Macro Market Update August 22nd, 2022

Last Week Recap

- Crypto markets enter correction before the merge as BTC down to 20,760 lows and ETH to 1,523 lows, which represents a sharp 17.7% for BTC and a 25% drop for ETH in less than a week (from recent highs of 25,215 and 2,032, respectively) mainly due to:

- Fed officials re-focused market into the inflation fight, which changed dovish narratives priced in the market, US dollar index pushed above 108

- Profit-taking by traders who have betted the ETH rally since July (100% return)

- Tether published its latest quarterly attestation report, which shows a 57.5% decrease in CP holdings over the prior quarter from $20 billion to $8.5 billion

- Tether holds US$8.4bn in commercial paper, comprising 12.6% of its total reserves of US$66.4bn

- FTX generated more than $1 billion in 2021 revenue after making only $90 million the year before, representing a 1000% growth

- FTX had $270 million in revenue in the Q1 of 2022 and was on track to do roughly $1.1 billion in 2022

- Uniswap Labs has partnered with TRM Labs to block 253 crypto addresses related to stolen funds or sanctions

- Huobi Stablecoin HUSD recovered to $1 after dropping 10% due to liquidity problems

- CME Group announced it plans to launch options on Ether futures on September 12, before the merge

- ETHW Official will temporarily freeze certain LP contracts to protect users’ ETHW tokens after the hard fork.

ETH Merge Monitoring Dashboard

Protocols/Communities/Companies support ETH hard fork

-

- BitMEX: to offer leverage trading for potential Ethereum POW fork

- OKX: to evaluate and support the airdrop and withdrawal of forked tokens

- Binance: “will support The Merge”, In the case of new forked tokens, Binance will evaluate the support for distribution and withdrawal of the forked tokens.

- Poloniex: has enabled the trading of potential ETH forks, ETHS (ETH2) and ETHW (ETH1), and listed TRON-based ETHS and ETHW.

- APENET: the APENFT Marketplace will support all NFT trading on the ETHPoW chain, allowing APENET to facilitate the ETH 2.0 merging.

- Huobi: confirmed that it would support Ethereum forked assets on its platform as long as they meet the exchange security requirements

- Gate: Will Support ETH Potential Hard Fork and List ETHS and "Candy" Token ETHW

- MEXC: Supports Ethereum (ETH) 2.0 Upgrade & Lists Potential Hard Fork Tokens

Protocols/Communities/Companies object ETH hard fork

-

- Circle: Circle plans to only support the Ethereum PoS chain after the Merge

- Tether: USDT supports ETH PoS transition

- Debank: All Products Do Not Support Ethereum Forks

- Chainlink: Will Not Support Ethereum Forks After the Merge

- Digital Currency Group: does not intend to back any Ethereum hard fork

- ETC Coorperative: Urges ETHPoW To Drop Ethereum Fork (ETHW) Plan

- Aave Community: Only Support Post-Merge Ethereum PoS

- Yuga Labs: Only accepts NFT on ETH Pos

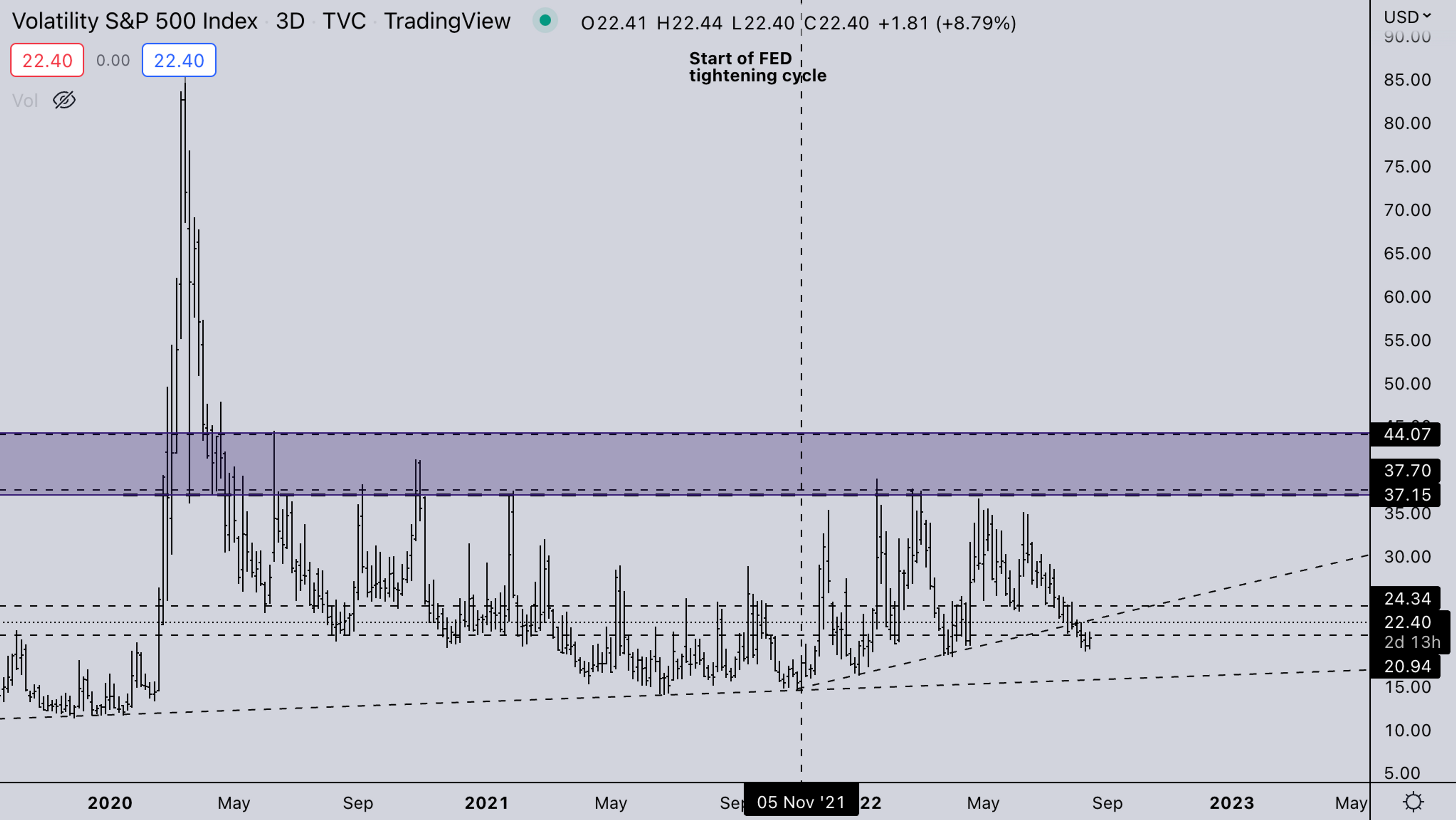

Legacy Markets

Markets dropping with VIX at the low 20s indicate a large distribution. If the VIX rotates back upwards to the high 20’s / low 30s, that probably forms the next leg lower on some coins that didn’t bounce as hard as others. For other coins, that could become the macro higher low.

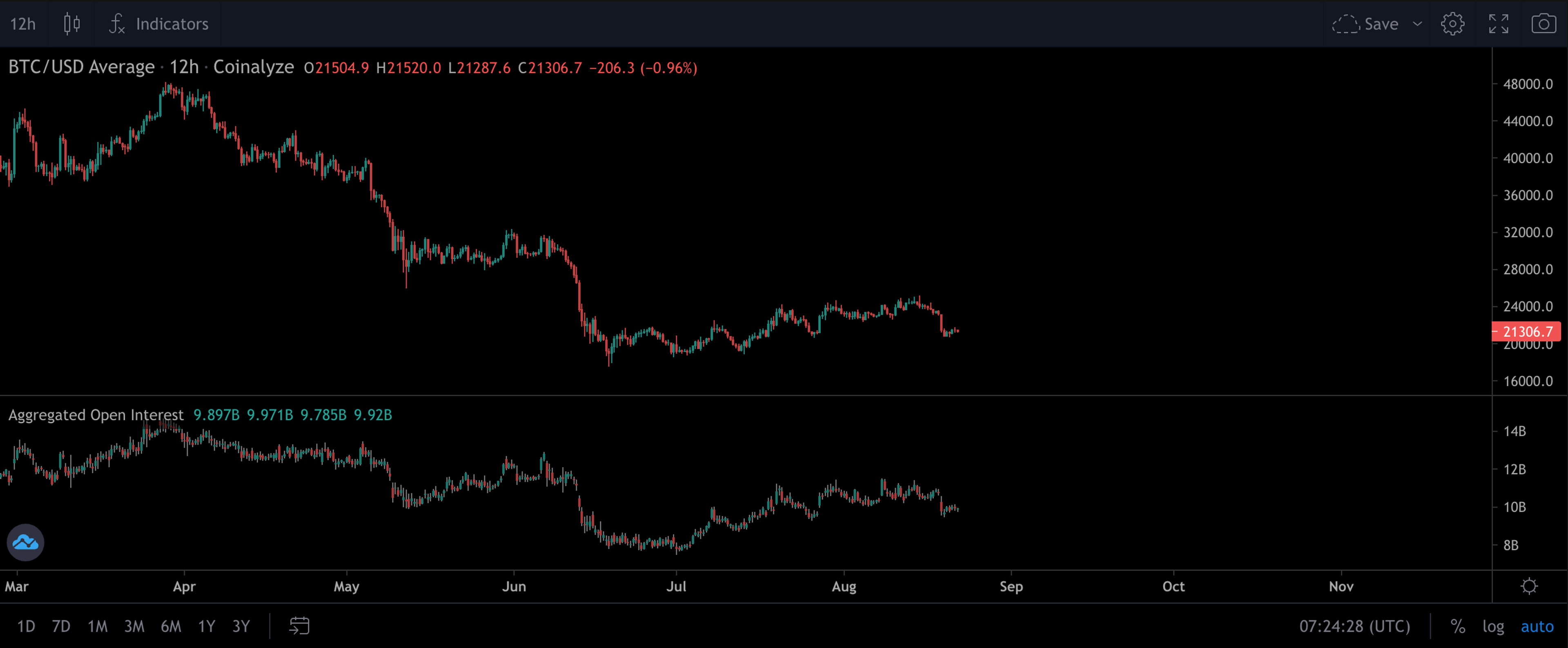

Open Interest & Funding Rates

There were fairly large liquidations on the drop from 24k. Even though the range is relatively small, participants were already levered up quite high. With summer slowly coming to an end and the merge coming, there’ll be lots of uncertainty in the market for September.

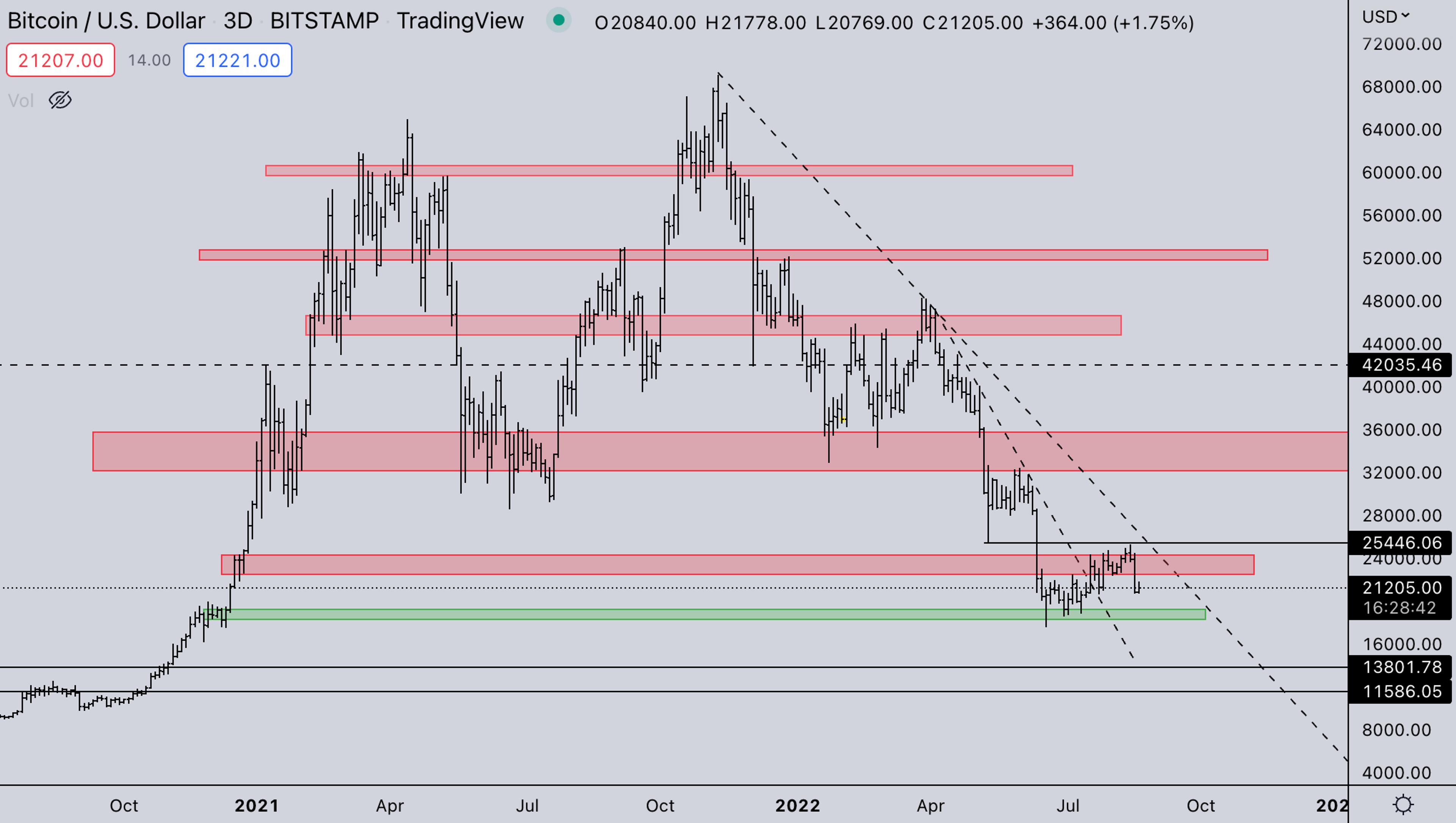

BTC Weekly View

After grinding upwards to 25k, BTC saw a large drop-off. With no recovery over the weekend, the market seems to be risking off for September. With the merge and FOMC coming up, there are lots of unknowns.

ETH Weekly View

ETH is structurally trading higher than BTC. A possible scenario could be that BTC potentially breaks its current lows while ETH builds a macro higher low. The current weakness is mainly because the reversion trade of the 3AC liquidation is completed; additionally, the window of no FED is ending with FOMC starting again in September.

ETH/BTC

After a significant low surge, ETH/BTC traded upwards for several weeks. With it finally slowing down in the .08 region. With the upcoming merge and supply reduction, this is likely just a corrective counterwave before ETH/BTC marches higher.

TOTAL2 - USD Market Strength

TOTAL2 is painting a similar picture as ETH. With that in mind, multiple altcoins retrace 2 months of price action on 2-3 days. This shows just how thin liquidity in the market is at the moment, and it’s continuously rotating between coins that are outperforming in hopes of catching some momentum.

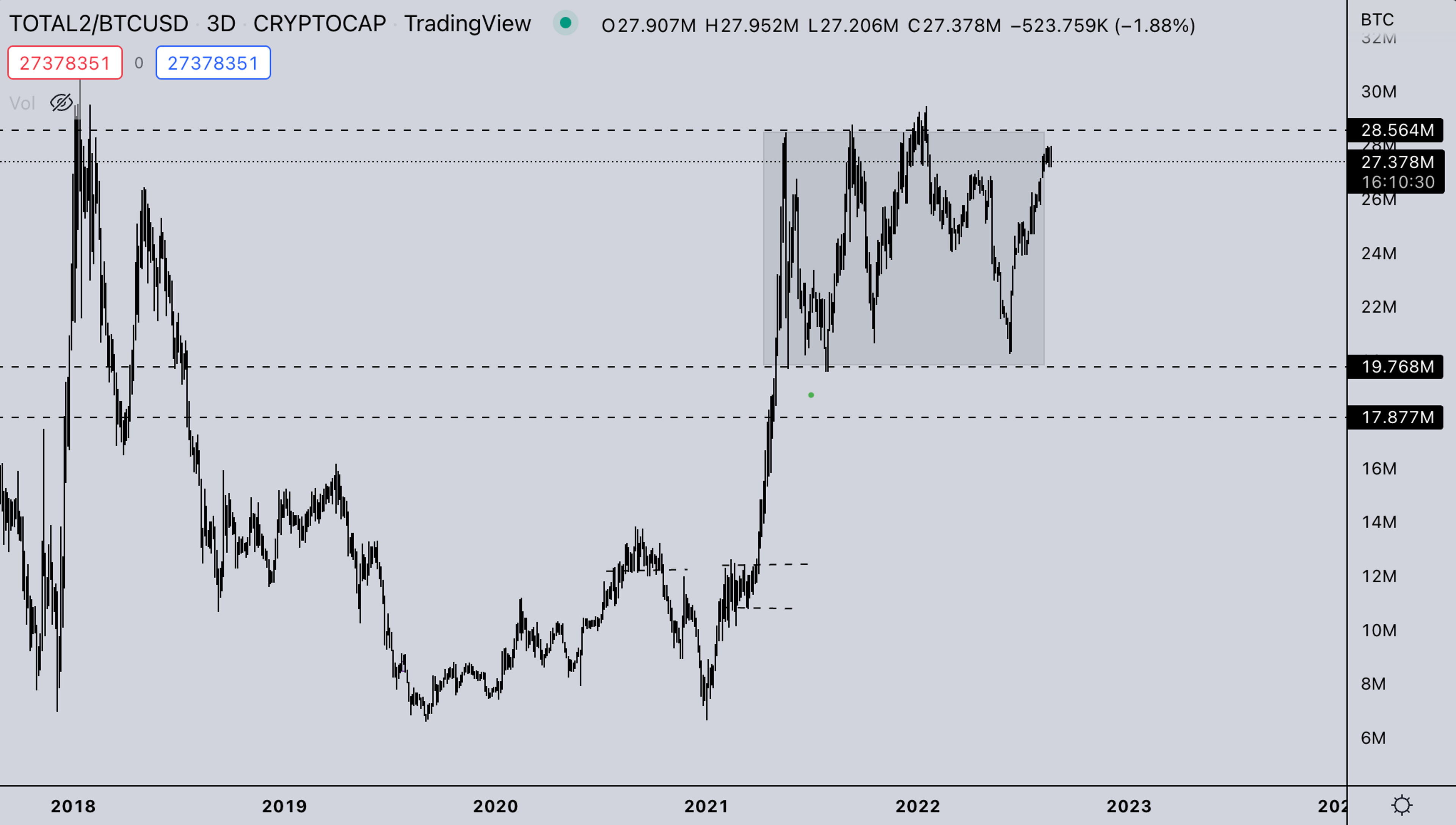

TOTAL2BTC - BTC Market Strength

TOTAL2/BTC is painting the same picture as ETH/BTC. We will most likely see it correct out until BTC finds a new floor from which altcoins will run faster. This will be the first time since 2017 that the TOTAL2 ratio breaks highs. This can lead to a fairly long-duration rally against BTC.

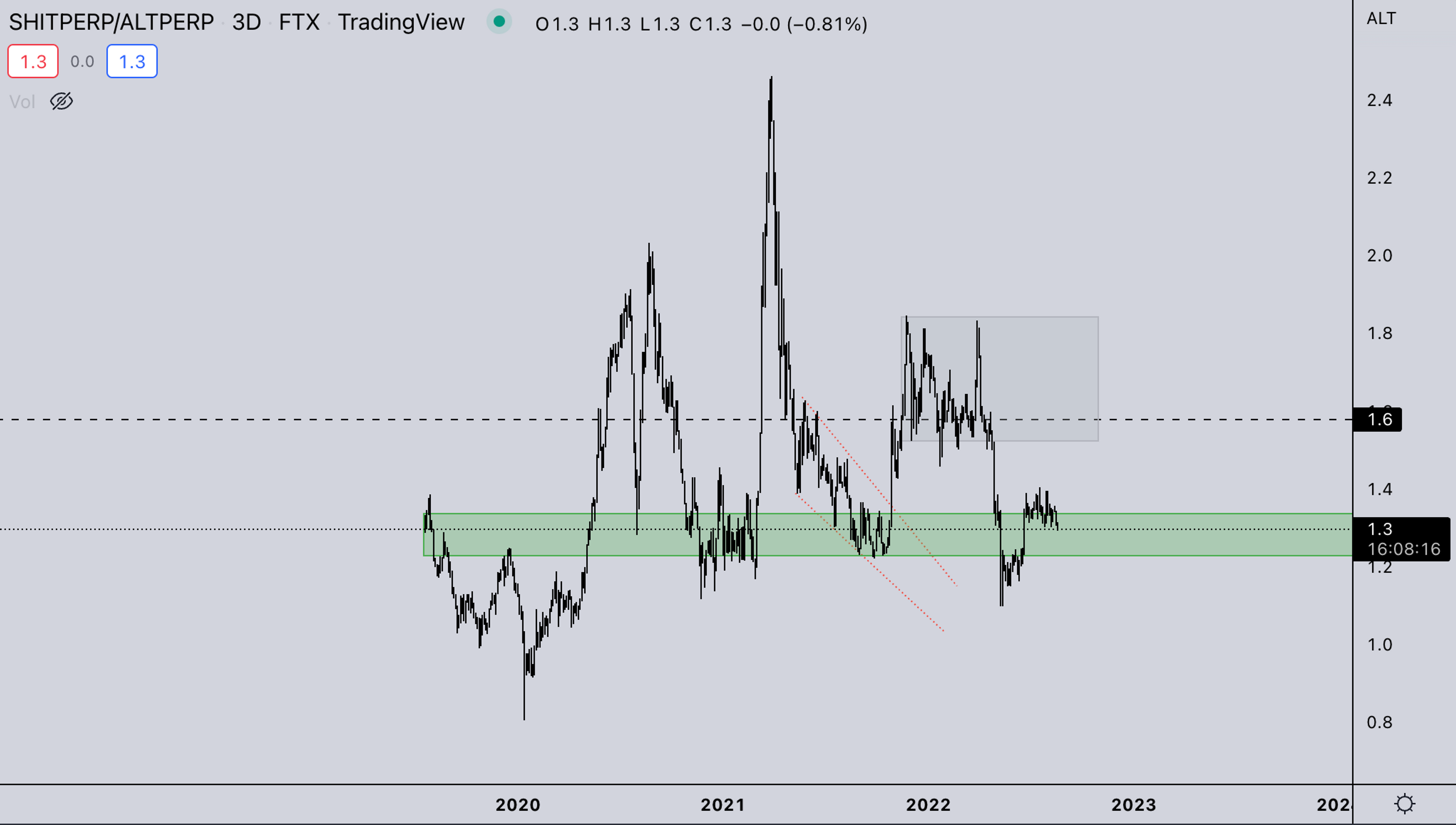

SH*TPERP/ALTPERP

As mentioned before, with thin liquidity, we can already observe low-cap sh*tcoins losing out steam vs the more stable higher caps.

Summary

- Powell’s Jackson Hole speech comes on Aug 26th, with Fed expected to be more hawkish than what was priced in the market.

- Merge uncertainty inching closer with August slowly coming to an end.

- The FED hasn’t really started the balance sheet reduction yet, if they do in the upcoming periods, it will impact risk assets negatively.

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?