Weekly Crypto Market Update – February 27, 2023

Last Week Recap

- The U.S. PCE increased 0.6% in January (4.7% YoY), higher than the expected 0.5% (4.4% YoY).

- Coinbase launched a new layer 2 Base, which is built on Optimism OP Stack with no network token issue plan.

- Coinbase reported $629 million in revenue and a loss of $2.46 per share, both better than expected.

- Ankr partnered with Microsoft to offer enterprise node services.

- Alchemy Pay adds Google Pay for on-ramp fiat-crypto purchases.

- Voyager transferred assets to centralized exchanges.

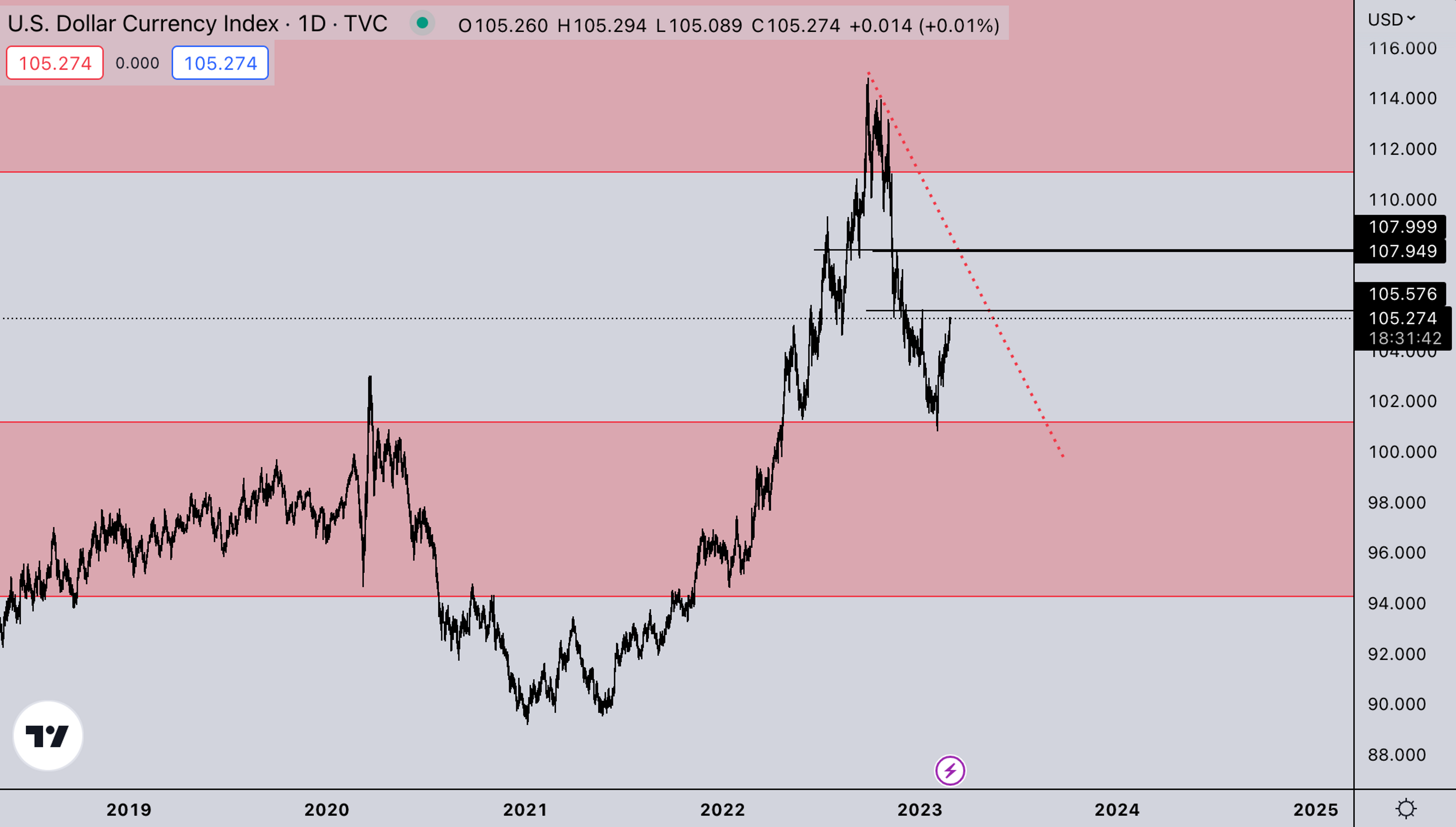

Legacy Markets – DXY

As mentioned last week, with DXY over 105, techs already saw larger pressure. Crypto also got a lot weaker especially alts. BTC and ETH are holding better though they’ve also shown more willingness to drop last week. For this week, we’d expect the current bounce to consolidate somewhere between 105-107. A slowdown in DXY would give room for crypto - if it can keep up its relative strength to other markets.

Legacy Markets – VIX

VIX traded above 21 all of last week. During US hours there was a higher correlation between crypto and stocks than we’ve seen lately. Still, crypto is holding up quite well relatively speaking. It also needs to be noted that the Nasdaq has outperformed all other indexes and stayed stronger in recent weakness. With crypto correlating the most with the Nasdaq it has to be seen how real the “Decorrelation” is once it underperforms/weakens relative to the other indexes.

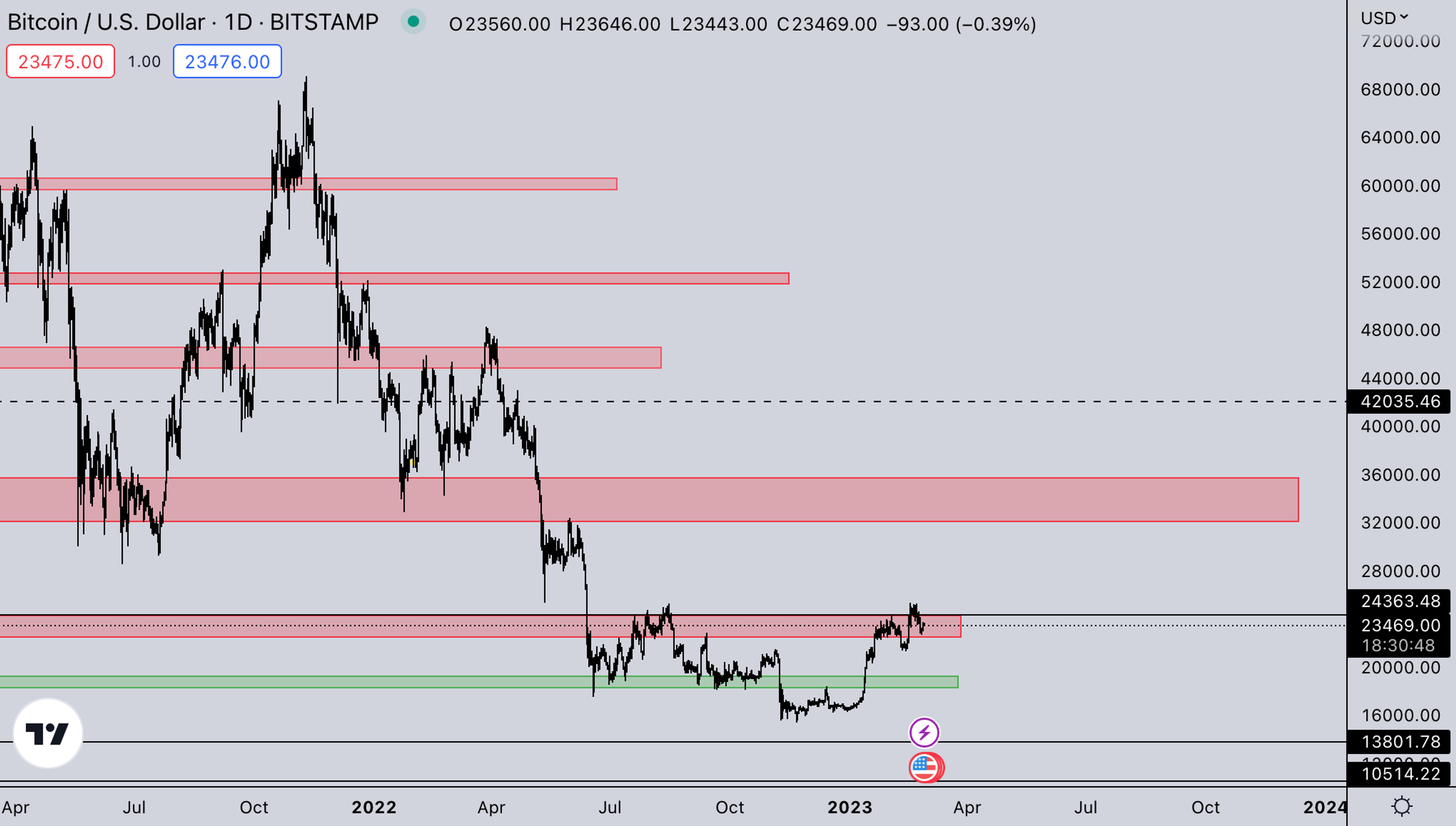

BTC Weekly View

BTC has still been resilient during equity weakness and a stronger dollar. With inflation seemingly re-accelerating, the question remains, if BTC can truly decouple from equities. At the moment, it does seem like there aren’t many events that could cause for lower prices. What’s more likely at this point is an extended period of range/chop.

ETH Weekly View

ETH is still grinding at the 2021 lows. With the market seemingly gearing up for a larger move. Shanghai upgrade is approaching rapidly and with this - we see 2 scenario’s going into the event.

- ETH rallies further into Shanghai Upgrade by doing a "buy the rumor sell the news" approach.

- ETH starts selling off pre-event, and therefore the Shanghai launch is expected to result in consolidation.

Targets for ETH would be 2 - 2.2k which should be a heavy resistance / TP area for traders who played the bear market rally.

ETH/BTC

ETH/BTC is still grinding on mid-range. Holding relatively stable, while BTC is also ranging. We’d still expect ETH to likely underperform both upside and downside if BTC would make a bigger move. After the Shanghai upgrade and ETH has unwinded, we’d expect it to perform once again on a relative basis to BTC.

TOTAL2 – USD Market Strength

TOTAL2 is also grinding right under 2022 support. ALTS did see a lot of weakness last week with the majority being down 30-50% from the recent highs. We’d expect BTC to take over from here, and show the alts direction on what’s coming next.

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC is reflecting what we mentioned in the previous part. That is ALTS have seen larger retraces from recent highs and are showing some weakness relative to BTC. We’d expect further pressure as long as DXY stays strong. Alts that have already ran in this mini cycle would likely make lower highs if BTC would make another leg up, thus confirming the BTC dominance move.

Summary

- Inflation down-trending and the FED pivot narrative seems over for now.

- With heavy short positioning & allocation in both equities and crypto, we saw a massive rally to start the year off. Now that most of this move has played out, the market will likely go through a transition period until the next CPI numbers are out and see if the “higher for longer” narrative takes place, or how the FED will handle that. There are actually more scenario’s than most are debating:

- FED starts raising more aggressive again -> Bearish

- FED keeps raising 25BPS and stops as initially planned as per last meeting -> Bullish/Neutral (in the short-midterm)

- FED raises target inflation from 2% to 3-4% -> Bullish

- The Shanghai testnet upgrade is tomorrow: the 28th of February.

- NFT market showing resilience so far with the boost of BLUR tokens farming.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?