Weekly Crypto Market Update – March 20, 2023

Last Week’s Recap:

- 100% of Circle’s deposits in SVB are secured, and USDC is pegged back at $1.

- European Central Bank hiked 50 bps but pledged to provide support if needed.

- The People's Bank of China (PBOC) said it would cut the reserve requirement ratio (RRR) by 25 bps to boost liquidity.

- Leading DeFi lending protocol Euler Finance has been hacked for $197 million.

- Binance would convert the remaining of $1 billion Industry Recovery Initiative funds from BUSD to native crypto, including BTC/ETH/BNB

- Arbitrum announced the ARB token airdrop and will transit to DAO

Legacy Markets – DXY

DXY is still struggling with the 105 - 106 level. For now, it seems to be building a base that ranges between 101-102 and 105-106 from a technical point of view. Fundamentally, there’s a lot more going on with the FED being trapped between bailing banks and doing QT/fighting inflation.

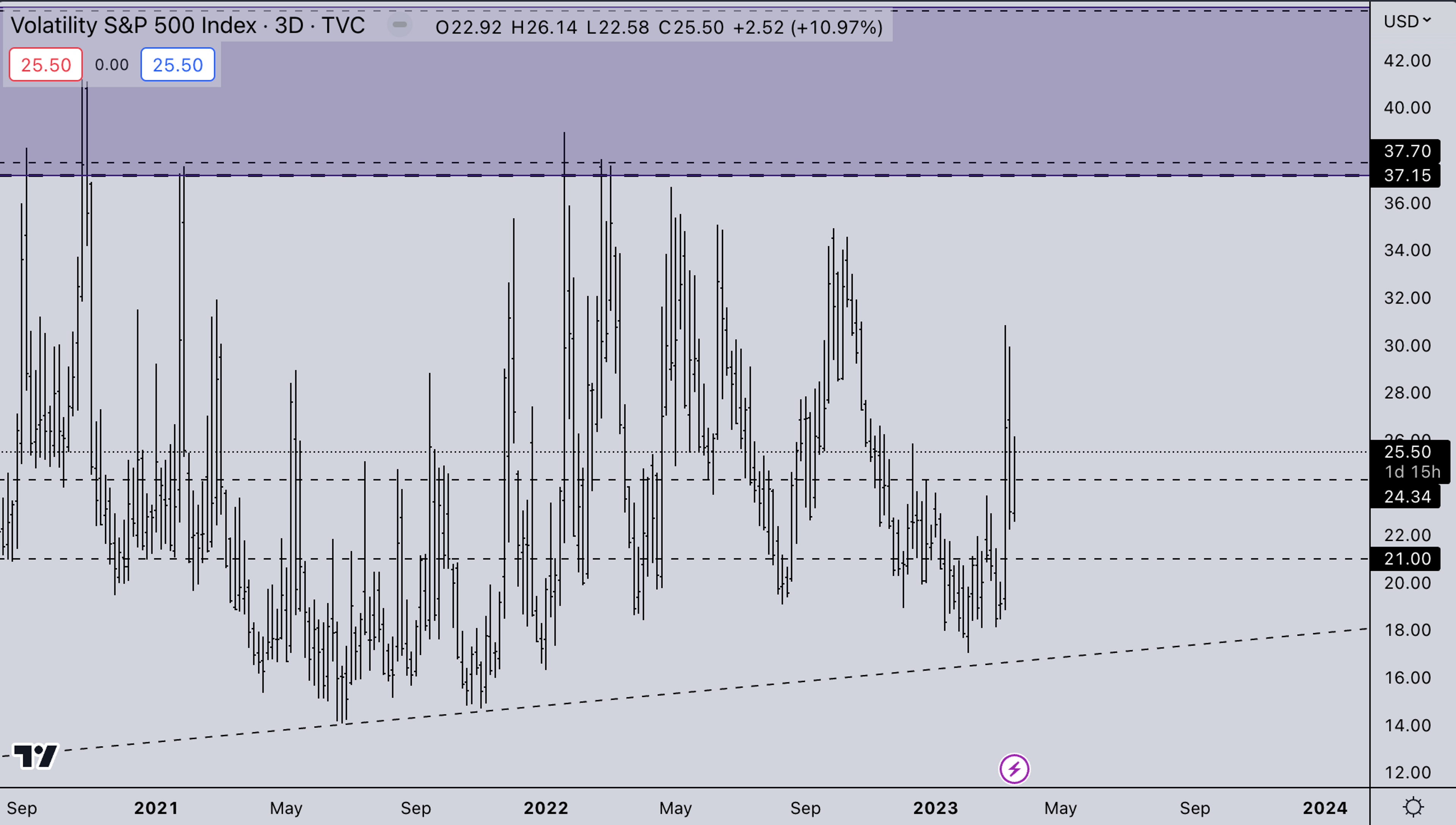

Legacy Markets – VIX

VIX has re-entered the +21 regime. Meaning, correlations across the board should increase. Big tech and ETH / BTC are still standing while underlying altcoins and smaller tech in equities are dropping for quite some time now. In the coming weeks, it’ll be clear if BTC wants to trade akin to Gold or if it was just a higher beta relative to big tech.

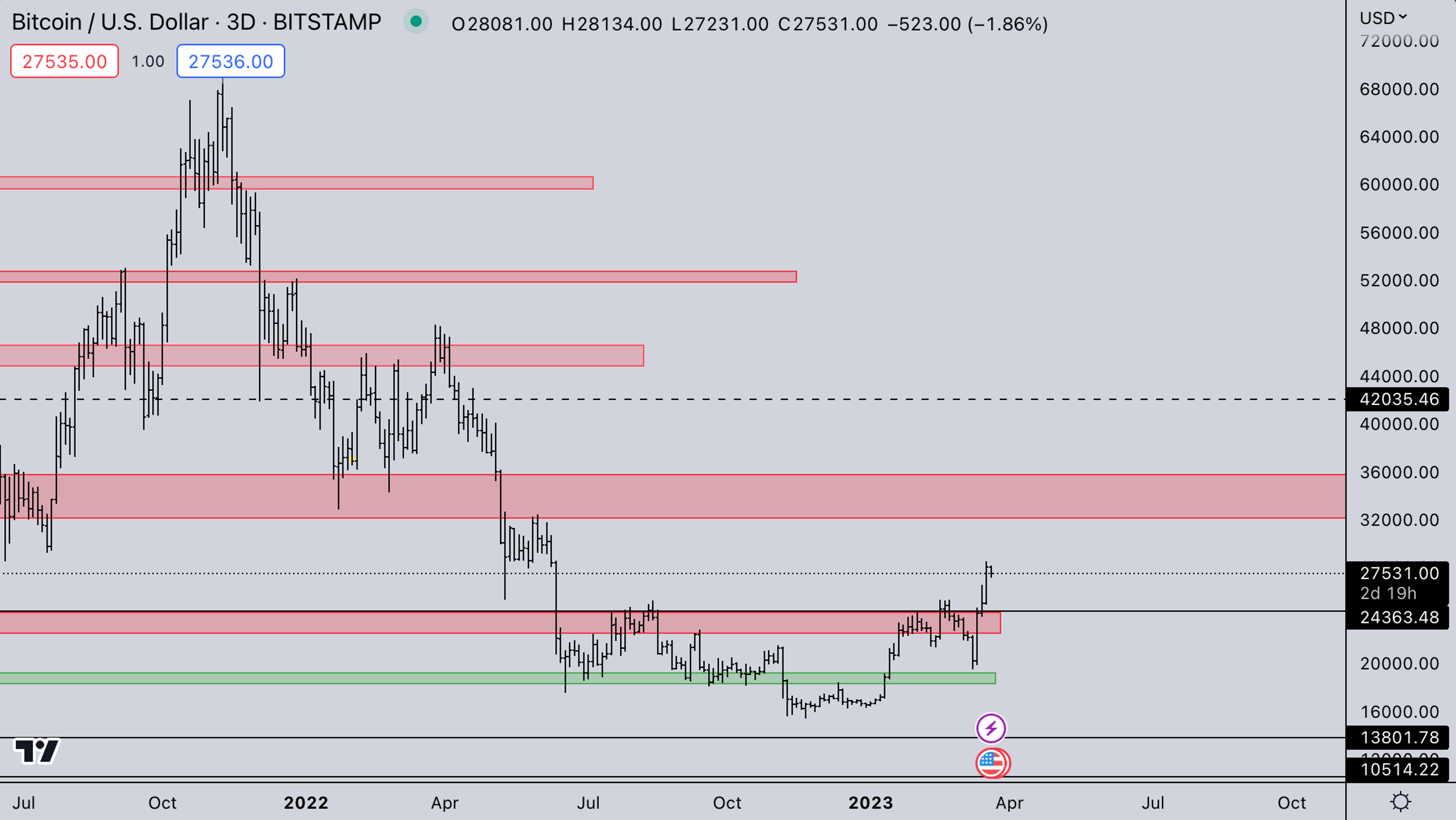

BTC Weekly View

BTC broke out of a 9-month-long accumulation structure. From a technical point of view, breakouts out of such large bases give quite a lot of upside. The big question at this point is if this can give enough fuel to break the 2021 floor at 28-32k. For now, BTC is the strength of crypto and is showing major momentum. It also has the narrative of it being the digital gold. And gold does historically well in periods of high inflation.

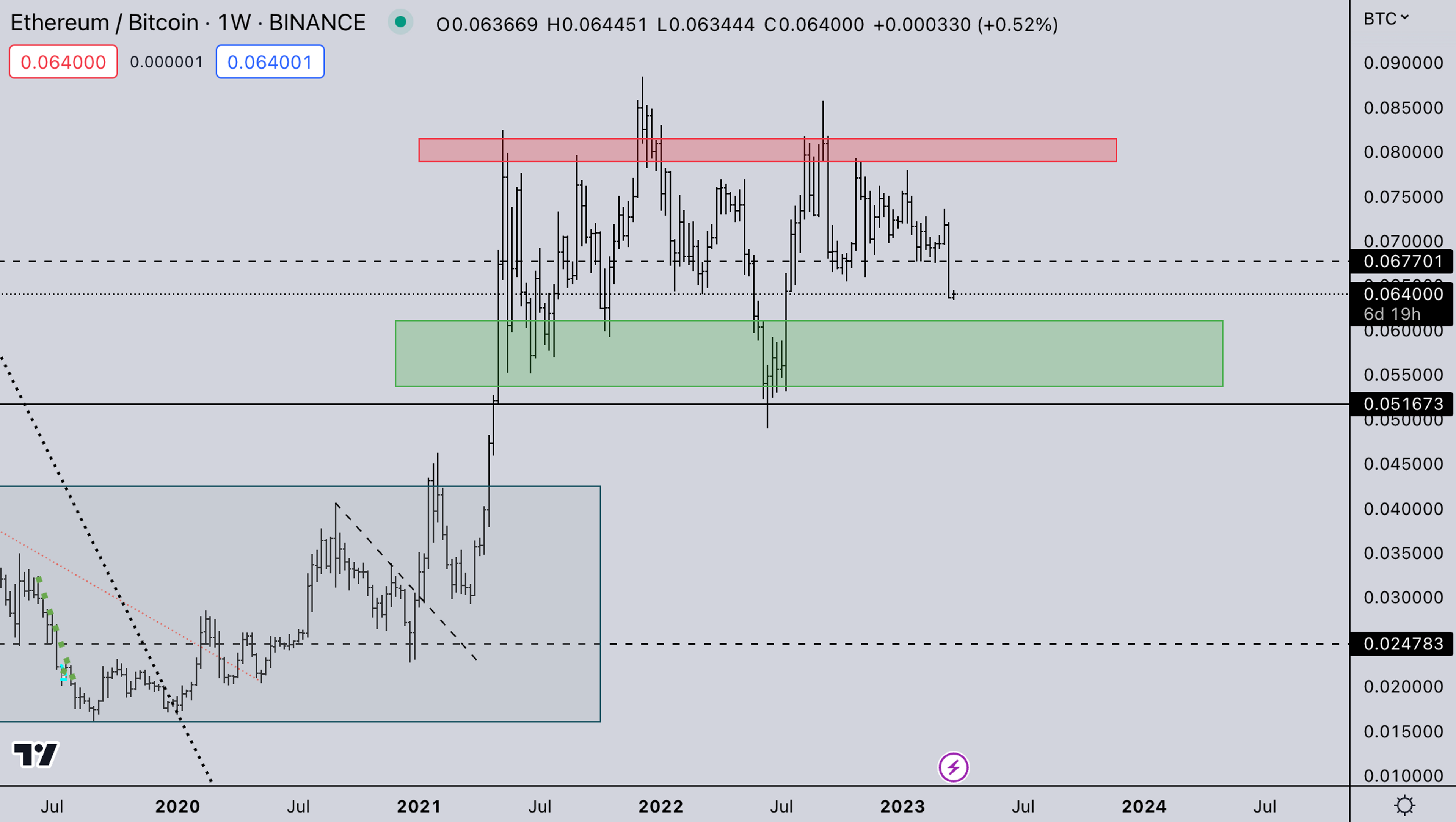

ETH Weekly View

With the weakness in ETH/BTC, BTC has caught up to ETH in terms of relative valuation. They are now both on the 2021 floor. ETH has built up a lot more price structure close to this resistance, so it would make sense that it breaks first & can actually hold above it. The relative weakness, in our opinion, is mostly because of the Shanghai upgrade's apprehensiveness. Once the market has passed that, we’d expect ETH to become the dominant leader once again.

ETH/BTC

As mentioned in the previous slide, ETH/BTC is still weak on a relative basis. We still think that it's because of the Shanghai Upgrade, and the underperformance is strengthened by the current BTC digital gold as a hedge against the trap that the FED has fallen into with banking and the current sticky inflation.

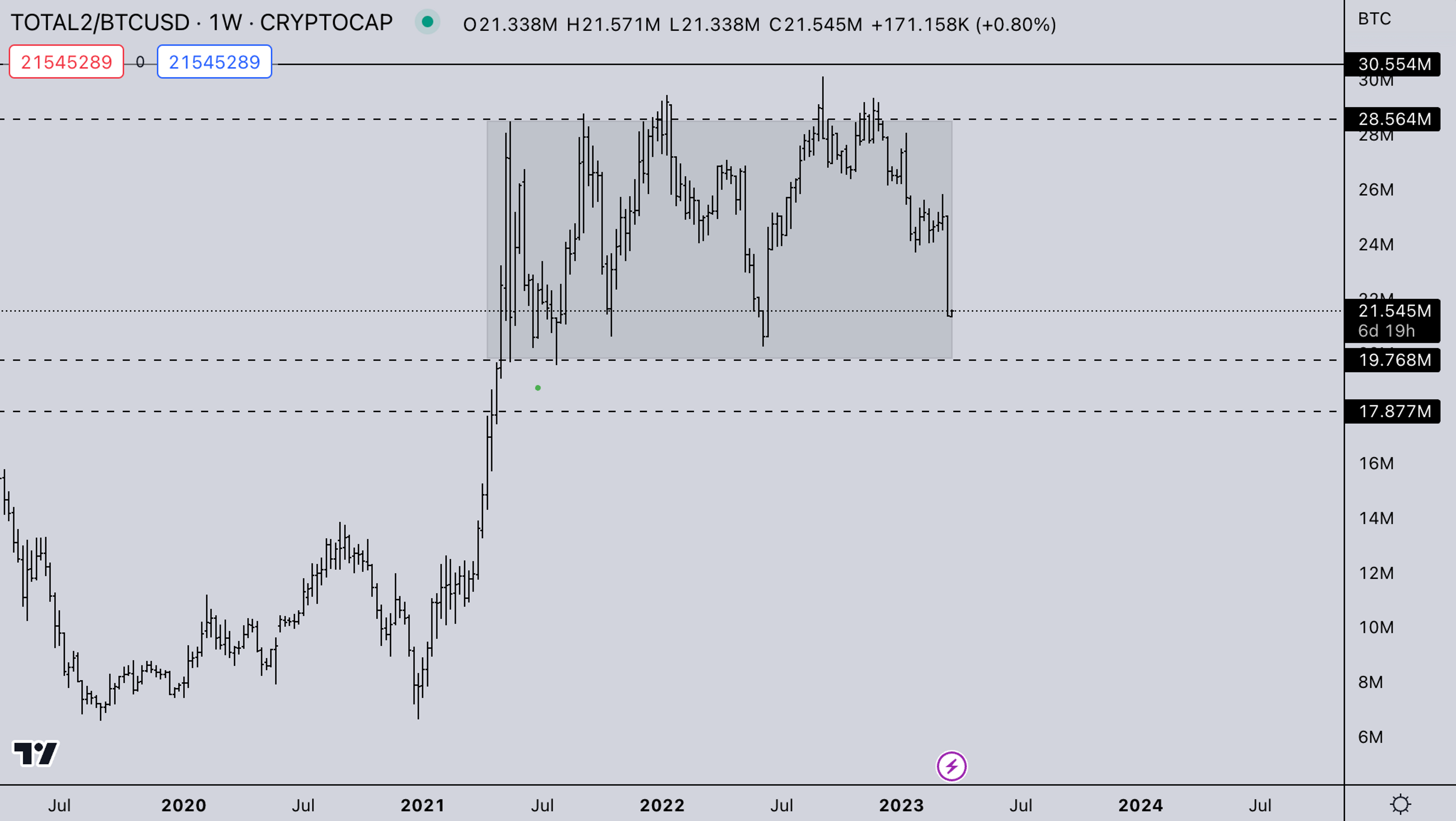

TOTAL2 – USD Market Strength

TOTAL2 is also still under the 2021 floor. With altcoins bleeding since mid-February, even though BTC is making new highs, the “flight to safety” from banks and digital gold against inflation narrative has strengthened. The real test will happen when big tech finally sees a decent correction, that's if BTC trades with it or keeps its relative strength.For altcoins to pick up again, BTC needs to stall in momentum. Currently stalling zones would be a fallback into the 20-25k range or entering the 30k+ zone.

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC shows the same picture as ETH/BTC. For now, crypto is led by a BTC dominance wave. The market has not seen a true BTC wave in a long time. And for those who remember in 2017 and 2019, BTC had huge run-ups for months on end without any decent altcoin action.

Summary

- BTC dominance wave leading the market with altcoins being weak since mid-February. Good to remember that BTC has had waves in past (pre-2020 era), where it went up months on end without altcoins catching up.

- FOMC this week. With the current stress in the banking system, we’d expect the FED to be forced to not hike rates even though inflation is still high. This would be the “pivot” the market has been frontrunning since the start of the year.

- Crypto options update:

- Crypto approaching quarterly expiration 31-Mar-23.

- Kairon Labs trading team monitoring market liquidity for downstream impact on position roll/close.

- ETH 30-day 25 delta R/R activity picking up - moving 12.2 pts over the week from a bear into the bull territory.

- ETH 30-day ATM vol moving ~ 17 pts higher from mid-week before coming off slightly.

- 17Mar23. Closed ETH 24Mar23 1400 short put (DOV auction play). Days Live: 2. Ann. Return: 91.95%.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?