Macro Market Update September 12th, 2022

Last Week Recap

- Ethereum’s ‘Bellatrix’ upgrade went live

- Solana NFT’s gaining more traction as entry is more accessible for the average market participant.

- Microstrategy announcing 500M stock sale and possibly “Using some for Bitcoin”.

- Bank of Russia agrees to legalize crypto for cross-border payments.

- Google builds a merge countdown when searching for “The merge”.

- LUNA makes a comeback with huge price surge.

- Gate.io joined the pack to offer 0 trading fee for all USD spot pairs

- Binance Will Support Potential ETH Fork via ETH PoW Airdrop on BNB Chain

- Delphi Labs shifts research focus to a Cosmos

ETH Merge Monitoring Dashboard

- Protocols/Communities/Companies support ETH hard fork

- BitMEX: to offer leverage trading for potential ethereum POW fork

- OKX: to evaluate and support the airdrop and withdrawal of forked tokens

- Binance: “will support The Merge”, In case of new forked tokens, Binance will evaluate the support for distribution and withdrawal of the forked tokens.

- Poloniex: has enabled the trading of potential ETH forks, ETHS (ETH2) and ETHW (ETH1), and listed TRON-based ETHS and ETHW.

- APENET: the APENFT Marketplace will support all NFT trading on the ETHPoW chain, allowing APENET to facilitate the ETH 2.0 merging.

- Huobi: confirmed that it would support Ethereum forked assets on its platform as long as they meet the exchange security requirements

- Gate: Will Support ETH Potential Hard Fork and List ETHS and "Candy" Token ETHW

- MEXC: Supports Ethereum (ETH) 2.0 Upgrade & Lists Potential Hard Fork Tokens

- Five major South Korean exchanges (Upbit, Bithumb, Coinone, Korbit, and Gopax), plans to support the airdrop and listing of Ethereum’s proof-of-work (PoW) hard fork token ETHW

- Protocols/Communities/Companies object ETH hard fork

- Circle: Circle plans to only support Ethereum PoS chain after Merge

- Tether: USDT supports ETH PoS transition

- Debank: All Products Do Not Support Ethereum Forks

- Chainlink: Will Not Support Ethereum Forks After the Merge

- Digital Currency Group: does not intend to back any Ethereum hard fork

- ETC Coorperative: Urges ETHPoW To Drop Ethereum Fork (ETHW) Plan

- Aave Community: Only Support Post-Merge Ethereum PoS

- Yuga Labs: Only accepts NFT on ETH Pos

- OpenSea: Will Only Support Ethereum Proof of Stake After Merge

- imToken: it will only support the Ethereum merge and not support PoW chains

- Lido: no plans to support ETH PoW

- Uniswap: We support the upgrade & have no plans to back forks in our web app

- Maker: will not support any hard fork of Ethereum

- StarkWare: will exclusively support PoS

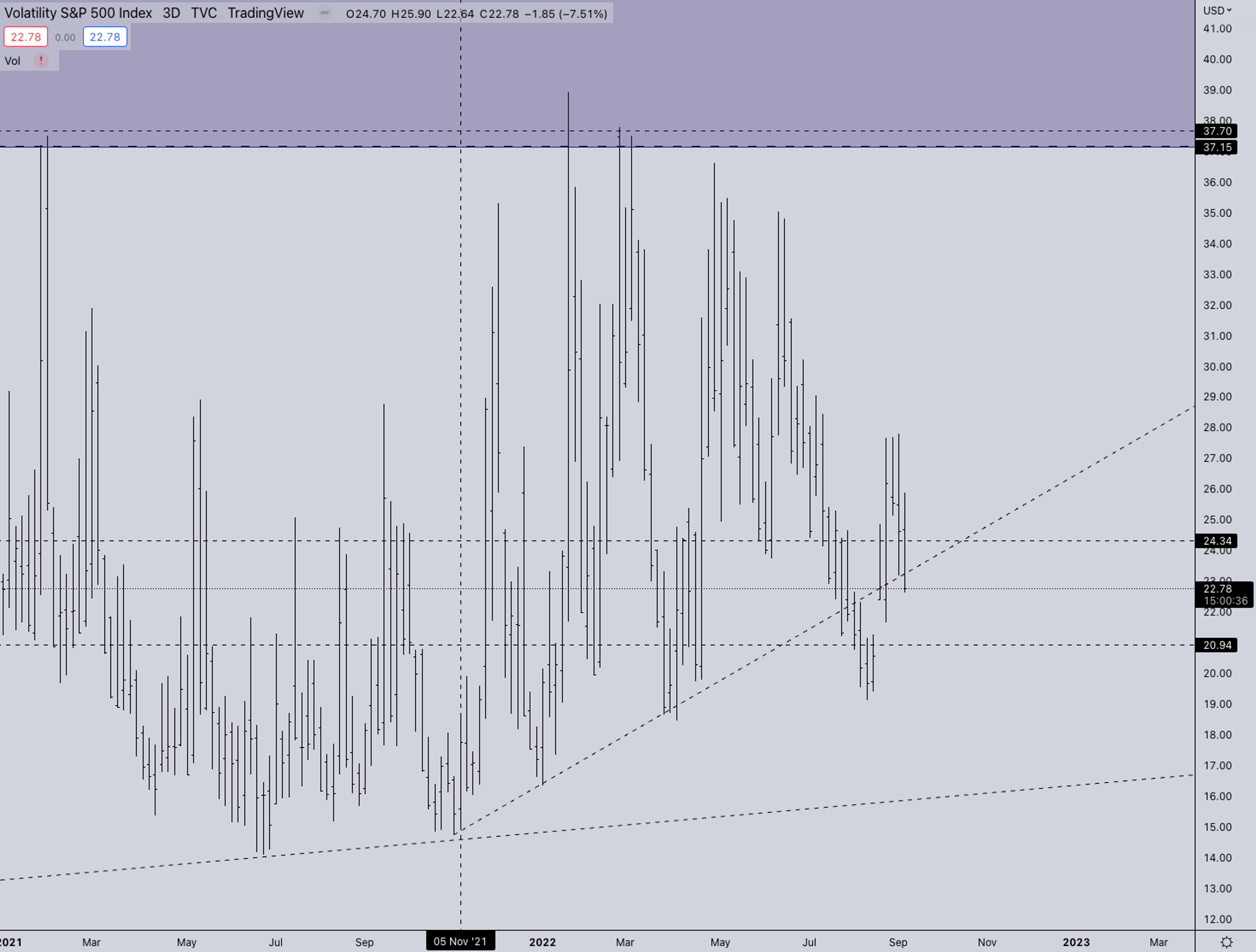

Legacy Markets

- With VIX dropping back below 24 and S&P500 bouncing off support together with temporary dollar exhaustion markets got some relief last week.

- This week is filled with big events the market is seeking for a continued trend in lower inflation (CPI on Tuesday). If this is the case this bounce in risk assets has a high likelihood of continuing this week.

- For crypto specific it’s also a big week. Ethereum is upgrading from POW to POS. The expectation is that the merge will be successful. However this still can come with lots of volatility both ways in the short term as there most likely will be some kind of disorder.

Open Interest & Funding Rates

At the moment the market is seeing a large leverage unwind from the “merge” trade. For the merge there were 2 types of trade most took. 1) Buy spot ETH short futures for the possible ETHPOW fork. 2) Long the ETH/BTC ratio which means long ETH and short BTC. The current BTC rally was largely initiated by these trades started to close which creates buy support on BTC as closing as short means -> buying.

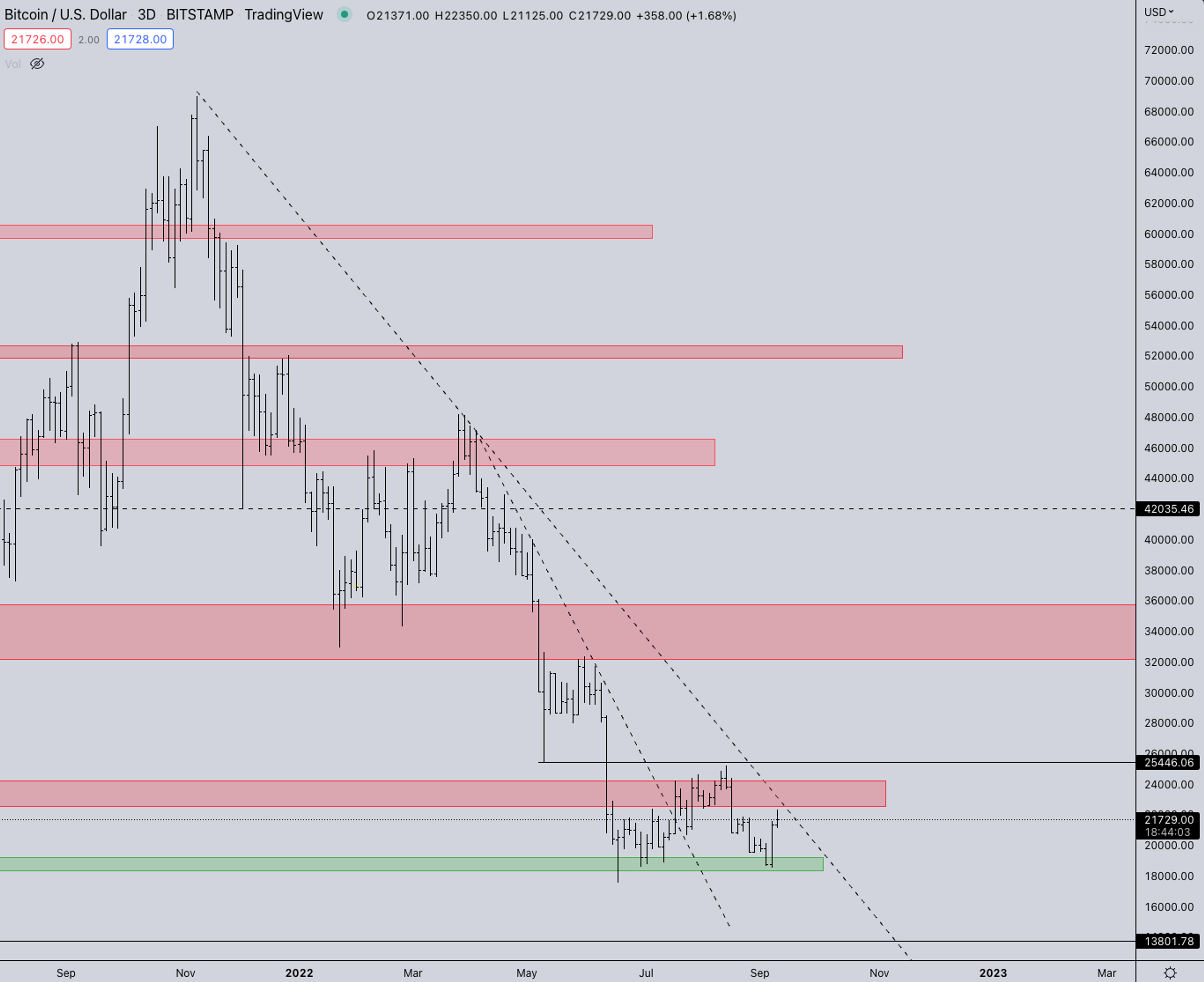

BTC Weekly View

- BTC is still ranging as can be seen between the green and red box. BTC currently doesn’t have any large narrative going for it. That said if the S&P continues higher this week and the market gets a lower CPI number and successful merge.

- Ofcourse this is a lot of “if’s” in a chain of events. But this also brings good day trading opportunities as there will be lot’s of volatility both ways.

ETH Weekly View

- ETH is stalling again at the 2021 support (BTC is still trading way below it). With the merge approaching the market is seeing lot’s of trades being closed around the merge (See Open interest part). With ETH stalling here again it’s likely a chop week till the merge completely clears and is successful.

ETH/BTC

- After the large surge in BTC ratio’s it finally seems that BTC is finding footing again against alts. This also show’s in ETH stalling at the range high’s of the 2021-2022 price structure.

- From a purely observational point it seems that BTC is at the moment dominant when dollar is in corrective mode. While ALT/BTC trades activate as soon as the dollar trades upwards again. With that said most likely ALT/BTC ratio’s build price structure in ranges for a couple of weeks before attempting the larger breakouts in Q4.

TOTAL2 - USD Market Strength

- TOTAL2/BTC is seeing the same congestion as ETH/BTC did near ATH’s. As mentioned in that slide the ALT/BTC ratio’s are most likely gonna consolidate for quite sometime before attempting the major break against BTC. Also looking at DXY which is most likely also entering multi week consolidation.

- Once the DXY has proper consolidation eyes should come back to taking ALT/BTC trades as BTC will in tandem trade weaker when/if that happens

SH*TPERP/ALTPERP

- The smallcaps still are in consolidation in a tight range against larger cap altcoins. It does seem some underlying fundamental altcoins are actually flying. Coins like FOLD did over a 10x to date since the June lows. If the ratio break upwards there’ll be a huge push across the board on smaller altcoins.

*SH*TPERP/ALTPERP is a measure of speculative risk. When SH*TPERP outperforms ALTPERP it show a measure of speculation in the market which shows how much risk people are willing to take at a certain time.

Summary

- CPI on Tuesday. The market is seeking a continuation of lower inflation numbers for further upside.

- Merge week! Finally the moment has come that a lot people have been anticipating for quite a while. Ethereum is transitioning from POW to POS.

- MagicEden on Solana is popping off and seeing huge volume and price performance in NFT’s.

- It’s also end of quarter. The september future contracts and quarterly option expiry are nearing. The dynamics of these are unpredictable but there is large positioning around it because of the merge trade as explained in several slides.

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?