Weekly Crypto Market Update – April 17, 2023

Last Week’s Recap:

- Bitcoin surpassed $30K and Ethereum surpassed $2K.

- Ethereum’s Shanghai upgrade is complete and withdrawal is enabled.

- U.S. CPI rose 0.1% in March and 5% YoY, both below estimates.

- Hong Kong established a Web3 association to support regulated Web3 development.

- Uniswap wallet went live on App Store.

Legacy Markets – DXY

DXY is on the edge of the lower range 102-106. A full break under the lows around 101 would accelerate crypto and equities higher. However, the breakdown would be back into a 7-year price change. This gives a higher probability of fake breakdowns.

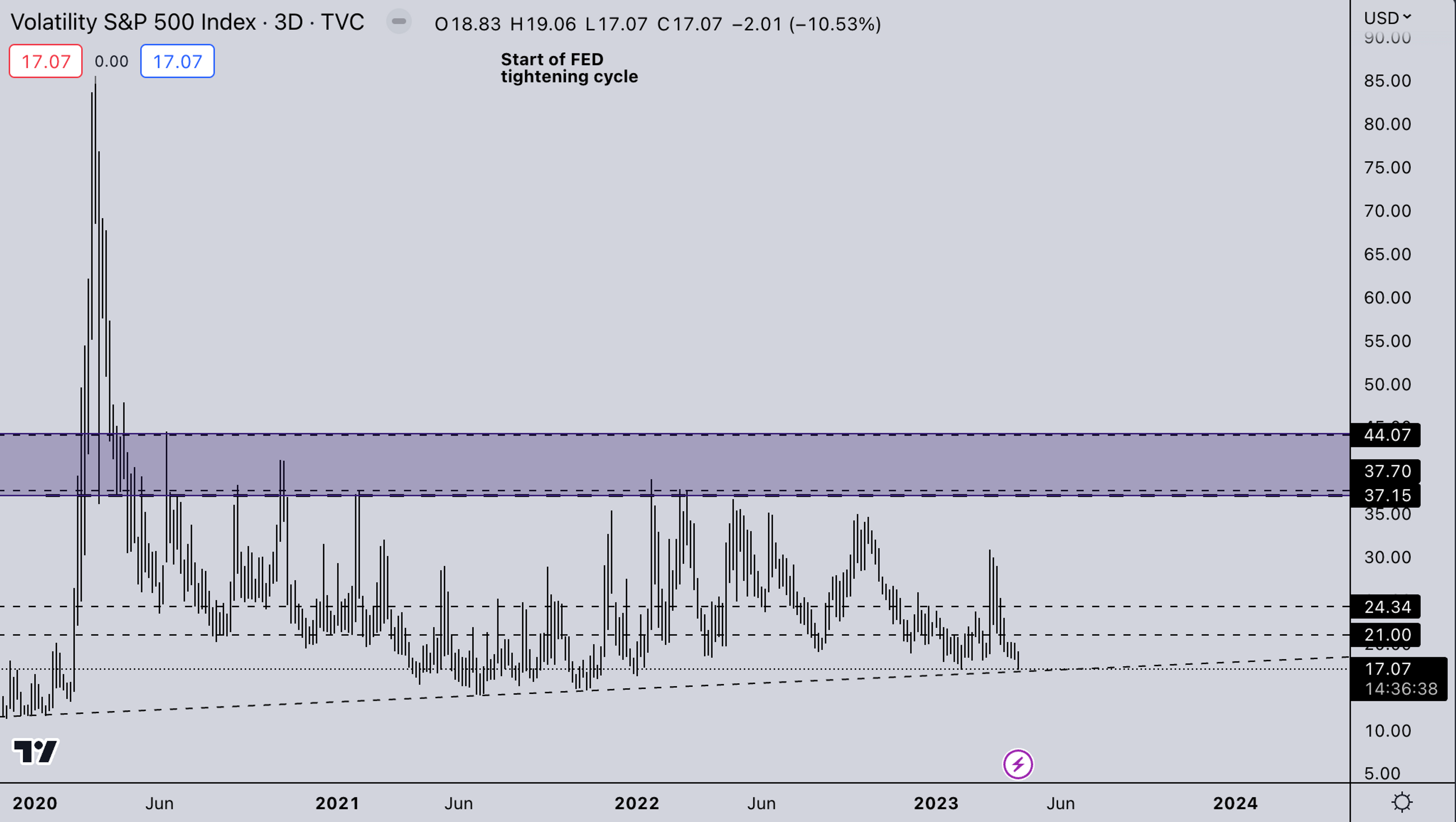

Legacy Markets – VIX

VIX levels continue to drop crushing IV premiums in options markets. For the first time in a while, it's finally touching the trendline that started in 2018. On this trendline, the last 5 years have given big impulse changes every time (instantly or after some accumulation).

BTC Weekly View

BTC is currently right on the 2021 support. So a stall in price is expected here. With two possible outcomes:

- If BTC keeps consolidating on this level and actually breaks above, it could run fairly fast into 40-45k levels (but we should see some more weeks of consolidation in the 28-32k zone).

- The second scenario would be, initial rejection as this is a very big level. So a fake breakout on the initial try makes sense. We think in that scenario that ETH would likely give a retest around the 1700-1800 level and confirm acceptance back in the 2021 range. This would set up select alts and nft’s for early bull markets.

An interesting POV is the BTC and Gold correlation. If Gold can hold and base above 2k we think BTC should see continued strength if the narrative holds up (Speaking in weeks above 2k not days).

ETH Weekly View

ETH has found its way back into the 2021 price range after the successful Shapella upgrade. ETH has room to run all the way up to the 3k area depending on if BTC stalls or if gives a correction first. If we’d get a correction first the red zone 1.7-1.9k would be the ideal entry for people who missed the initial run-up.

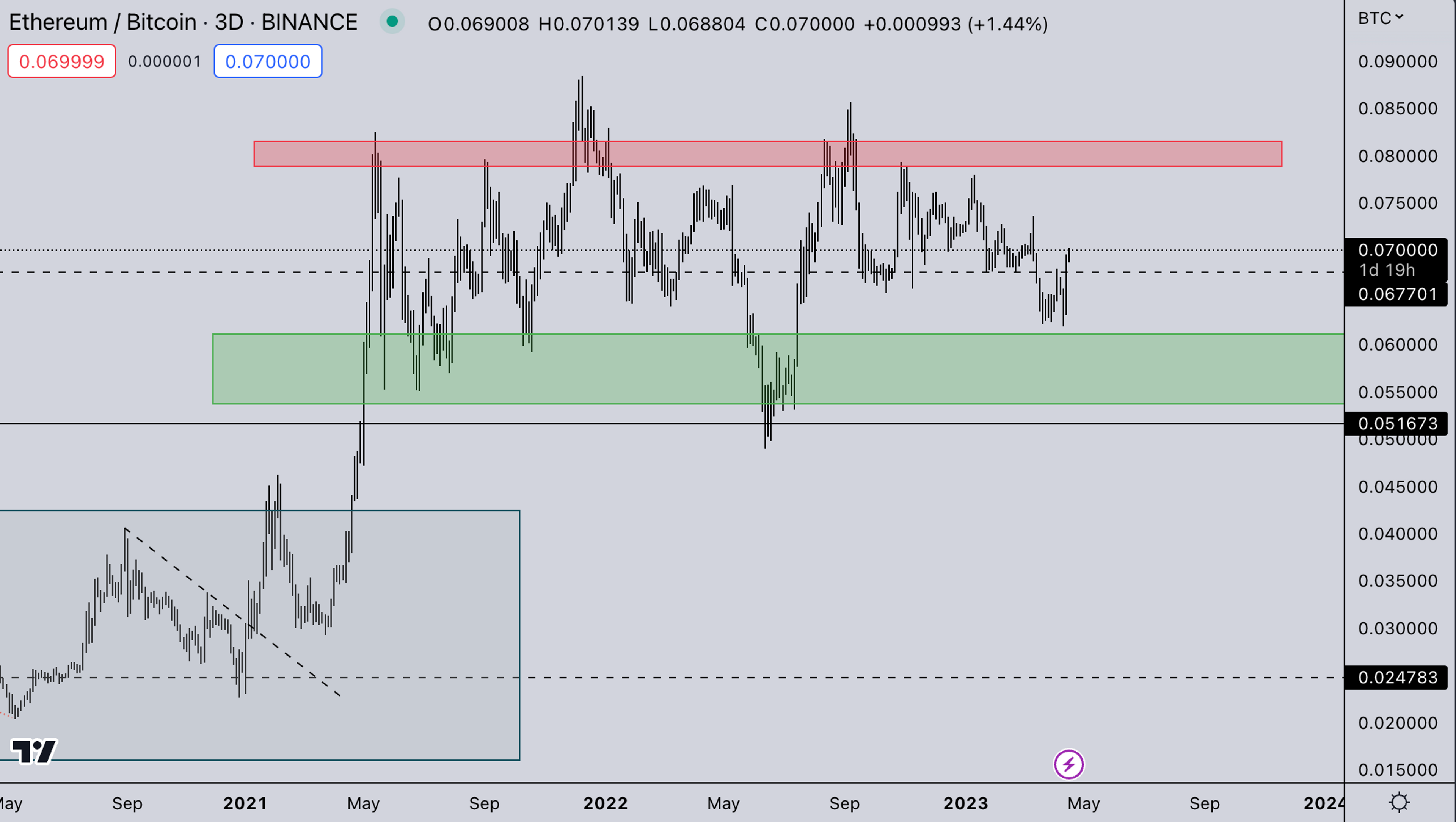

ETH/BTC

ETH/BTC ratio after Shapella saw an instant bid back after the derisking into the event. With the upgrade working as intended it’s hard to see what would weaken ETH/BTC from this point. The point of weakness could come from another inflation surge, if BTC would confirm the Gold correlation as mentioned earlier it could be that ETH will trade more like big tech which should then be reflected in ETH/BTC weakness.

TOTAL2 – USD Market Strength

TOTAL2 is gaining strength with ETH. Under the hood, there are select alts (mainly newer ones ARB/BLUR/HOOK/OP…) that are performing well on BTC and USD pairs. This is why one should seek strength and not touch laggards for now as there are still no large new capital inflows(Though they’re increasing a bit).

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC saw a little reversal together with the bid on ETH/BTC. The market is now on a cross edge if ETH and BTC slow down giving room for more alts or if the main bid stays on ETH. We think an ETH-driven rally would suck strength away from the other alts. So it’s important to keep an eye on ALT/ETH ratios.

Summary

- BTC is right at a large inflection point in the market.

- Big tech earnings coming up again. This time they will either confirm the “temporary” slowdown most claimed in Q1 or if it’s a more permanent halt. If that would confirm we’d start trading the “recession” narrative which is unexplored territory for crypto. We think as outlined in the Gold <> BTC scenario that it’s likely BTC trades as digital gold while ETH is more likely to trade as a big tech stock in that environment.

- Sentiment-wise, people who missed the bottom in November are finally starting to pile in which is always a sentiment indicator. Especially with BTC right at that large inflection point.

- The NFT market is seeing capitulation in ETH valuations which could make it attractive for a fresh run coming weeks/months.

- Crypto Options Update:

- ETH 30 day 25 delta R/R continues sideways moving around the neutral level.

- ETH 30 day ATM vol was also caught in a sideways trend.

- Closed majority ETH 1850 28Apr23 long put < spot pump,

- Re-entered long ETH put side 2100/2150 28Apr23 post-pump. PnL: +ve.

- ETH IV Prop Portfolio LTD pnl in USD (ann.): +171.02%. ETH Benchmark: +17.56%. Days Live: 248.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?