How to Prepare for the Next Bull Market: Key Trends to Keep in Mind When Investing in Crypto Projects

Planning for the next bull market? You should be. With Bitcoin and Ethereum trading below their last cycle ATH (all-time high) not long after Terra’s UST collapse and the Federal Reserve pulling out all the stops to curb the roaring annual inflation rate, investors and traders are left to navigate an unpredictable yet opportunity-rich bear market. Like many other people with a stake in the crypto world, you’ve probably been wondering what your next move should be while trying not to give in to the fear-based news. What will make a difference in the performance of your cryptocurrency portfolio is not trying to predict the start of the next bull market but rather getting prepared for what opportunities an upward movement across different sectors will bring. Therefore, starting with a clear understanding of your risk profile and long-term financial goals, you should pay close attention to the latest developments within the market and the future potential of cryptocurrencies both in the real world and the metaverse. To help you make the best portfolio decisions in the next bull run, we’ve put together a forecast highlighting key crypto trends that could play out in the upcoming bull market.

What developments could the next bull market bring about?

There are a lot of unknowns about what could happen next on the crypto rollercoaster ride. Nevertheless, considering past performance and current information on market movements, the team at Kairon Labs has identified a couple of trends we speculate will majorly impact investor confidence and returns from newly launched and well-established crypto projects.

Widespread Bitcoin and crypto adoption across the world

Bitcoin will see more adoption from ultra-high net worth individuals and possibly institutions. In the case of institutions, there will be a focus on building a wall between financial crypto products and actual physical coins to extract more fees from average investors. We’ve already had the chance to see real-life examples of this upturn trend with Fidelity’s plans to provide Bitcoin in 401(k) investments but not yet for their target-date funds and Visa’s crypto-enabled card launch in Latin America that will let users spend and purchase crypto in locations accepting Visa cards.In the current geopolitical landscape, Bitcoin also has the chance to become a worldwide settlement layer between countries meant to replace doing business in native currencies. With the Lightning Network’s expanding ecosystem set to play a significant role in enabling payments at scale, this shift would exponentially increase the value of the ledger due to the sheer amount of capital that would flow through it, thanks to international oil and commodities trading.

Crypto and NFTs as part of the core infrastructure of the metaverse

The convergence between the metaverse and cryptocurrencies is a topic worth keeping an eye on in the years to come. After last year’s quarter brought the rise in popularity of cryptocurrencies like MANA and SAND, numerous people got caught in the gold rush of digital land buying. With public figures like Philip Plein, who bought a $1.4 million Decentraland plot to financial institutions like JPMorgan, which opened a virtual lounge in Decentraland’s Metajuku mall, the world is left wondering what the future of digital real estate will look like. Looking at the rising living and transportation costs, we expect people to start embracing digital metaverses as a key medium of interaction, which could render these lands extremely valuable in the future. Nevertheless, something to watch out for in the next cycles is the inflationary effect that credit lenders will have on these metaverse spaces. Their entrance into the metaverse could create a price boom similar to what happened in real life to the real estate sector. At the same time, despite competing with popular metaverse coins, ETH has all the chances to become the base currency of the metaverse due in part to the mainstream adoption of its blockchain — with popular projects like Decentraland, OpenSea, and The Sandbox being built on Ethereum — and the development support for smart contracts. Last but not least, NFT, an emerging digital asset class with ownership functionality in the metaverse, took the crypto world by storm. One could even go as far as to say that what altcoins couldn’t do in almost ten years, NFTs did in less than a year. The current NFT environment resembles the evolution of altcoins in 2013-2015 — many copycats, cash grabs, and other outlandish stories. However, we predict that there will be gems that will arise from the dirt just like some coins did in those experimental times.

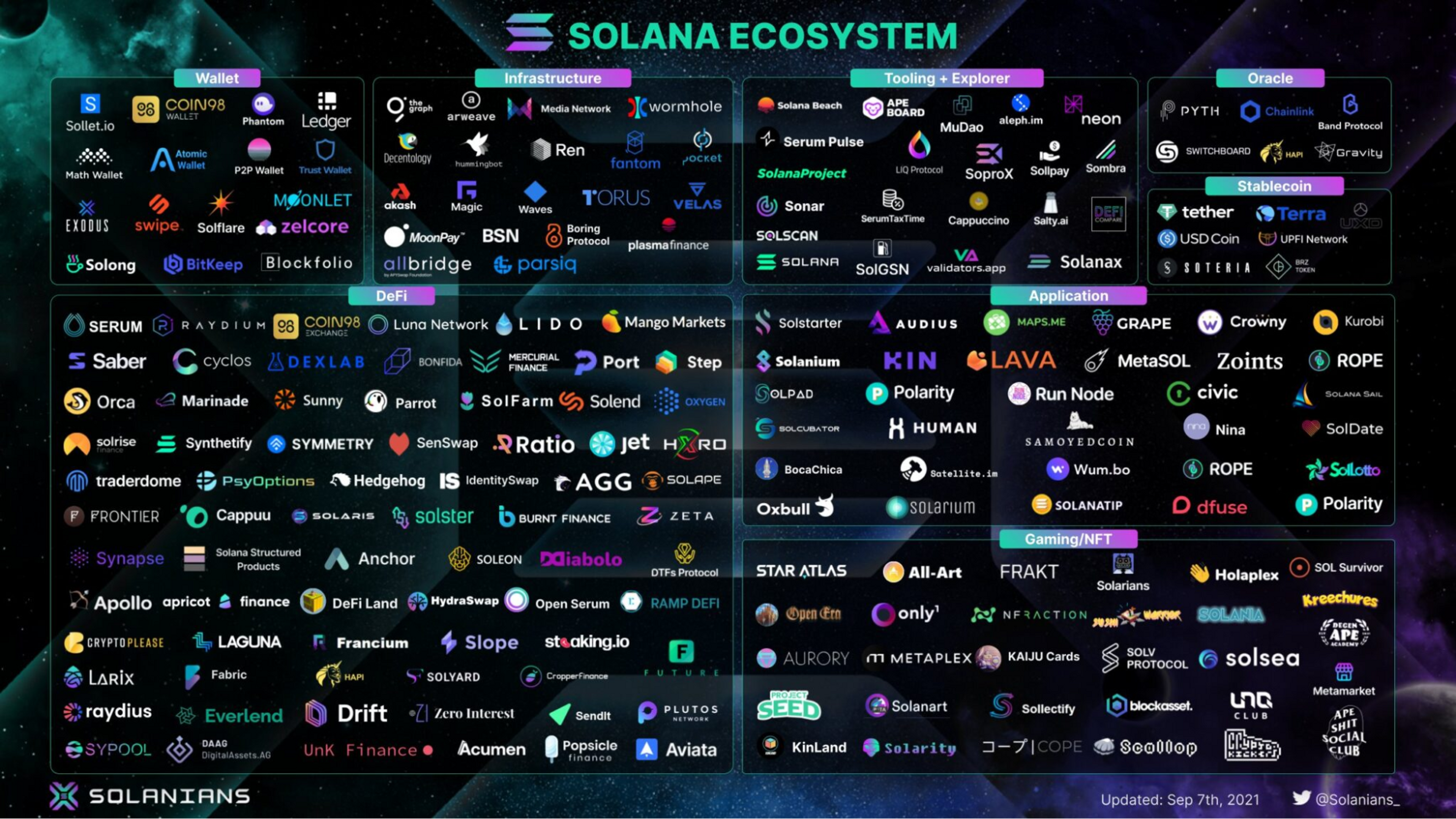

Solana’s ecosystem to mature and build a speculator community around it

Solana as an ecosystem is still in its infancy, experiencing recurring power outages that have started to discourage potential investors. As developers work on solutions to optimize Solana’s chain stability, we can draw a clear parallel with ETH’s ecosystem growth in 2016-2017, when exploited bugs threatened the blockchain’s future.

Source: TwitterOn top of that, another challenge in Solana’s road to maturity is a large amount of VC-backed coins trading at exaggerated, fully diluted valuations and misleading crypto investors and traders. This situation will require further correction to support an active community of speculators that can accurately plan for the impact of inflation on the coin’s price as the circulation supply increases over the years. For now, Solend’s (Solana-based DeFi lender) recent whale crisis serves as a lesson of how disproportionate project valuation and increased sell-side pressure could potentially topple an entire ecosystem and lead to mass liquidation.Yet, one has to only look at the returns sophisticated retail traders gained from ETH/ AVAX DeFi projects in the last couple of years to see the growth potential of Solana.

The uncertain fate of meme coins and L1 copycats to be determined

The love story details between Dogecoin, Litecoin’s copycat, and Tesla’s founder, Elon Musk, are all over Twitter and crypto news. With Mr. Musk looking to acquire Twitter, Dogecoin fans expect to see a positive impact on the coin’s future. But will celebrity tweets and the FOMO from fans wanting to be part of the Dogecoin saga be enough to help the cryptocurrency survive the next bull run? [caption id="attachment_353" align="aligncenter" width="438"]

Source: Twitter[/caption] Dogecoin started as a joke in 2013 when Jackson Palmer and Billy Markus created a coin based on the popular Shiba Inu doge meme. After Elon Musk started tweeting about Dogecoin in Q3 2020, the token gained popularity among crypto enthusiasts and people from the meme community. The sudden public interest combined with excess stimulus from central banks and the pandemic retail craze made it possible for Dogecoin to flip Ford (the multinational automaker) in market cap valuation.Like meme coins, many L1 copycats will have a hard time reviving after the complete implosion we’ve seen in Q1-Q2 2022 since these ecosystems aren’t yet getting the traction they desperately need to survive a crypto winter. Billionaire entrepreneur Mark Cuban compared this imitation stage in the adoption of crypto with the dot-com boom we’ve seen in the 2000s when copycat product returns proved exceptionally alluring until the bubble burst.

GameFi working on sustainability issues toward a booming revival

GameFi is a relatively new sector that has gained traction at the end of 2021 when playing Axie Infinity, a popular NFT-based Play-to-Earn (P2E) app, transformed into a full-time job for numerous people within communities in the Philippines. Despite the overnight success, GameFi remains where DEFI was at the end of 2017 — everyone claiming this to be the next big thing, with almost no products other than AXS being released. However, that’s not the only issue. The current P2E model focuses primarily on monetization, lacking the engaging gameplay and sustainable tokenomics that would help retain users for the long term and build a strong gaming community. So it’s no surprise that Axie Infinity has lost 45% of its daily users since November 2021. Unless P2E games shift their focus on delivering products with better tokenomics models that embrace the real joy of playing, not just the promise of financial incentives, their revival is uncertain.

Move2Earn’s growing appeal here to stay

Move-to-Earn (M2E) apps came in and stole the spotlight from their Play-to-Earn counterparts right before a broad market cascade. In short, these games aim to help users transition to a more active lifestyle by offering cryptocurrency rewards whenever they go running, dance, jog, or simply walk their dogs in the park. The user base, coin volume, and price increase that GMT (STEPN) achieved before larger market sell-offs were highly impressive, reminiscent of early Meta/GameFi projects. However, following a series of operative failures that kept users from using the app, FUD spread within the community, resulting in a mass exit of participants. As the market recovers, we expect strong money rotation back into the M2E sector. Therefore, derivatives of GMT will have a great chance of stealing market participants and market cap from the market sector leader and expanding their communities.Thanks to the great number of EVM multichain holders and the general average crypto asset value of multichain holders compared to Solana’s ecosystem (STEPN’s native), there could be significantly more market entrance for FITFI (STEP APP).

Wrapping up

The money flow in crypto has historically been from majors into midcaps into smallcap as the bull cycle continues. So how should you position for the future to protect and ideally increase the value of your investments? After large crashes, your portfolio should cover as many sectors as you’d think to be profitable in the next cycle since nobody knows for sure what the next narrative will be and the chances of guessing the first runners are altogether small. Once a new narrative starts to unfold, you can pivot or concentrate on it, depending on how accurate your initial choices proved to be. At the moment, we see the next narratives being played out in the metaverse, with Ethereum and Solana leading as favorite platforms to build on. The appeal of the metaverse and NFTs will gain more traction in the content creator economy, and exclusive access NFT drops like the ones Mike Tyson and Logan Paul could become the norm.On the cryptocurrency front, the few original L1s that focus on differentiating themselves rather than competing with other major ones will grow. Meanwhile, many EVM copycat L1s are fated to die due to their inability to sustain strong economic activity without considerable VC inflows. Staying on top of market news and possibilities is just one step in getting ready for the next bull market. To set yourself up for success in a bear market, you should consider leveraging the expertise of a leading crypto market maker partner like Kairon Labs, which can help you efficiently mitigate market fluctuations. Despite these tumultuous times, being well hedged against downside market risk has helped Kairon Labs remain a resilient player and trade profitably for most of our clients at the time of writing. Get in touch with us to discuss the best bull market strategy for your portfolio goals. Disclaimer: As always, this merely represents the opinion of Kairon Labs BV, and it’s not financial advice nor an inducement to make a particular investment or follow a specific investment strategy.

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?