Weekly Crypto Market Update - March 6, 2023

Last Week Recap

- Silvergate failed to file its annual financial report on time and told the SEC that it may be “less than well-capitalized.

- Ethereum developers target March 14th for the Shanghai upgrade on the Goerli testnet.

- ConsenSys zkEVM is ready for public testnet.

- Uniswap introduced a mobile wallet.

- Binance launches AI-powered NFT generator platform ‘Bicasso’.

Legacy Markets – DXY

DXY ran into resistance last week at the 105 zone. With a lot of data coming this month, we still expect larger movement in DXY, and also confirm if the hotter-than-expected CPI print was a one-off or if it actually sustains.

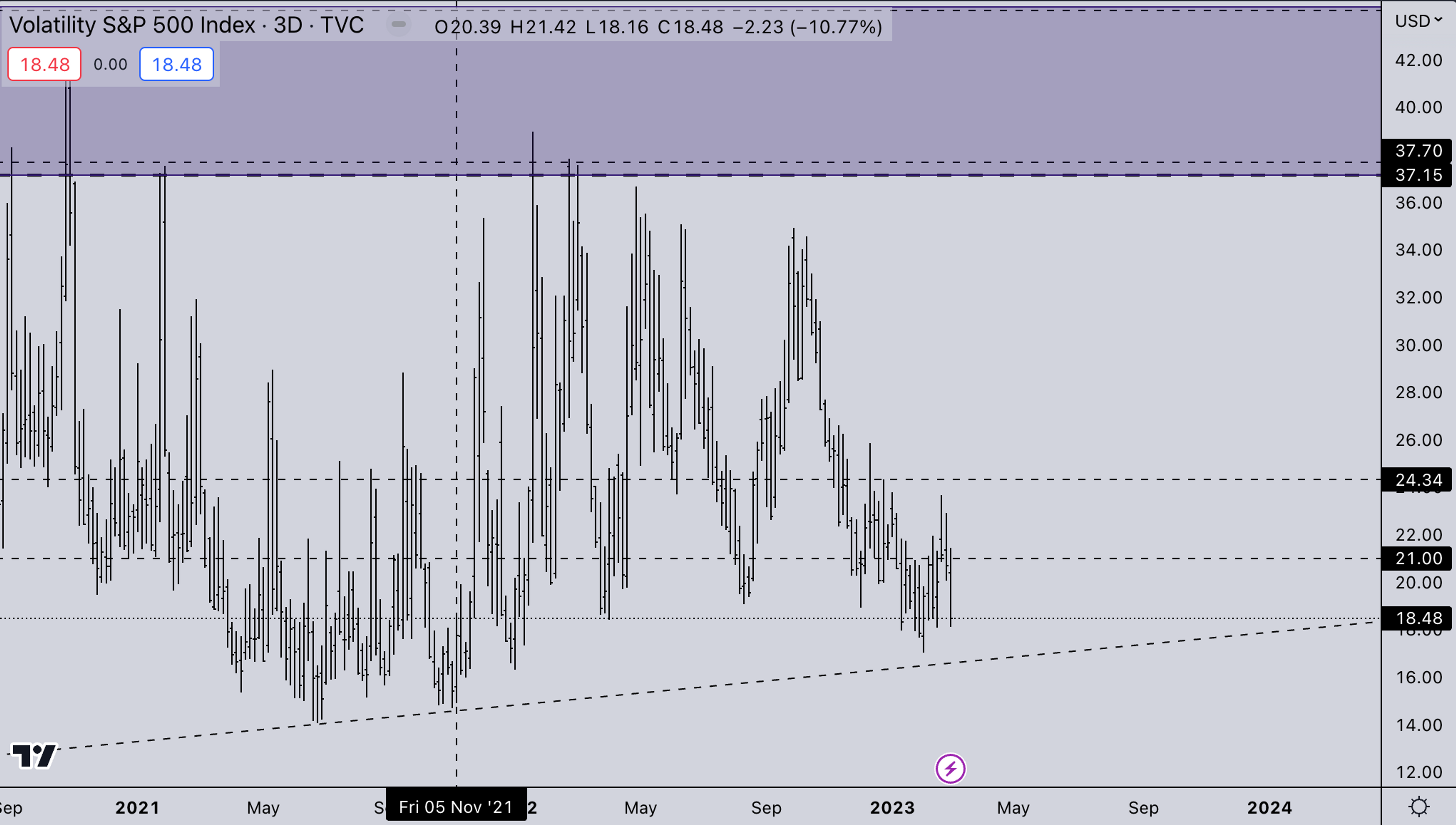

Legacy Markets – VIX

VIX is still failing to sustain above 21. This gives the market room to rally & correlation between market drops. As long as VIX trades sub-21, expect crypto to be less prone to equity moves either to the upside or downside. The ideal scenario for the FED has dampened volatility, while markets stay in a larger range as they tighten, and slowly get rid of inflation.

BTC Weekly View

BTC has quite a bit of a headwind. MTGox distribution starting this month, Silvergate failing to file the annual financial report, and a large Quarterly futures/option expiry. Still a larger move seems to be upon us. After the FTX crash, BTC consolidated for ±60 days, while in the early run-up in January, BTC is already consolidating for 51 days, making a larger move seemingly imminent.

ETH Weekly View

ETH is also still under the 2021 lows. There is some debate on which one can adopt the current view. If you believe that crypto has made macro low and that 3AC liquidation back in May last year was the bottom, then ETH has been forming an accumulation range of almost 12 months (!!)- If one could see anything between 800-1600 “Accumulation”.The other view is that crypto will go lower because of the macro. For this to become a high-probability option, we’d like to see ETH break the FTX low. At this point, this seems miles away - though it would make sense to accumulate any dip close to that price with a mental stop under it (1075-1100).ETH/BTC

ETH/BTC is still slowing sluggish price action. We’ve seen it show relative strength every time BTC isn’t moving. We don’t think this is a “real” relative strength, as the price action is not impulsive relative to BTC. ETH/BTC breaking above the red zone, would indicate for us the return of real market-wide speculation/bull market.

TOTAL2 – USD Market Strength

TOTAL2 was also rejected again at 2021 lows. With a lot of altcoins down 30-50%, while BTC and ETH barely moved, shows that most of the rallies were fueled by sidelined capital and rotations, and not by a fresh influx of capital. We think it’s paramount to keep a close eye on altcoins that had strong price action and could now be forming a macro higher low in the coming weeks. These would likely be ideal longer-term entries if they can build those higher low bases.

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC also still reflects the same picture: sluggish price action with no real relative strength. BTC dominance also seems quite strong which is generally a bad thing for alts, as we don’t wanna see BTC have relative strength over altcoins in the past (Pre 2021 era). BTC had massive time periods of outperformance, which we haven’t seen in a long time. With the current macro environment, it could become a possibility and is something we definitely need to keep an eye on.

Summary

- Altcoins are down 30-50% across the board while BTC and ETH are still in a larger range. Indicating capital rotation or sidelined money fueled the rally + short covering. And not a fresh influx of capital so far.

- Large option expiry end of the month, this could mute upside price action with large OI at strikes above 1600$ on ETH

- MTGox Distribution starting, if it’ll cause any real selloff is a big if, but the uncertainty around it has plagued the market for years so this could induce further weakness.

- Lots of economic data this week and the rest of the month. This will either confirm the sticky inflation narrative or make January an outlier.

- Seems the FED could land a soft landing if they can keep the market muted long enough, meaning large ranging price action with small outlier sector waves and dampened volatility.

- Crypto options update:

- ETH 30-day 25 delta R/R in slightly bearish territory. Very tepid moves (+/- 5% range) since mid-Jan23.

- ETH 30-day ATM vol softening since mid-Jan23, low 50s currently.

- Closed the remaining leg of our ETH 31 Mar 23 option position. Days Live: 54. Annualized Return: 40.54%.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?