Macro Market Update - December 5, 2022

Last Week Summary

- Powell said smaller interest rate hikes could start by December.

- Nov US job number is hotter-than-expected, but the market shrugs off its impact.

- Gemini is seeking 900M back from Genesis.

- China Covid policies ease more, giving cryptocurrencies good breathing room during Asian hours.

- Binance does its first launchpad listing in quite a while with HOOK.

- Telegram to launch CEX and self-custody wallets.

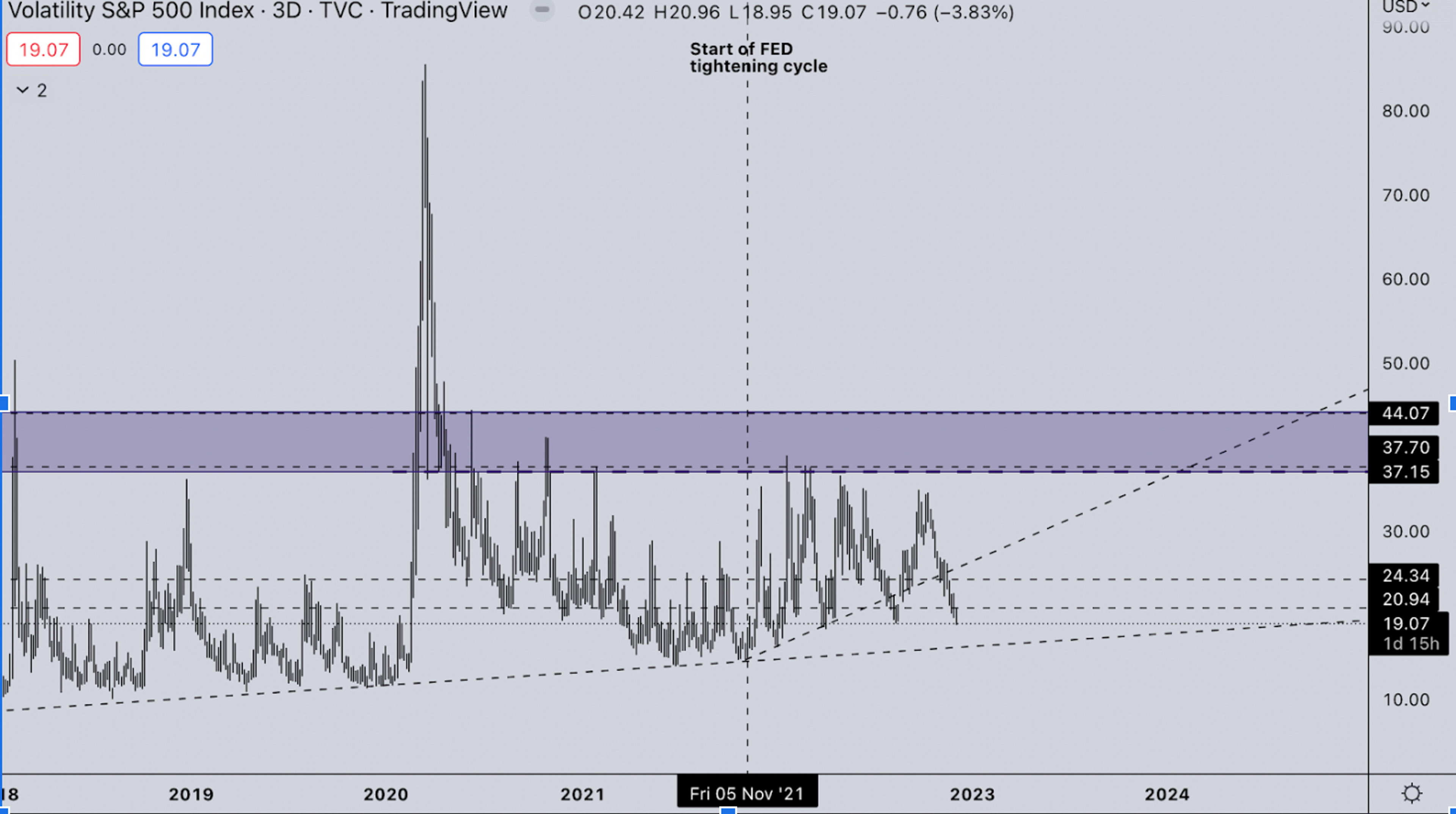

Legacy Markets VIX

VIX is nearing its lowest level of the whole year. With low VIX markets get less correlation and usually, some areas will run way faster than others. Currently, the Dow Jones is leading in equities trading almost back at ATH’s, while tech and crypto are still way lower. As the VIX is back below 21, and given it can stay there for at least a bit, there’s a good chance crypto does a catchup move higher at a faster rate.

Legacy Markets DXY

DXY is still correcting from its major upswing all year. With COVID easing further in China over the weekend, we see it softer again on the opening. The softer DXY trades, the more upside equities/crypto have. The drop will likely stall around 102, and consolidate for quite a while after a big correction. During this correction, it’s prime time for cryptocurrencies to start moving again. With the contagion slowly spreading to Gemini and others, it seems most institutions are caught up. These all go through legal channels so those assets should be tied up for quite a while (years/months) before they ever hit the open market.

Open Interest & Funding Rates

Open Interest (OI) is still quite okay on BTC (Bitcoin), but picking up a little bit. We do think Open Interest (OI) has less importance in these regions because spot has been dominating way more at current levels.

Bitcoin (BTC) Weekly View

Bitcoin (BTC) is reverting back up slowly. We see this as major strength with it not dropping further, after the whole FTX blowup. If everything goes as it is, BTC could finally give that major bear market rally, taking it well back into the 20s again. Macro is still not ideal, but with hikes finally slowing down, the next thing to search for is earning recession, and although there are some data points hinting at it, the job market is still not slowing down. This should be the window of opportunity for risk assets.

ETH Weekly View

ETH is still holding higher lows vs June. If Ethereum (ETH) rotates from this support, the size of the price structure would actually allow a sustained rally. This could possibly lead to ETH trading back to 2.5-3k in early 2023 (Q1-Q2). If ETH would fall back to sub 1K, we don’t think the June low would hold and most likely see ETH fall deeper into the 600-700 per dollar value area.

ETH/BTC Market View

Ethereum (ETH)/ Bitcoin (BTC) is still struggling with major resistance for over 2 years now. We’re still looking for a breakout above .081. If that happens, ETH will gain major outperformance relative to BTC.

TOTAL2 - USD Market Strength

TOTAL2 is reflecting the general tendencies we’re noticing in BTC and ETH. Finally catching some strength, some dino coins are seriously outperforming (LTC, DASH, etc.). Our thought is that these coins have absolutely no overhead so they can be moved easily, while others especially L1’s have lots of VC overhead etc.

TOTAL 2/BTC

TOTAL2/BTC is also still slow cooking into the ATH.The breakout of this ratio will likely correlate together with ETH/BTC also breaking out of the range. We think this likely happen in early 2023 (Q1-Q2).

Summary

- Crypto is ready for a period of relief, in line with a potential Santa rally in the US equity market.

- MTGox creditors getting their payouts in Q1 2023, with a choice if they want it in BTC or cash - depending on if they held BTC or cash on the account. (Source: Mark Karpelès on UpOnly podcast).

- Next week is FOMC and CPI week, so FED is in blackout mode this week (no interviews).

DISCLAIMER

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?