Tools for Cryptocurrency Portfolio Risk Management - Part 2

Review

In our previous portfolio risk management article (read here) we reviewed several VaR (Value-at-Risk) models & their applicability in the crypto trading space. While our view is that VaR is a useful tool in a crypto portfolio risk management toolbox, it is by no means the only tool. In this article, we will examine several other complementary risk tools the author has used in practice, namely Expected Shortfall, Stressed VaR & Bespoke Stress Scenarios.

Expected Shortfall (ES)

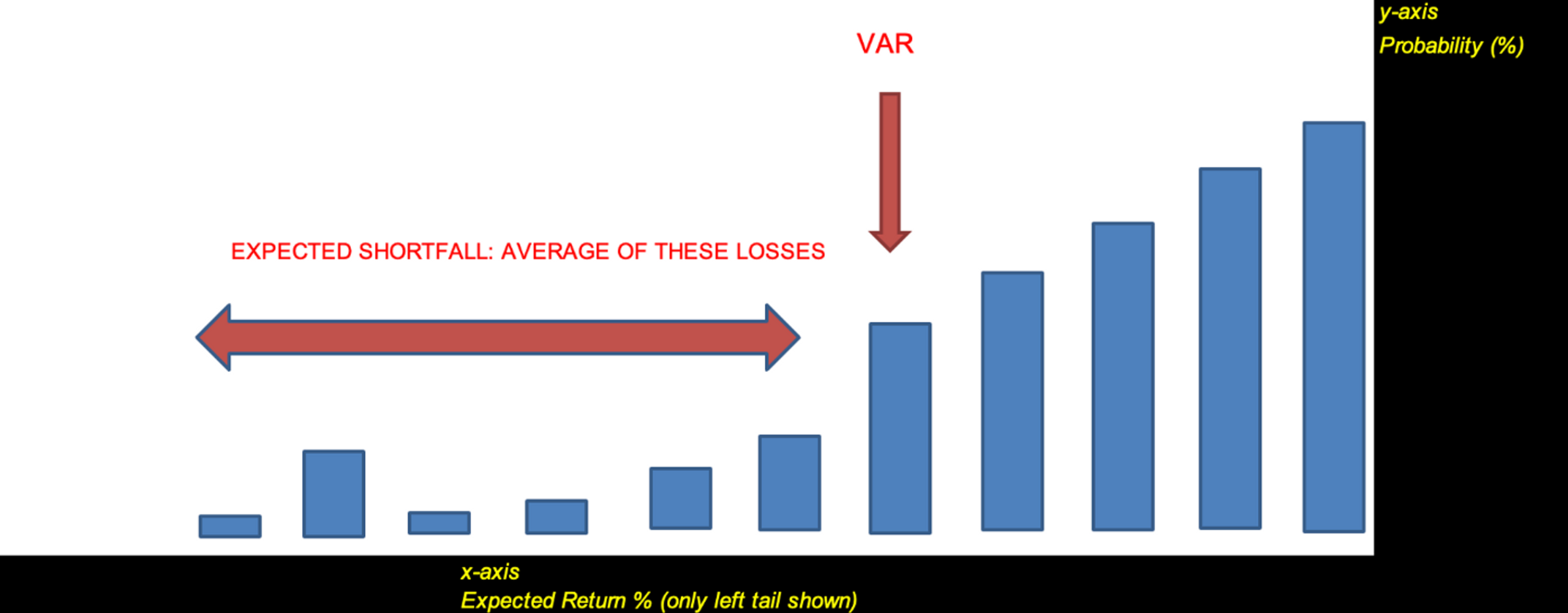

One of VaR’s weaknesses is the inability to capture “tail risk”. An alternative metric (ES) has therefore emerged, which measures the riskiness of a position by considering both the size & the likelihood of losses beyond a certain confidence level. In a nutshell, think of ES as the expected value of these losses beyond a given confidence level. So while we understand that VaR is the loss that is expected to be exceeded (100 - X) % of the time in N days for specified parameter values (X & N), ES is the expected loss conditional that the loss exceeds VaR. For example, if X = 99% & N = 1 day, ES is the average amount that the portfolio loses over a 1-day period when the loss is (already) in the 1% tail of the distribution.

Stressed VaR (SVaR)

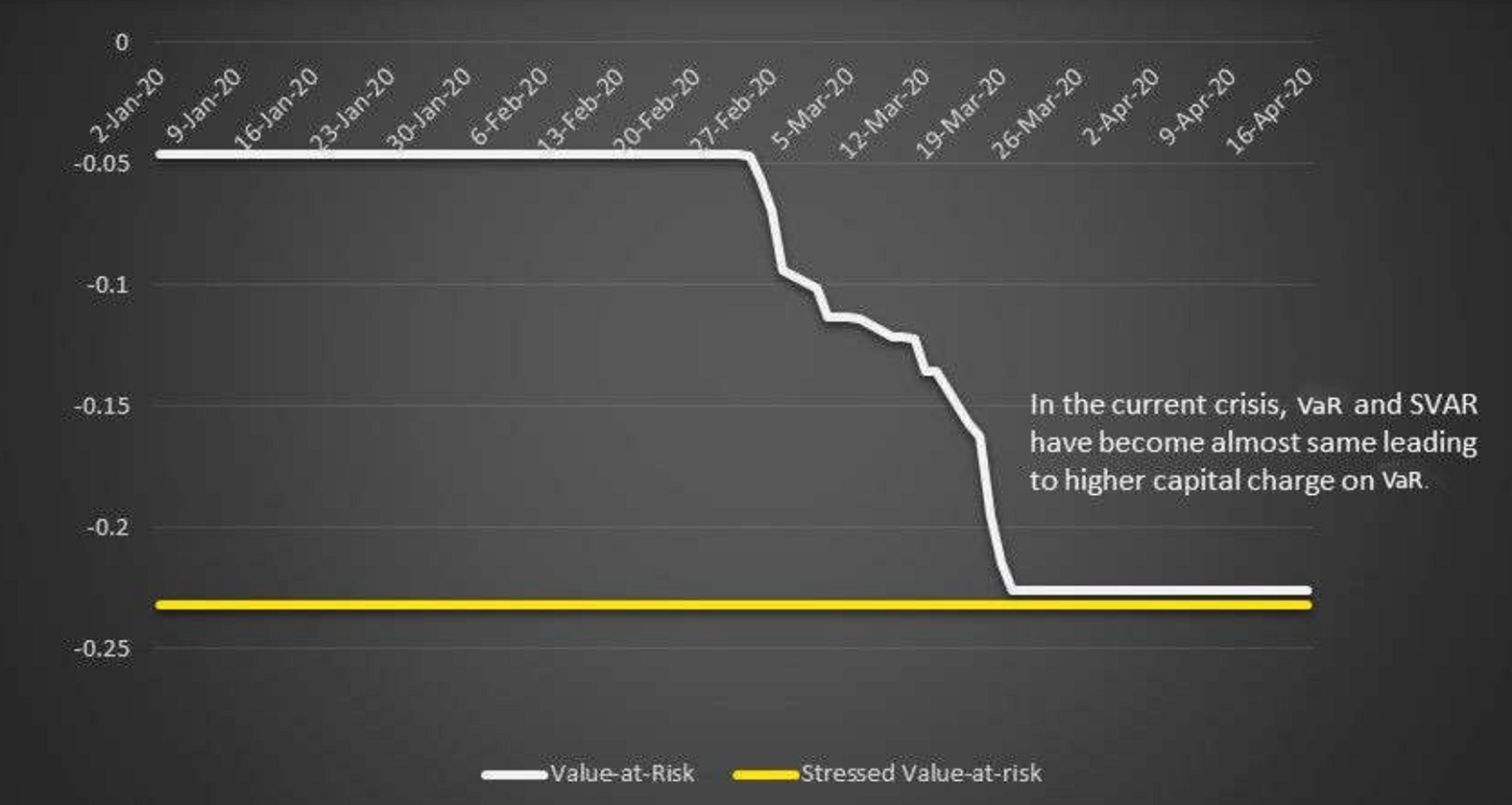

In practice, both volatilities & correlations of the cryptocurrencies in the portfolio need to be stressed, taking into account historical moves as a sanity check. Increasing the assumed volatilities is the easy part and has the effect of lengthening the tails of the gaussian (normal) loss distributions underlying the VCV VaR calculation. The 2nd step – stressing the correlation matrix – is trickier. In volatile periods correlations typically approach 1.0 (ex. 1987, 1998, 2008), which is known as “tail contagion”. Note when stressing the correlation matrix, the VaR calculator requires the matrix to satisfy the mathematical property of positive definiteness which simply means that the correlations need to be internally consistent with each other.

The photo above is from (GARP)

Bespoke Stress Scenarios

Industry feedback to our earlier VaR article included a reference to the importance of scenario risk management. The author agrees and believes this is one area where a risk manager can really get creative & show their value-add. Scenarios can be stand-alone or incorporated into VaR. A stand-alone delta1 scenario example might be “BTC futures curve steepening/flattening/ inversion” where you check historical data to get a sense of extreme moves, aggregate & bucket your cross-exchange portfolio BTC futures strip deltas by tenor and then shock each bucket x% to calculate your futures portfolio profit&loss. If say the “flattening” scenario negative pnl is above your comfort level, then a hard scenario loss limit could be applied to manage this risk. For VaR scenarios, say a crypto exchange uses other exchanges for cover-trading & one of these “sub-portfolio” exchanges is hacked, and accounts are frozen with no crypto liquidation nor crypto/fiat withdrawals permitted for 30 days. Run your Overall Portfolio VaR but with the assumption of a 30-day liquidation period for this sub-portfolio. Readers may consider the above VaR scenario a type of “liquidity-adjusted” VaR, which is a subject the author finds fascinating. An astute risk manager setting Portfolio VaR parameters needs a solid understanding of the liquidity of the various instruments in the portfolio. For a while a modestly-sized tradfi portfolio composed of NASDAQ liquid equities, US T-Bonds & G7 FX spot positions may be liquidated relatively quickly without much bid/offer impact, thus making a VaR (99%, 1 day) metric relevant, what if this portfolio also includes material positions in illiquid EM HY bonds & CLOs which take much longer to liquidate and/or would be expected to cause significant market disruption in the case of a forced sale? Overall market liquidity itself also varies over time of course & this should also be taken into consideration. As always, please feel free to reach out for a chat about your risk management needs.

Upcoming

In our next portfolio risk management article, we will move from market risk over to counterparty credit risk management, another crucial risk tool in the crypto space if you are keen to remain a “going concern”. Author: Charles Belford

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?