Weekly Crypto Market Update – May 8, 2023

Last Week’s Recap:

- U.S. Fed hiked 25 bps last week, hinting it might be the last one.

- U.S. non-farm payrolls increased 253,000 in April v.s. estimated 180,000, and the unemployment rate is 3.4% v.s. estimated 3.6%.

- Binance listed $FLOKI and $PEPE.

- Ethereum Foundation transferred 15,000 ETH to Kraken.

- Bitcoin’s BRC-20 standard is rising as a new choice for meme coins.

- Gate.io is listing Ordinals on their platform.

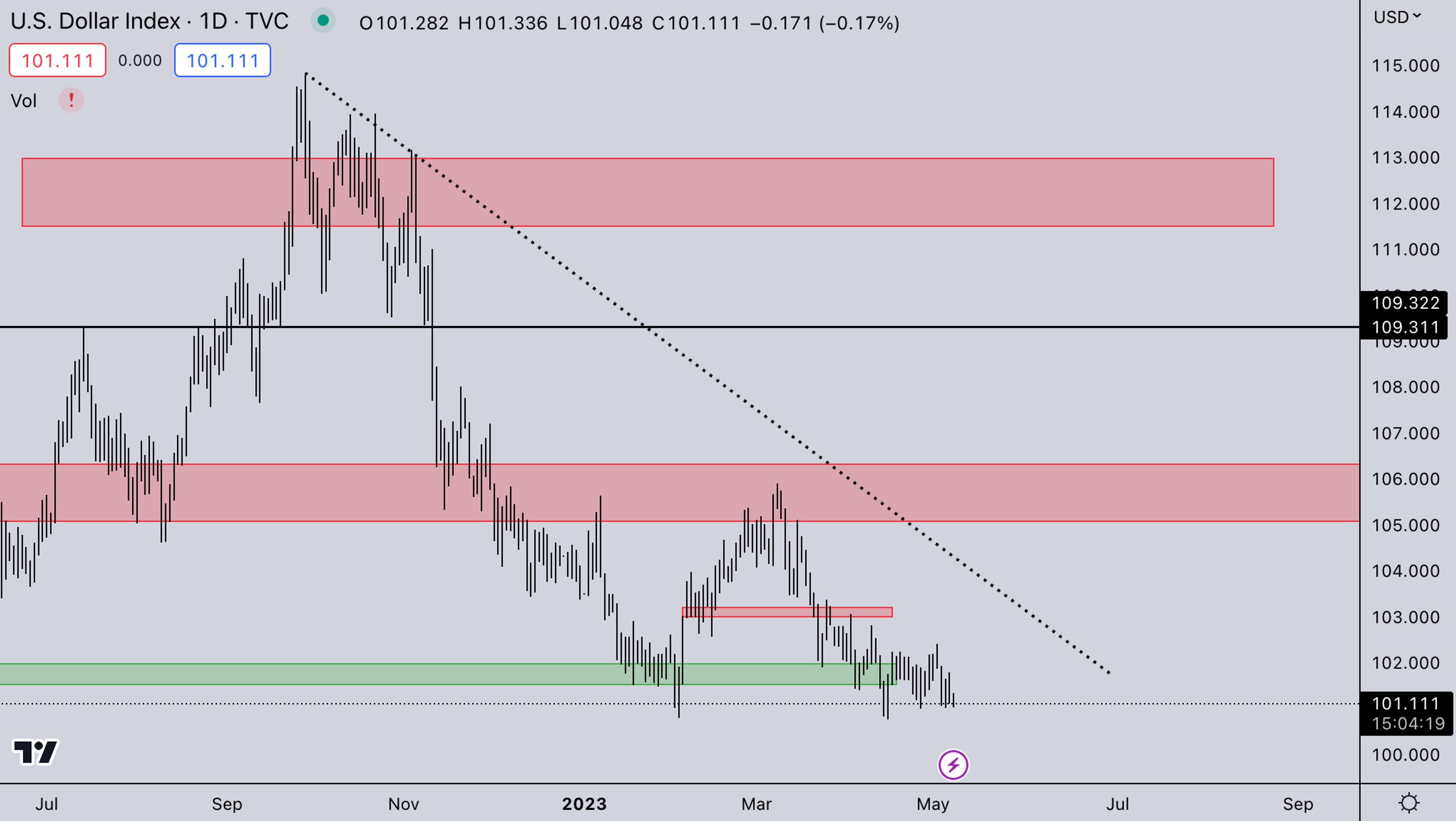

Legacy Markets – DXY

Most major market components are at large inflection points after quite a bit of consolidation. We’re expecting big movements in crypto soon, DXY seems to be confirming this by consolidating on the lows of a major range. If it breaks down, this likely accelerates crypto further up.

Legacy Markets – VIX

VIX is still in low volatility regimes. This dampens the correlation between assets. This is also the reason some equities are really strong, while crypto is seemingly lagging momentarily, crypto also has some idiosyncratic risk at the moment that we’ll cover later.

BTC Weekly View

BTC is still under 2021 support and getting rejected multiple times now. With the consolidation at the highs taking quite a while now, we’d expect BTC to make a larger movement relatively soon. Altcoins have already been derisking hard over the weekend seemingly in anticipation of this movement. If BTC is actually correlating to Gold, we’d expect the price to pick up soon after the loan repayment date as Gold is consolidating near all-time highs.

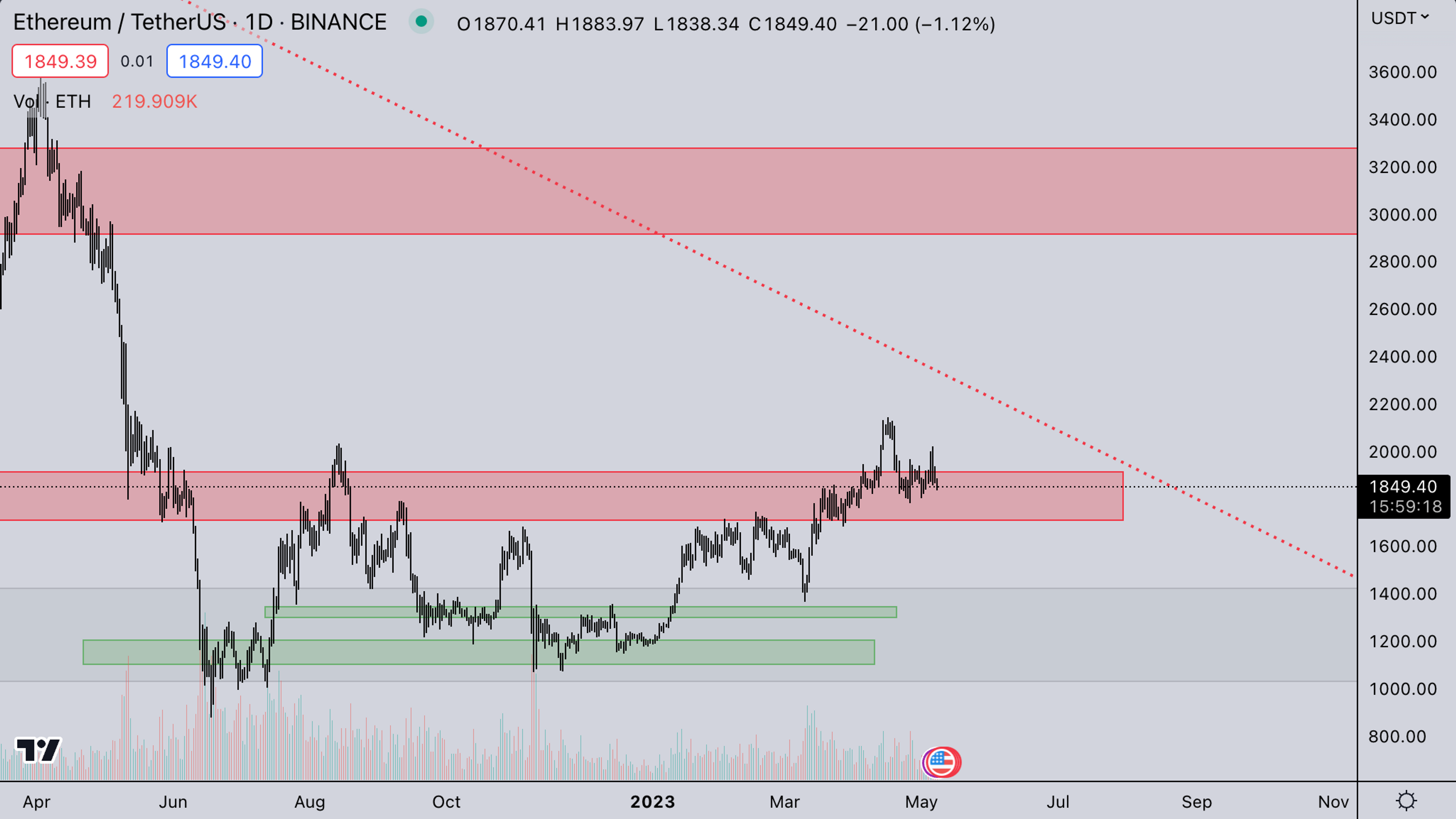

ETH Weekly View

ETH is floating on the 2021 support. We still think it testing the 1600-1700 area would give a stronger case for ETH, flipping the 2021 area back into support. And this would also give NFTs more space, as currently, there’s no follow-through bid in anticipation of a possible correction on BTC / ETH.

ETH/BTC

ETH/BTC is still sideways down. For now, we’re still waiting on ETH breaking the 0.08 zone. Once it breaks over that we expect large market outperformance on ETH. For now, the consolidations are just building and a break either way will lead to a large multimonth/year trend in the ETH/BTC ratio.

TOTAL2 – USD Market Strength

TOTAL2 is still weaker, were ETH actually flipped the 2021 support, so far TOTAL2 hasn’t been able to. This is mainly apparent in a lot of alts already retracing almost their entire move up back to November lows (FTX crash). For now, the market is focusing on new coins + older coins that have relative strength on BTC pairs.

TOTAL2BTC – BTC Market Strength

TOTAL2/BTC is reflecting what we mentioned in TOTAL2, most of the alt market is de-risking relative to BTC with a few outperformers. Being mainly strong narratives/ newer coins/ meme coins. The lack of liquidity in the market can be seen with most alts being unable to hold any reasonable levels of support.

Summary

- DCG loan repayment commencement date is this week (May 11). The market is seemingly de-risking going into the event. If DCG is distributing crypto to repay it or if the market is just de-risking out of the protection of that possibility is an unknown.

- Binance temporarily closed withdrawals for BTC over the weekend due to high traffic on the chain with the activity of BRC tokens picking up on the chain.

- FED telegraphed that this was likely the last rate hike for a while. There has also been more and more noise about raising target inflation. We think the market is likely closely watching for more signals that the FED will actually go ahead with this.

- In crypto we’re looking for a strong reaction after May 11, to mainly see how real the risk of default is for DCG on the loan.

- $OSHI and $ORDI mooned higher than expected over the weekend: $ORDI went from $4 to $27 with a market cap of half a billion, and $OSHI started at $100 to average $900 today.

DISCLAIMER:

The information in this report is for information purposes only and is not to be construed as investment or financial advice. All information contained herein is not a solicitation or recommendation to buy or sell any digital assets or other financial products

This post is prepared by Kairon Labs Traders: Joshua van de Kerckhove, Charles Belford, and Patrick Li

Kairon Labs provides upscale market-making services for digital asset issuers and token projects, leveraging cutting-edge algorithmic trading software that is integrated into over 100+ exchanges with 24/7 global market coverage. Get a free first consult with us now at kaironlabs.com/contact

Featured Articles

What Is Bitcoin Halving and How to Prepare For It

Bitcoin Halving Aftermath: Post-Halving Trends to Expect

Most Anticipated Retrodrops and Airdrops in 2024

Crypto Bull Run Hottest Altcoins: Meme Coins, GameFi, AI

Launching a Token 101: Why is Liquidity Important?