Weekly Crypto Market Update – March 27, 2023

Last Week’s Recap:

- Fed hiked well-anticipated at 25bps.

- ARB ranked top 40 with an FDV of $12B after the airdrop and CEX listing, which started last Thursday.

- US SEC issued a Wells notice to Coinbase.

- ZkSync launched the ‘Era’ main net, with the community expecting a possible airdrop.

- Terra founder Do Kwon was arrested in Montenegro.

- LooksRare announced the launch of the first phase of its aggregator.

- Metamask plans to add a staking marketplace and partners with Kiln, Blockdaemon, and Allnodes.

Legacy Markets – DXY

As mentioned last week, it would be likely that DXY is building a range in the 101-106 area. As long as it stays docile in the range it shouldn’t pressure crypto too much. If it breaks over the 105-106 area it’ll likely put pressure on crypto.

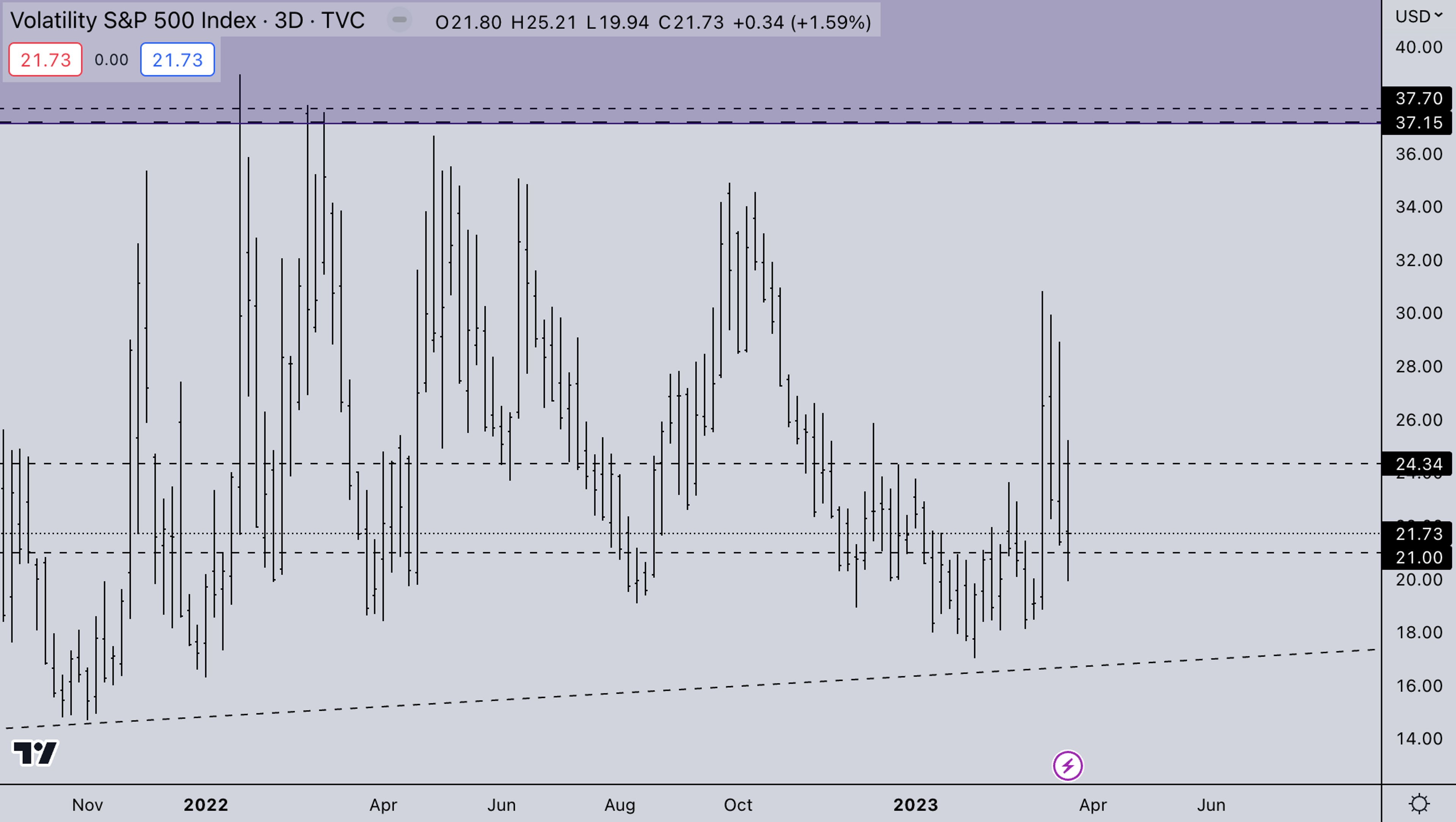

Legacy Markets – VIX

VIX has been trading over 21 for quite a bit now with the banking crisis unfolding in the US and EU. For now, it’ll likely stay headline-driven whenever there are rumors of new banks being on the edge of a bank runs.

BTC Weekly View

Is BTC the new Gold or still just a tech stock? It seems like BTC is having a split personality some days it correlates to Gold and other days to the Nasdaq. End of last week, when the Nasdaq showed some signs of weakness, BTC correlated pretty fast to it. For now, it does seem like BTC is the sole leader in crypto with interesting areas being the 30-32k zone and 23-25k zone. Also, note that this is the first time BTC is coming close to the 3AC breakdown level. While ETH already traded at those levels in the summer of 2022.Note: BTC broke out of a 9-month range. Range breaks of this duration usually lead to prolonged price trends.

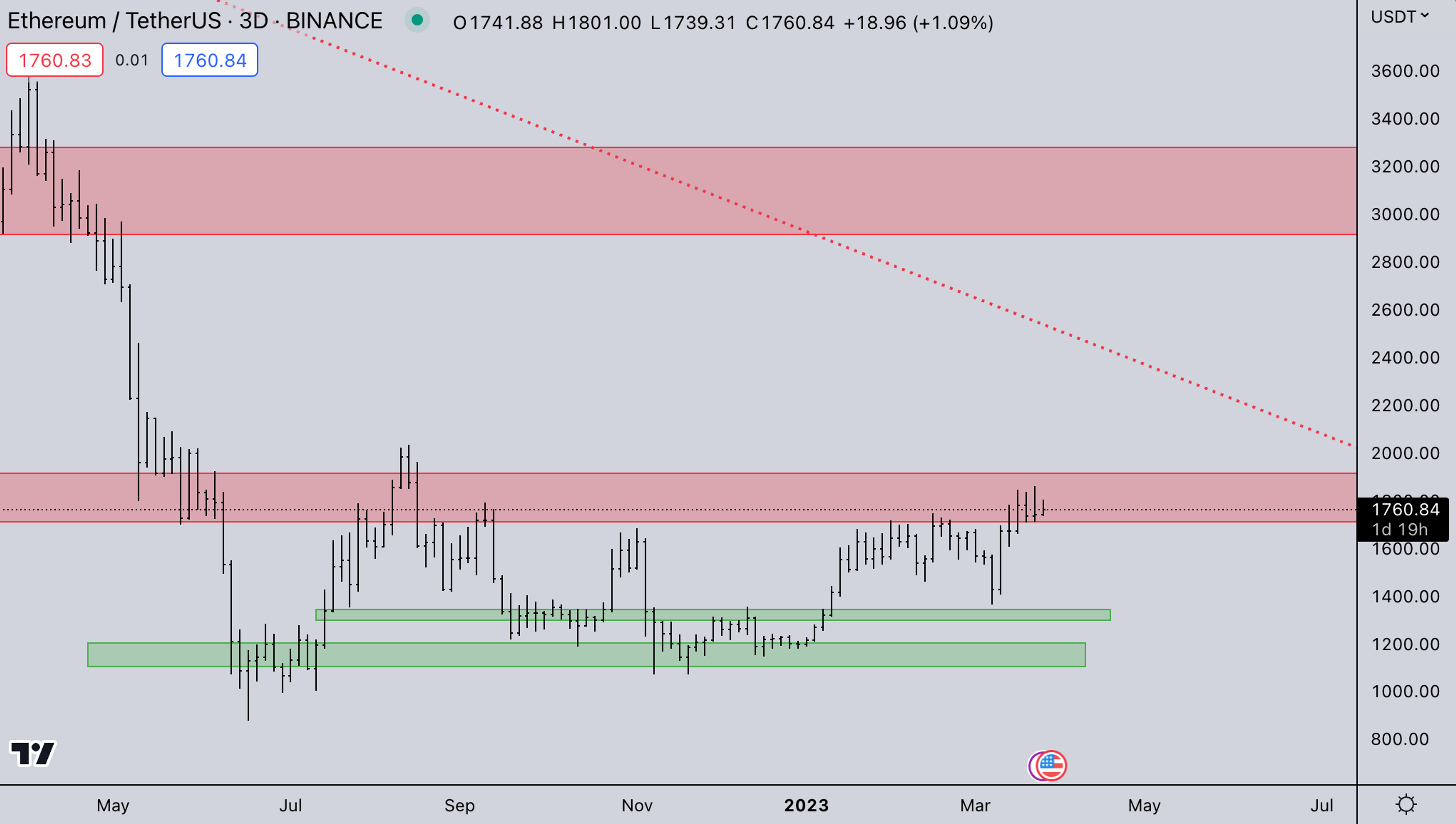

ETH Weekly View

ETH is currently also still pushing against the 2021 lows. It’ll probably stay below for this week as there is the quarterly expiry. With option OI’s being very high on the call side over 1700, this should put some pressure to further price appreciation and create more range/chop price action. After this quarterly expiry, we’d expect crypto to move more freely again.

ETH/BTC

ETH/BTC is trading at its lowest levels since May-June 2022, with BTC clearly leading the way. For now, we’d expect this trend to continue at least till post-Shanghai Upgrade.

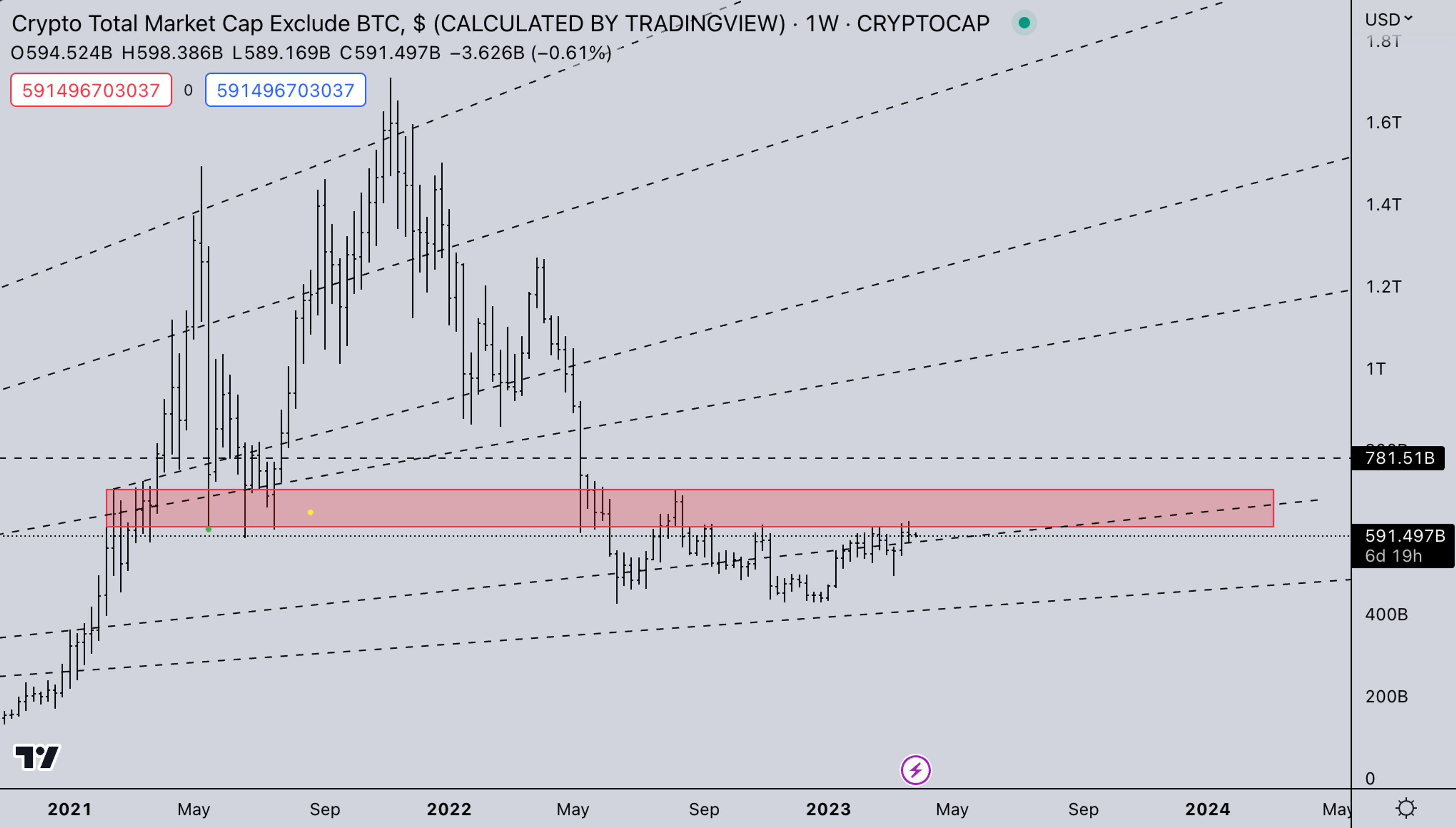

TOTAL2 – USD Market Strength

With ETH losing relative strength and BTC re-entering a large resistance zone, altcoins have felt the pressure already after large price appreciation in early January till mid-February. Since then, most have been ranging/bleeding out. We’d expect this to continue at least until BTC confidently breaks over 30k, or retests 23-24k. For now, the altcoin game seems to still be in rotations - from money already in the system and not from new entrants.TOTAL2BTC – BTC Market Strength

TOTAL2/BTC is also significantly weaker, with it almost trading at range lows. This is not ideal because if BTC loses strength, alts will get hit with double damage, losing value on BTC pairing - but also in USD. Which can cause quite some significant drops.

Summary

- The quarterly expiry in options & futures is this week.

- BTC is struggling to decide if it trades like digital gold or just another Nasdaq component.

- Altcoins are mainly dependent on continued BTC strength from this point on, as current rallies are mainly just rotations.

- Crypto options update:

- Crypto approaching quarterly expiration this Friday 31-Mar-23.

- Kairon Labs trading team monitoring market liquidity for downstream impact on position roll/close.

- ETH 30-day 25 delta R/R activity moving away from bullish back into neutral territory.

- ETH 30-day ATM vol softening 10pts WoW.

- KL took advantage to play IV around last Friday’s DOV auction. Holding Period: 1 day. Return (ann) 105.95%

- Since Deribit & Volmex are both launching - Implied Volatility crypto indices.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?