Macro Market Update June 27th, 2022

Last Week Recap

- Further relief rally across the market in both equities and crypto.

- More info emerging around 3AC & their undercollateralized loans.

- Quarterly derivatives expiry did not result in vol spikes last week.

- Binance partners with Cristiano Ronaldo for NFT platform.

- Solana introduces its smartphone. Ref: https://decrypt.co/103707/why-solana-mobile-smartphone

- GS seeking $2B to buy Celsius assets.

- Ref: https://blockworks.co/goldman-sachs-joins-deep-pocketed-investors-eyeing-crypto-lender-celsius-assets/

- Binance.US Launches Zero-Fee Bitcoin Trading, and Coinbase stocks impacted

- Powell: Congress to Receive Guidance from Federal Reserve on CBDC (Central Bank Digital Currency)

Legacy Markets

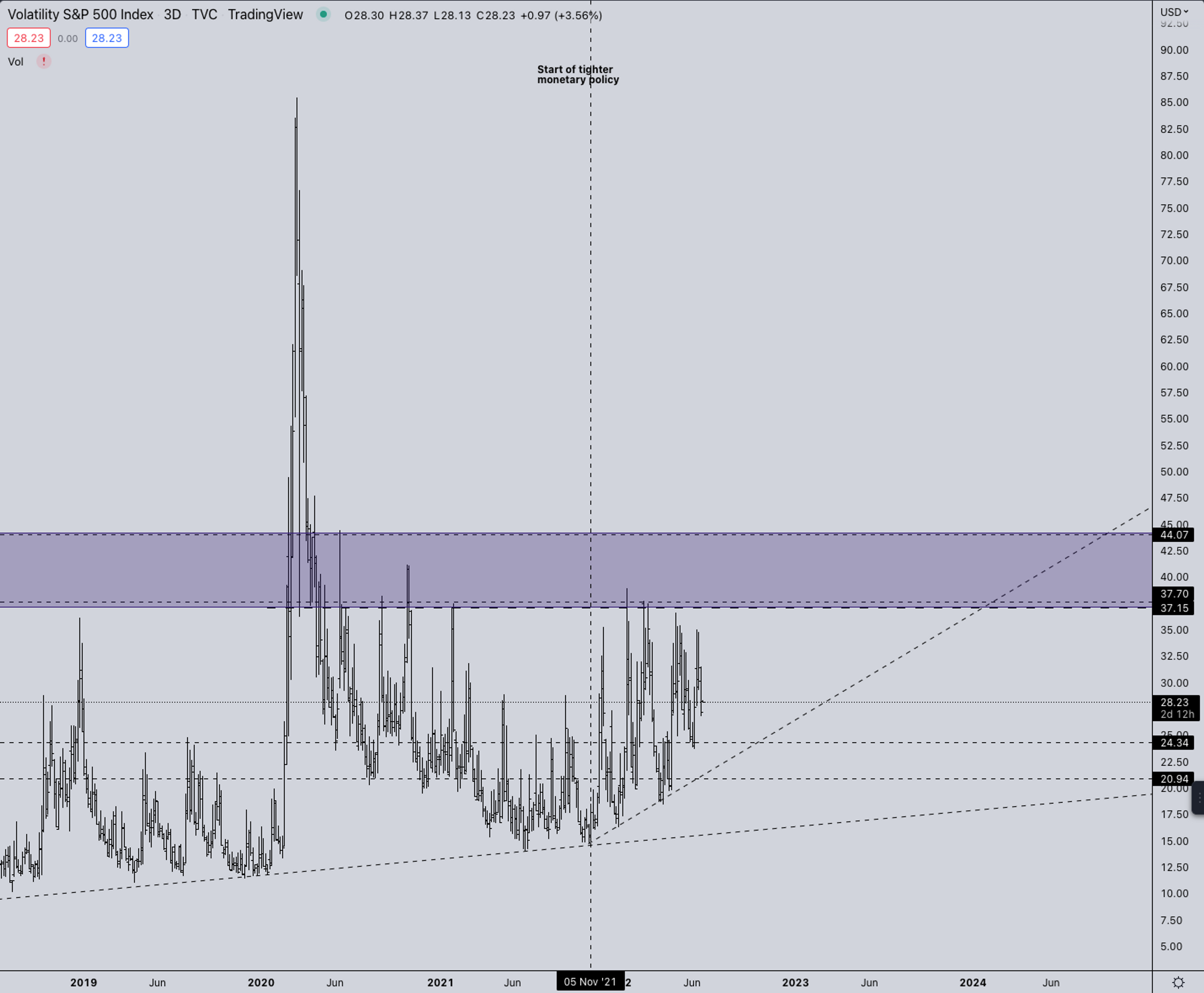

- VIX dropped to sub-30 levels last week coinciding with a general market relief rally. Although the rally was strong the FED is still expected to hike & is also actively engaged in balance sheet reduction. Globally the geopolitical situation appears to be slowly creeping into neighbouring countries so there is definite need to remain vigilant.

- VIX history has never encountered a situation where it remained at these elevated levels without further spiking higher into the mid-40s. Although the current relief rally is quite strong in equities & in select cryptocurrencies caution is warranted & any “low” should be treated as a local low until FED pivots.

- As the news shifts focus from inflation->recession fears, this may downstream have a positive impact on future FED decision making (similar to what occurred in the 70s).

Open Interest & Funding Rates

Current exchange OI is not as interesting to analyze as real leverage and liquidations are behind closed doors of lenders and potential firm insolvencies. Wintermute CEO recent podcast noted having to close more than half of their positions due to lenders calling back loans and doing a headcount who was still solvent. With EOM approaching this will become more transparent as some will be forced to liquidate assets or funds dealing with redemptions.

BTC Weekly View

- Last week we noted the possibility of a bounce into 22-24k. BTC briefly touched 22k over the weekend. Currently appears a further relief could be in the books.

- Although technically BTC appears poised to move higher, note it is also used as collateral with lenders. If any of them goes insolvent or bankrupt BTC will be market sold causing more downward pressure. This also reflects in altcoins which have seen massive rallies on their BTC pairings.

ETH Weekly View

- ETH is likely in the same spot as regarding collateral BTC to lenders , all though BTC is trading above its 2017 ATH and ETH below. The probable main reason for this is that 3AC had massive stETH positioning and ETH as collateral which they all market sold during the initial liquidation event.

- The positive note for ETH is that underlying NFT ecosystem is picking up against ETH. This shows us together with altcoin outperformance on BTC pairings that there is still some kind of risk seeking behavior.

ETH/BTC

ETHBTC is pretty much following the expected projection. With BTC likely being caught up most in the contagion of loans and collateral for quite some time. This could set the market up for relative strength on BTC pairings. A strong statement from ETH and upcoming merge would be relative strength on the BTC pair and heading upwards into the range high of this price structure.

TOTAL2 - USD Market Strength

TOTAL2 just like BTC held above the 2017 ATH. With USD value being entirely dependent on BTC strength if BTC can see a further push the total upside in TOTAL2 is around 20% higher.

TOTAL2BTC - BTC Market Strength

Like previously mentioned the ALTBTC pairing is strong. With BTC being contained this could setup for a relative larger wave in ALTBTC. Even coins like LTC and XRP had strong upward momentum on BTC pairings. Currently we think the market isn’t well positioned for this “sudden” upside because most are focussed on USD valuation. But a tale as old as crypto “accumulate BTC while it’s cheap”. If it’s currently “undervalued” is relative but with altcoins showing relative strength they are the perfect vehicle to increase BTC holdings.

SH*TPERP/ALTPERP

- SH*TPERP continuing to show relative strength. Market participants focussed on both lower cap altcoins & further out the risk spectrum.

- NFTs impacted by the same sentiment.

*SH*TPERP/ALTPERP is a measure of speculative risk. When SH*TPERP outperforms ALTPERP it show a measure of speculation in the market which shows how much risk people are willing to take at a certain time.

Summary

- 29Jun22. Powell speech. Note possibility of focus shift from inflation -> recession & downstream market impact.

- 30Jun22. Semi-annual/Quarterly & EOM approaching, Crypto HF redemptions expected (3AC damage etc).

- Midterm bull wave possible for BTC pairings (as earlier noted a perfect setup for pair trades!)

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?