Weekly Crypto Market Update – April 10, 2023

Last Week’s Recap:

- U.S. non-farm payrolls increased to 236,000 in March vs the 238,000 estimated, while the unemployment rate lowered to 3.5% vs the 3.6% estimated.

- PancakeSwap V3 was launched on BNB and Ethereum.

- Trader Joe launched Liquidity Book V2.1, a competitor to Uni V3’s concentrated liquidities.

- OpenSea rebranded Gem into OpenSea Pro, an NFT aggression tool with NFT rewards to compete with Blur.

- Crypto exchange OPNX formed by 3AC founders went live.

Legacy Markets – DXY

The low U.S. unemployment rate boosts the likelihood of another 25 bps hike, which placed a floor on the DXY level and DXY started moving up from 2-month lows. Further movement will be up to the CPI readings, a break above 106 will likely cause a market sell-off.

Legacy Markets – VIX

VIX level continues a downtrend after the banking liquidity crisis for 1 month with recent macro data mostly in line, but likely pick up a bit this week with speculative positions on CPI numbers as well as Shanghai upgrade in crypto. Without large Fed policy change, which is dependent on the economy's slow pace, any volume-up move is likely to be sold into.

BTC Weekly View

BTC continued holding 27-29K range last week and have been in the range since March, we expect BTC to continue low volatility as its mainly macro driven, and the macro picture of either high inflation continues or early recession kicks in is not clear yet.

ETH Weekly View

Shanghai upgrade will be the focus for ETH this week, as staked ETH withdrawal is likely to cause some short-term selling pressure. And the unclear macro picture is unlikely to offset this pressure and support the price move higher.

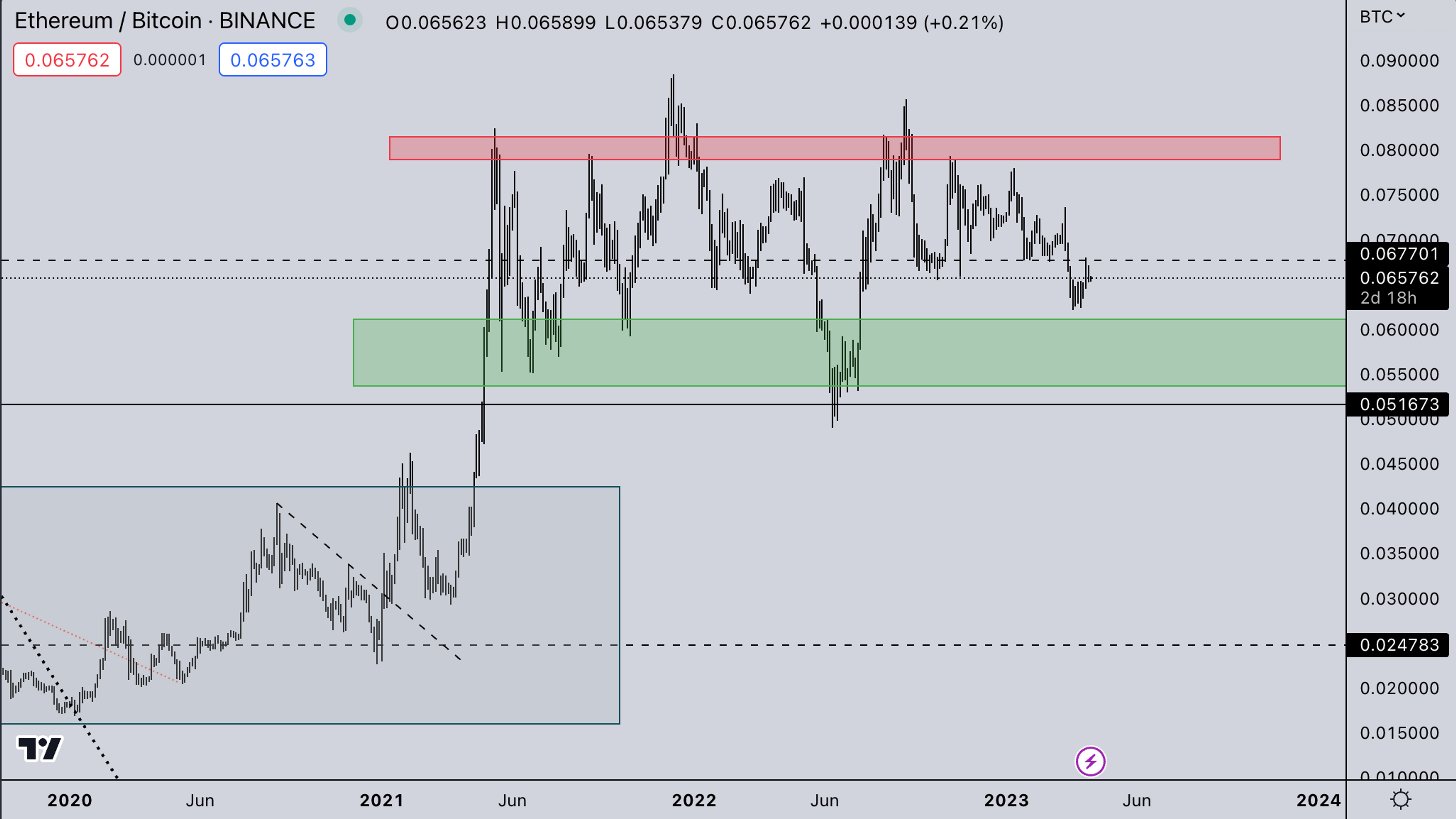

ETH/BTC

ETH/BTC rate is likely under pressure this week given how large the ETH selling pressure might look like, short term support is at 0.06 level with mid term support at 0.05 level.

TOTAL2 – USD Market Strength

The new capital flow into the crypto market continues to be at a low level and existing liquidities flow from alts to majors continues, even the Arbitrum airdrop and new Binance IEO didn't help boost the alts market. There is a decent chance to see alts market cap move higher given the recent L2 narrative and new chains such as SUI/StarkNet/zkSync etc. as long as macro cooperates.

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC is likely to continue a weak trend if total liquidity in the crypto market doesn’t improve, and the flow from alts to majors will likely continue if the market consolidates, recent L2/new chain and NFT aggregation tool narratives need a better macro condition to help alts thrive.

Summary

- The low U.S. unemployment rate has increased Fed 25 bps hike probabilities in May, and the strong labor market is unlikely to cause a large cool-off in the upcoming U.S. CPI number.

- Ethereum Shanghai upgrade is due on Apr 12th, which may cause short-term selling pressure.

- Crypto options update:

- ETH 30-day 25 delta R/R rangebound past 3 weeks around the neutral level (+/-10).

- ETH 30-day ATM vol is also quite subdued sub-60 level with tightening seen in 30-day VRP (Variance Risk Premium, IV<RV).

- Monitoring potential IV plays on the upcoming Shanghai/Shapella upgrade.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?