Macro Market Update October 3rd, 2022

Last Week Recap

- BOE intervenes after pension funds were on the brink of getting margin called.

- Quarterly expiry of options and derivatives concludes in flat price action.

- FED still keeps its stance on inflation targets: U.S. Core PCE price index rose 0.6% in August, higher than the expected 0.5%, this Fed's preferred gauge shows inflation is still quite high

- Eurozone’s CPI rose 10% year-on-year in September, higher than expected 9.7%.

- Crypto lender Nexo got enforcement actions from eight States (link)

- Warner Music Group has announced a collaboration with OpenSea

Legacy Markets

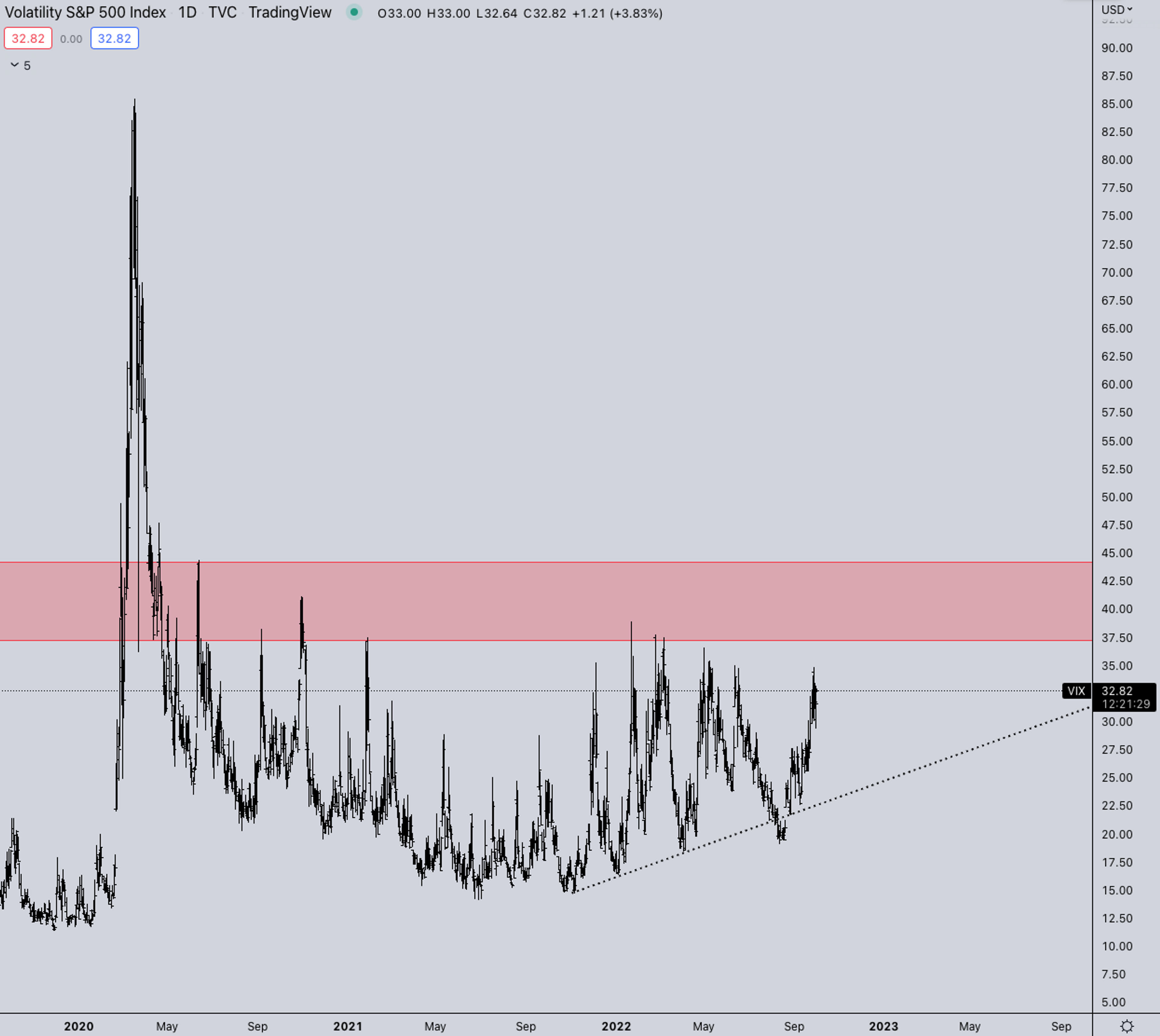

- With cracks slowly starting to form across the board in currency markets and Russia annexing multiple regions in Ukraine, VIX is trading above 30. This leads to an ultra-correlated market where everything moves in tandem.

- To get some relative strength again in crypto, VIX needs to fall back sub 27 then there will still be a correlation but not as large as it is currently.

- If VIX breaks the 2022 highs (over 37), that’s a major liquidation that will most likely result in everything breaking down on USDT/USDC pairs.

Open Interest and Funding Rates

OI on BTC is still flat. After the merge trade unwound on ETH, there has been no real derivative action other than some event-based trading around CPIs.

BTC Weekly View

- As mentioned last week, volatility is flat as the chart shows no movement. The incoming move will lead to quite a significant trend. BTC is close to interacting with the downtrend that started in November. One should stay flexible and wait for a break for safer play.

- The eventual increase in volatility is just a matter of "when". Likely the first couple of weeks of October.

ETH Weekly View

- With BTC lingering on the lows of June, ETH is still holding the base of June, which given all factors, does seem quite positive.

- After the merge, ETH/BTC saw a large throwback because of merge unwinding trades. We think the relative strength of ETH against BTC will pick up again this quarter, Q4 is historically a bullish quarter for crypto. Seasonality is quite strong.

ETH/BTC

ETH/BTC, as mentioned in the previous part, has had a large pullback. This was mainly because of the merge “sell the news.” With inflationary pressure being cut in massive amounts, the average daily sell pressure on ETH is magnitudes lower. We expect ETH to start exhibiting further relative strength against BTC on both the downside and upside.

TOTAL2 - USD Market Strenght

TOTAL2 is basically a carbon copy of ETH/USD. Rejected at the 2021 lows and currently also at an inflection point. We'll likely see a new trend arise in early October after the breakout of the current range.

TOTAL2BTC - BTC Market Strength

TOTAL2/BTC is structuring out on 17’ and 21’ highs. With other BTC pairings starting to push (See BNB/BTC). We think the ATH break is a matter of “if” not “when.”

SH*TPERP/ALTPERP

Lowcaps are breaking down after correlation picked up from majors against equity markets. This is because of the high VIX correlating all assets closer. Lowcaps really need some strength in majors and crypto in general.*SH*TPERP/ALTPERP is a measure of speculative risk. When SH*TPERP outperforms ALTPERP, it shows a measure of speculation in the market, which shows how much risk people are willing to take at a certain time.

Summary

- Early October is important for establishing a new trend, either up or down.

- The NFP and unemployment rate will be published on October 7th this week

- In currency markets, things are slowly starting to break, if FED keeps their aggressive path forward, other central banks worldwide will start facing similar issues as BOE had. This sets up an eventual pivot, but the question remains how far the FED wants to push other countries.

- A high VIX environment means everything trades in tandem. As long as VIX is in the > 30 zone, crypto will follow equities.

- Earning season is also kicking off again.

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?