Weekly Crypto Market Update – April 3, 2023

Last Week’s Recap:

- U.S. CFTC (Commodity Futures Trading Commission) charged Binance and CZ for regulatory violations.

- Arbitrum Foundation received criticism after having a "ratification" vote over decisions it had already implemented, including sending nearly $1 billion ARB to itself.

- Ethereum Foundation announced Shapella network upgrade will happen on Apr 12th.

- U.S. Government sold $215M BTC which was hacked from the Silk Road marketplace. They also plan to sell another $1.1B to follow.

- Ledger raised another €100 million, with a valuation of €1.3 billion.

- Gemini is looking to launch international derivatives exchange.

- Microstrategy adds another 6500BTC.

Legacy Markets – DXY

DXY tested range lows and holding. The extreme negative sentiment around the $ Dollar in the market seemingly gives a bit of strength for crypto in the long run. Although, this would put pressure on equities and crypto in the short term. Zone of interest would be up to the 106 area as a starter, but below the green zone would likely make crypto exceedingly bullish.

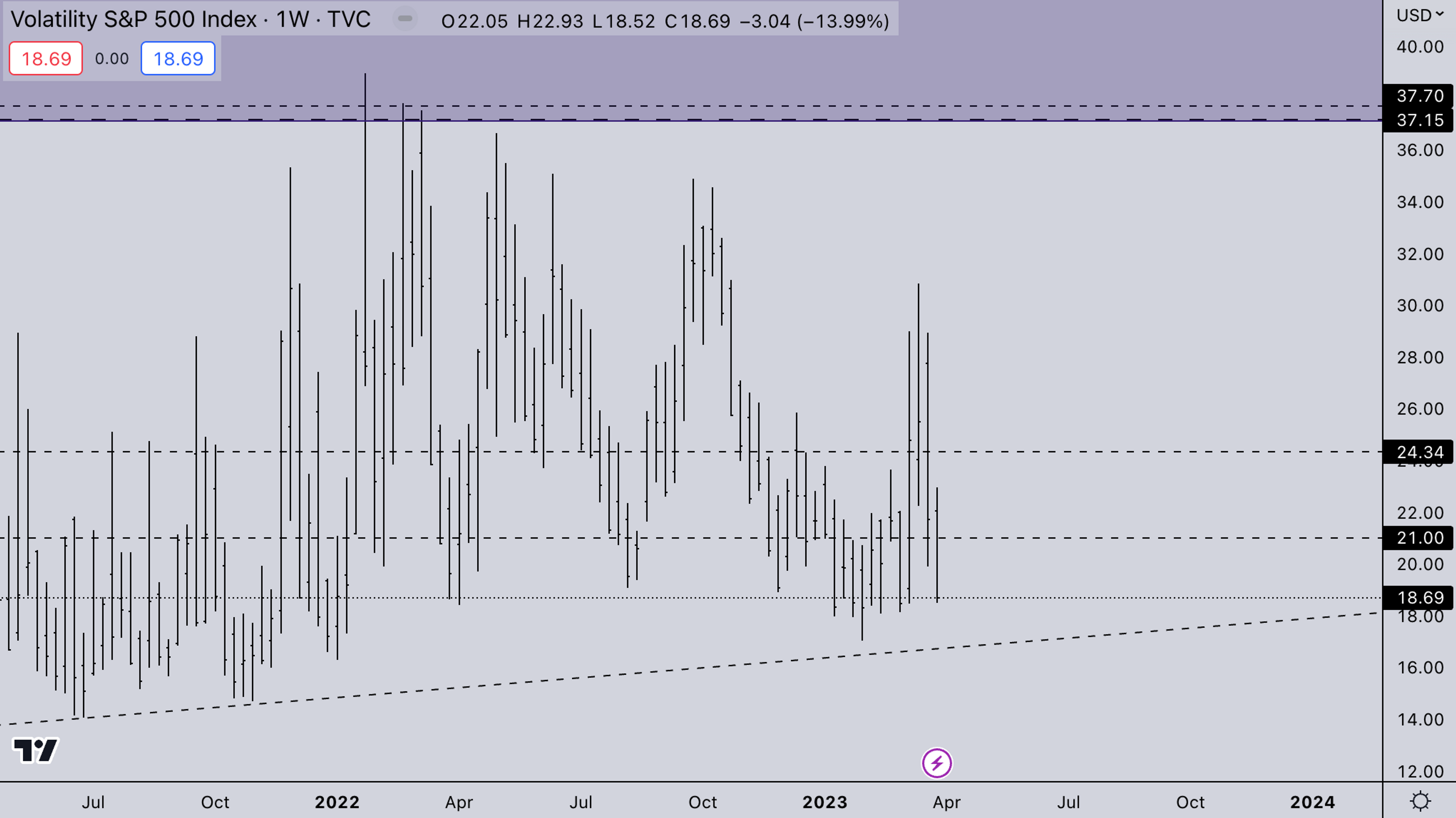

Legacy Markets – VIX

After the bank run panic, VIX made a comeback to sub 21 quite fast. The bad thing is that, neither the S&P500 or BTC have actually managed to break new highs on this fast drop. BTC has just been ranging, while some alts have started popping again after retracing quite a bit since January.

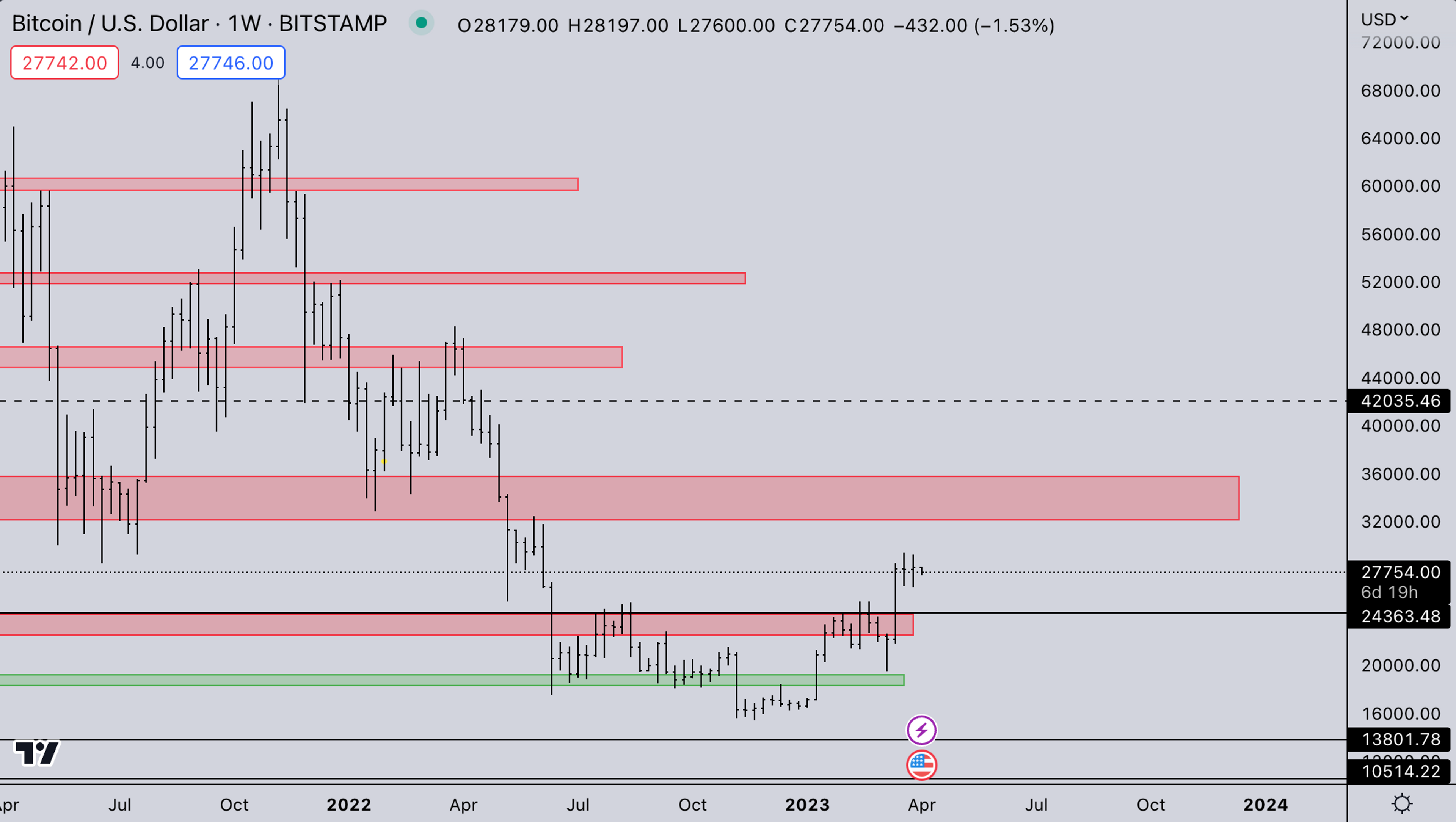

BTC Weekly View

BTC seems to be between the 20k-30k in range, if you look at the big picture. In summer 2022, ETH saw a similar chop price action right under the 2021 floor, which BTC is now experiencing. Althought it still shows a similar characteristic as that of Gold or Nasdaq. For now, breaking above 30k would probably cause a huge fomo in the market. We think it’s highly unlikely, that a break above 30k would be sustained. It appears to be more likely a fakeout (if it happens), to lure in participants that have mispositioned since the lows.

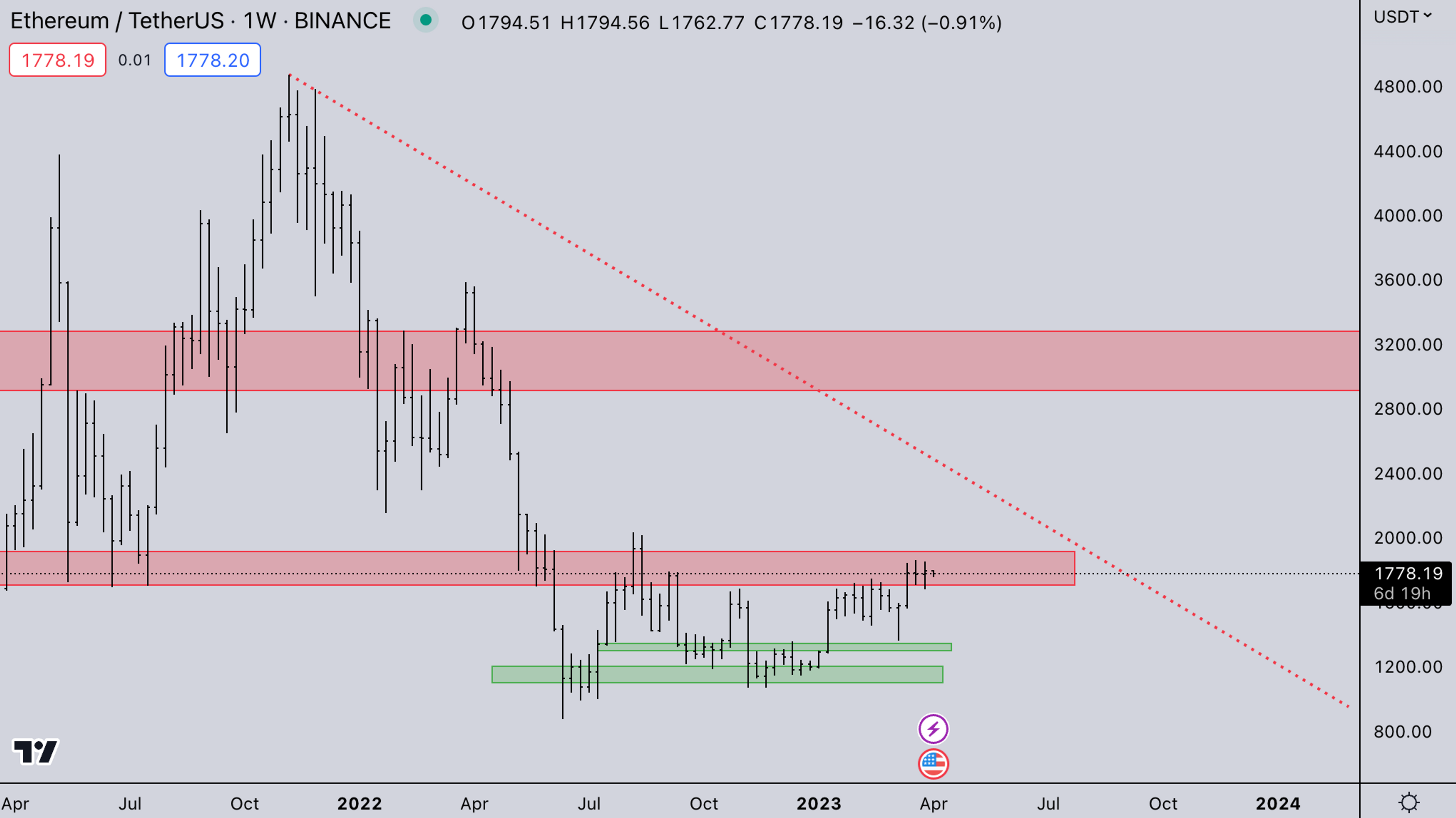

ETH Weekly View

ETH is consolidating on the 2021 lows for quite a bit now. Shanghai upgrade is scheduled for this month (or Shapella Upgrade). The event will likely cause some confusion, especially because of the long delay. At this point, it’s hard to estimate the impact as we’ve been trading “Flat” into it - so there’s no real momentum either way.

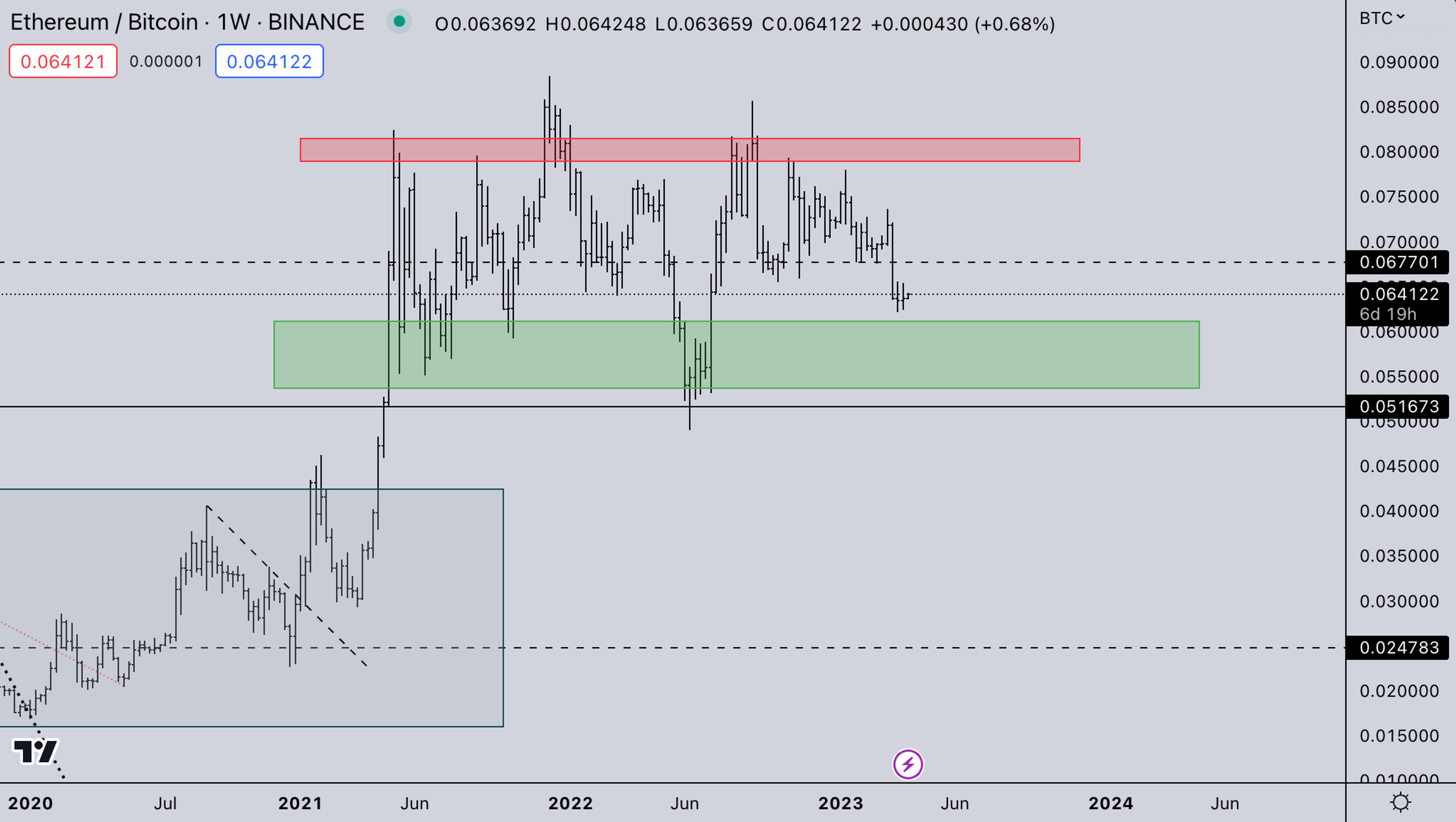

ETH/BTC

ETH/BTC is also still in no-mans-land as long as it trades in this larger range. To gain any real momentum, it either has to break above the red zone or below the green zone.

TOTAL2 – USD Market Strength

The entire market is seemingly at the same big inflection point (being the 2021 lows). There’s a high probability that we get extended ranges on ETH and BTC in the short to mid-term. This would mean, however, that there could be opportunities in altcoins and NFT’s. The longer ETH and BTC go sideways within well defined ranges, the more room alts have to run.

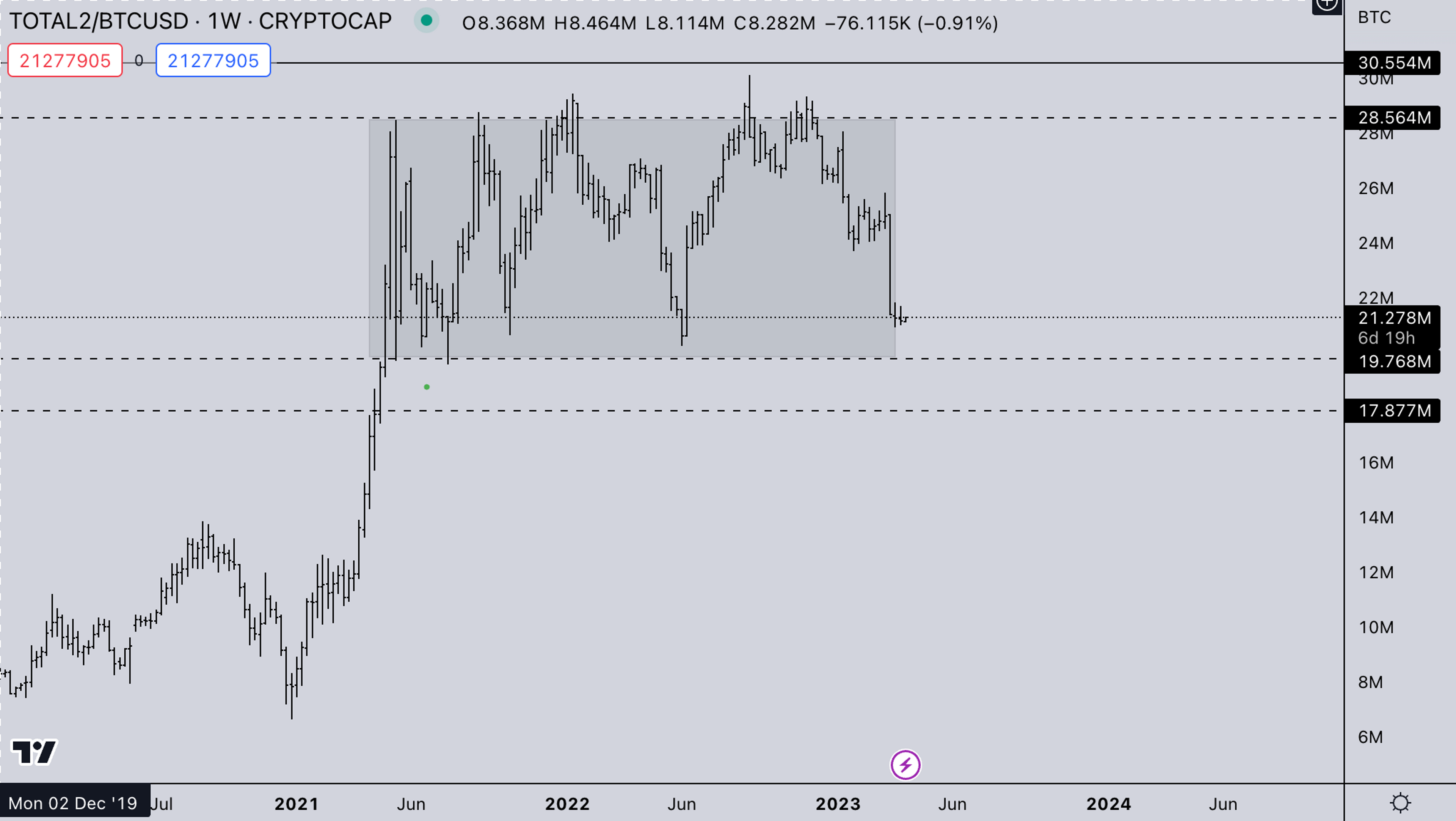

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC is still weak but with BTC slowing down right under 30k a viable scenario would be extended range on BTC and altcoins reversing upwards again. For those trading ETH denominated charts, NFT’s are also seemingly building large bases relative to it.

Summary

-

- BTC seemingly stuck under 2021 lows.

- NFT’s seemingly putting in bottom structures relative to ETH.

- Crypto options update:

- ETH 30 day 25 delta R/R moving sideways around neutral level.

- ETH 30 day ATM vol also trending sideways with widening seen in 30 day VRP (Variance Risk Premium, IV/RV)

- 31Mar23, Closed ETH 7Apr23 1600 short put (DOV auction play). De-risked 50% early. Gross PnL: flat. Portfolio LTD pnl(ann.) +874.56% Days Live: 133.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?