Macro Market Update September 19th, 2022

- The Merge was a success, with Ethereum transitioning from POW to POS.

- Solana NFTs are heavily outperforming the market, with multiple collections rising more than 10 fold

- CPI came in higher than the expectation at 8.3% - which made the market risk off pre-merge - and has the market in its grip with FOMC this week on Wednesday.

- ETHW (The POW fork after the merge) fluctuates around 1% of ETH's total value.

- South Korea issued arrest warrants for Do Kwon

- Starbucks announced the launch of their Web3 platform, Starbucks Odyssey, built on Polygon, to integrate its loyalty program.

Legacy Markets

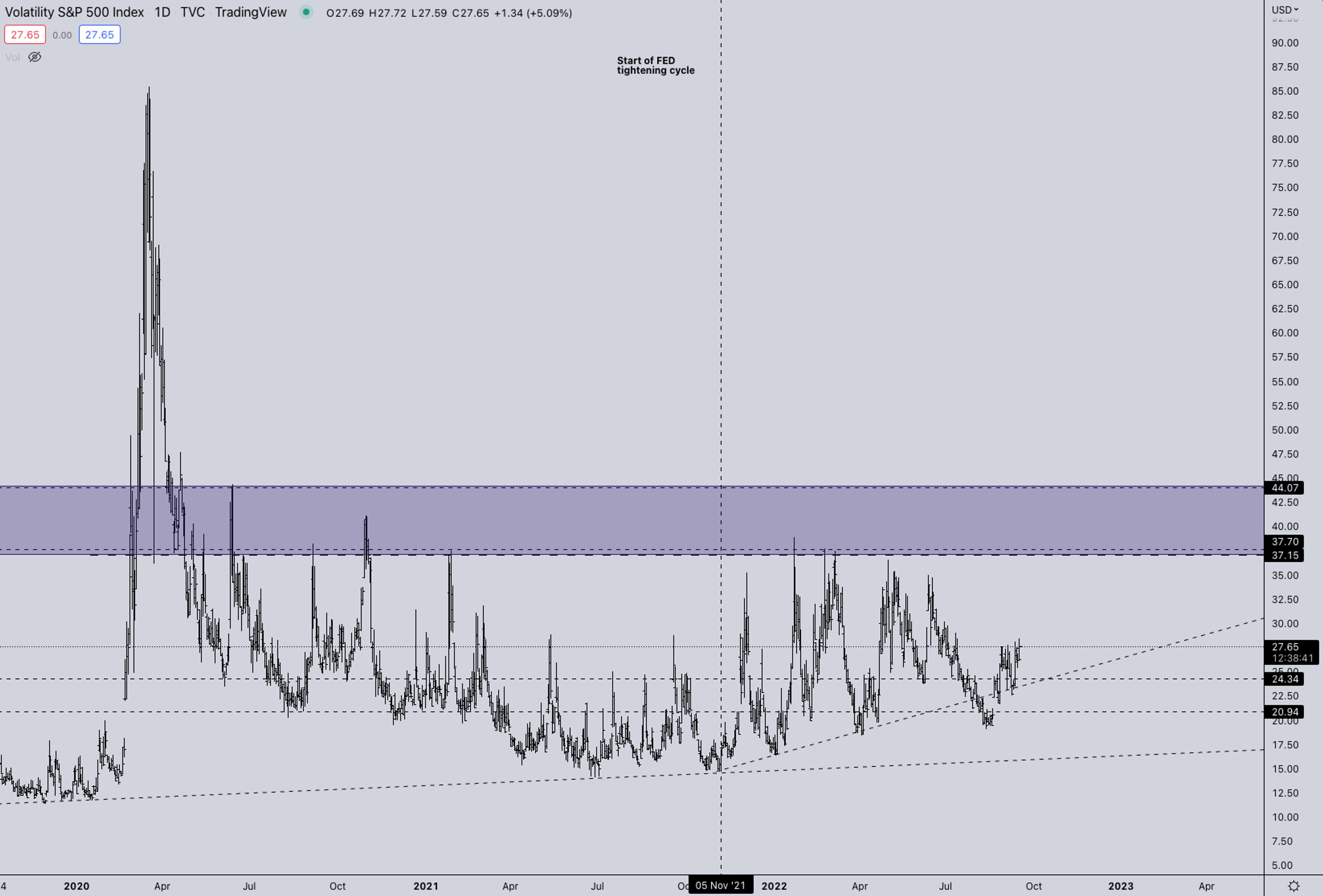

- VIX traded elevated all of last week. With the indexes seeing the largest drops since the June lows.

- Eventually, the pressure of equities and the weak price action after the Merge saw crypto following suit.

- VIX likely stays elevated till after the FOMC announcement on Wednesday. There are also the FED minutes on Tuesday which should give the market more information about inflation and views.

Open Interest & Funding Rates

The BTC OI has been relatively flat the last couple of weeks, not giving any directional information. The ETH OI profile is near ATH’s even after the merge. The general expectation was that many OI unwinding would happen after the merge. Till this moment, most of that has not been done. So the market still hasn’t seen the full effect of the ETH OI unwind.

BTC Weekly View

- BTC is currently purely trading as leveraged Nasdaq. As soon as the merge happened and NQ kept dropping, crypto followed suit.

- Currently, BTC is trading in dangerously low territory of this price structure. With global liquidity being sucked out of the market still. A break under the current lows at 17.6k Could give gas downwards in 12-13k.

- The upward catalyst would be a mild FOMC event. Which could lead to a quick turnaround on the drop in BTC and ETH

ETH Weekly View

- With the successful Merge, the market saw many “Sell the news”, and indexes also dropped. This saw ETH play a catch-up move to the downside.

- Currently, ETH is close to restarting the June price structure. This would be the ideal location if there’s any chance of making a higher low for ETH. The biggest risk is BTC trading closer to a downside breakdown already and the large OI that still needs to unwind on ETH.

ETH/BTC

- After the Merge, ETH started losing its relative strength over BTC. We still think ETH is in an uptrend against BTC and see this as a temporary “dip” before continuing to outperform.

- In the short term, a selloff was to be expected. We believe that the merge's full effects are not priced in yet. And will not be priced in for quite some time. Especially with merge effects being reflexive with good/bad price action. (Inflationary or deflationary dynamics with the burn).

TOTAL2 - USD Market Strength

Last week we talked about TOTAL2 seeing the same rejection as ETH. For now, TOTAL2 is just following BTC. Like ETH with TOTAL2 retesting the June price structure, the best shot for a market bounce is probably this week on a mild FOMC. But that’s a big “IF”.We don’t think the FOMC will do a 100bps raise, but that could lower the market.

TOTAL2BTC - BTC Market Strength

TOTAL2/BTC is also seeing a counterwave after rallying from the lows. As with ETH, we also think TOTAL2/BTC is in an uptrend and will form a new price structure at these higher levels before attempting an ATH break. On the other hand, this would mean BTC continuing to trade weak or in range.

SH*TPERP/ALTPERP

While things are getting smashed in USD valuations, some good plays in ratios exist. As we can see here, lower-cap altcoins are gaining some serious strength against their higher-cap counterparts. This means there is some underlying strength in crypto. Same as with the BTC ratio’s trade.*SH*TPERP/ALTPERP is a measure of speculative risk. When SH*TPERP outperforms ALTPERP, it shows a measure of speculation in the market, which shows how much risk people are willing to take at a certain time.

Summary

- Monetary policy minutes video release on Tuesday

- FOMC on Wednesday

- Quarterly expiry price action will start kicking in with about 2B in OI on options to be closed/rolled.

- Friday, Fed Chairman J. Powell speaks

DISCLAIMERThe information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell digital assets or other financial products.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?