Macro Market Update August 29nd, 2022

Last Week Recap

- FED is staying on course with tighter monetary policy as Powell says there's more "pain" to come.

- US indexes saw the biggest down day since June on Powell's comments and took crypto with it, with BTC falling below 20k.

- Sam Trabucco stepping down as co-CEO from Alameda (Source: https://twitter.com/AlamedaTrabucco/status/1562519114979356673 )

- End-of-month closes coming up this week.

Legacy Markets

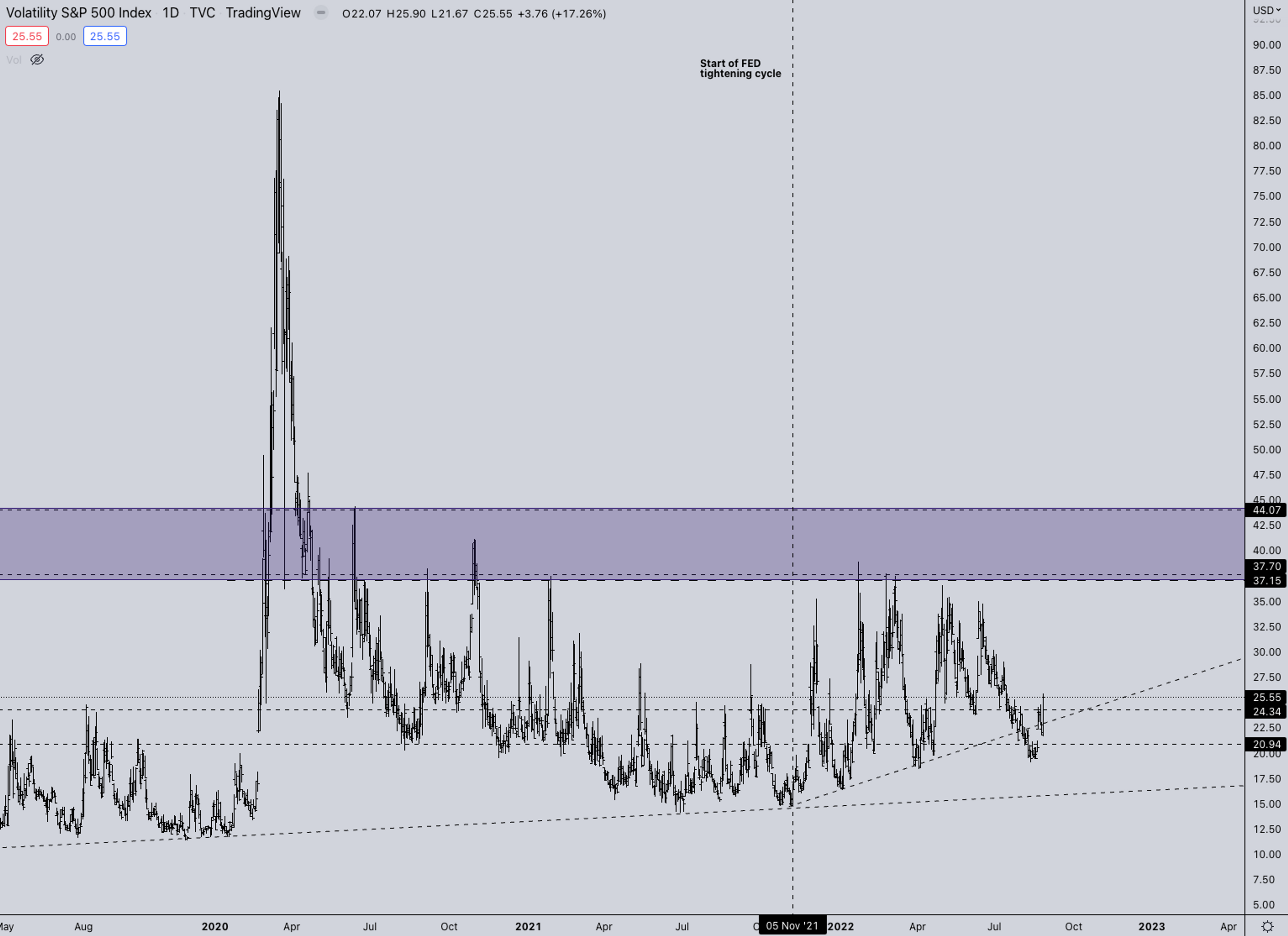

As mentioned last week, the market was already correcting when VIX touched the low 20s. As soon as it started rotating upwards into the Jackson Hole event on Friday, many coins started dropping more. US equities also saw its biggest down day since June.With VIX trading mid 20’s (and probably higher this week), it’s good to remember that the average daily volatility will also be higher.

Open Interest & Funding Rates

With the sudden fast drop on Friday, many OI seems to be underwater again. At the current price of 19.7k, there’s approximately 2B in OI underwater. With crypto correlating heavily to US indexes atm (Because VIX is trading higher, correlation increases), the direction will be solely dictated by what indexes do this week.

BTC Weekly View

After rejecting a resistance, BTC is closing in on its range low. With the current sentiment on socials being extremely negative without BTC breaking lows, the probability of a bounce is quite likely even though the market looks really ugly. This also seems to be confirmed by derivatives, with every future contract trading backward (Futures trading under spot price) and perps on constant negative funding.

ETH Weekly View

The market currently is/was driven by the merge trade. This still seems the case, with ETH being torn between the merge anticipation vs FED still talking extremely hawkish. As of this morning, ETH retested 2017 ATH again and had a small bounce since. If there’s any place where ETH could rotate upwards again, it should be around current prices. If we see no strength from current prices, it’s a steep drop into the 1k-1.2k zone. This would also damage other altcoins a lot. Currently, we see the impact of the retraces on ETH and BTC exponentially large in altcoins because of scarce liquidity.

ETH/BTC

After a significant low surge, ETH/BTC traded upwards for several weeks. With it finally slowing down in the .08 region. With the upcoming merge and supply reduction, this is likely just a corrective counterwave before ETH/BTC marches higher.

TOTAL2 - USD Market Strength

TOTAL2 rejected quite a bit from retesting the 2021-2022 support. We still think the total market is forming a larger price structure with the expectation that the 2017 ATH will hold as support for the coming period.

TOTAL2BTC - BTC Market Strength

TOTAL2/BTC is inching closer to the 2017 ATH. With multiple coins trading quite strong on the BTC pairings, BNB actually trades in price discovery. But others are structuring out quite well and seeing small upwards trusts while the USD market is dropping (see LTCBTC and XRPBTC).

SH*TPERP/ALTPERP

The smallcap to largercap altcoin ratio is trying its best to hold up. If the market doesn’t retrace any deeper than current prices, the likelihood of seeing upwards price movements in smaller-cap altcoins are quite good. Especially against BTC or ETH.(SH*TPERP/ALTPERP is a measure of speculative risk. When SH*TPERP outperforms ALTPERP, it shows a measure of speculation in the market, which shows how much risk people are willing to take at a certain time)

Summary

- The merge is inching closer at rapid speed. With August coming to a close this week, the market is setting up for a lot of volatility in September

- Unemployment Rate on Friday for the US. The market is looking for significant signs of weakness in these numbers. In the hope that the FED needs to pivot its policy to keep strong labor markets

- Considering other FED speakers are planning to comment on the situation in the upcoming week, the question remains how their statements will impact the crypto market

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?