the merge (LDO, Layer2’s…) are also massively outperforming the market.

- With ETHBTC catching strength and TOTAL2BTC likely pushing ATHs soon, there’s a fairly high possibility we’ll see older major coins run on BTC pairings as soon as ETHBTC gets above the 2021-2022 price structure (Over ±0.09).

TOTAL2 - USD Market Strength

TOTAL2 is still pushing the range low of 2021, reflecting the struggle in ETH with reclaiming the 2021 bottom. This again means that there’s a likely correction (which started this weekend) on dollar pairings for most coins. The clue is to keep a close eye on the BTC ratio. Coins that can hold or even slightly drift up on BTC pairings will likely be the first runners after the current counterwave/consolidation.

TOTAL2BTC - BTC Market Strength

As most will find surprising with the current market, TOTAL2BTC is almost at ATH’s. A price structure that has been forming since early 2021 and is nearing completion. The last time we had this was the beginning of 2017, which led to the massive ALTBTC bull run. In 2021 altcoins never broke the ATH ratio against BTC. But as mentioned in previous weeks, with BTC trading at lower valuations and having some muddy waters ahead with the 3AC <> Lender blow up, it makes sense for altcoins to push it and make new highs vs BTC. This does not mean alts will automatically hit new USD ATHs!

SH*TPERP/ALTPERP

SH*TPERP/ALTPERP is also showing strength & finding support. This means that several lower market cap coins are finding significant strength, and participants are seeking “gems” again.

Summary

- ALTBTC is where the market strength still is.

- ETH retesting LUNA crash low and summer 2021 bottom, expecting large price volatility near the merge

- DeFi total TVL recovered from a low $72B in May to $89B, a 23% surge, and Ethereum layer 2 scaling solutions Polygon, OP, and Arbitrium are contributing a large growth, the increasing TVL gonna help the total DeFi sector performance

- NFT sales still hold steady, but trading volume is down further, which impacts the metaverse sector and token trading volume

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?